- This event has passed.

Digital Assets and the Future of Finance: Examining the Benefits and Risks of a U.S. Central Bank Digital Currency (U.S. House Committee on Financial Services)

May 26, 2022 @ 8:00 am – 10:00 am

| Hearing | Digital Assets and the Future of Finance: Examining the Benefits and Risks of a U.S. Central Bank Digital Currency |

| Committee | U.S. House Committee on Financial Services |

| Date | May 26, 2022 |

Hearing Takeaways:

- Proposals to Establish a U.S. Central Bank Digital Currency (CBDC): The hearing focused on the U.S. Federal Reserve’s consideration of CBDCs and whether the central bank ought to issue a U.S. CBDC. A CBDC is a digital form of fiat currency backed by the full faith and credit of the issuer. U.S. Federal Reserve Vice Chair Lael Brainard indicated that while the U.S. Federal Reserve had not yet decided whether the U.S. ought to issue a CBDC, she called it important for the U.S. to study this topic and to be prepared to move forward on CBDCs if needed. She stated that the U.S. needed to consider ways to preserve ready public access to safe central bank money in light of the increasingly digitized nature of the financial landscape.

- Development Time: U.S. Federal Reserve Vice Chair Brainard emphasized that the U.S. would not be able to issue a CBDC instantaneously and stated that it would take time for the U.S. Federal Reserve to perform the necessary policy, design, and technology research on the topic. She indicated that the U.S. Federal Reserve was currently engaged in some of this research so that it could more swiftly act if the Executive Branch and Congress deemed it wise to pursue issuing a CBDC.

- Federal Agency Coordination: Several Committee Members noted how other federal agencies would have jurisdiction over CBDC and stablecoin issues and expressed interest in how the U.S. Federal Reserve was working with other federal departments and agencies on these issues. U.S. Federal Reserve Vice Chair Brainard testified that the U.S. Federal Reserve was currently working with the U.S. Department of the Treasury and the U.S. Securities and Exchange (SEC) on CBDC and stablecoin policy matters.

- Legal Authority for the U.S. Federal Reserve to Pursue a CBDC: Committee Members (particularly Committee Republicans) expressed concerns that the U.S. Federal Reserve would move forward on issuing a CBDC without specific authorizing legislation. They noted that while the U.S. Federal Reserve’s January 2022 report on CBDCs had indicated that the central bank would not move forward on CBDCs without support from the Executive Branch or Congress, the report did not expressly state that this support would need to come in the form of authorizing legislation. U.S. Federal Reserve Vice Chair Brainard testified that the U.S. Federal Reserve was currently working with the U.S. Department of the Treasury and the U.S. Department of Justice (DoJ) on assessing whether it possessed the legal authority to unilaterally issue a CBDC. She contended however that the U.S. Federal Reserve should ideally have authorizing legislation from Congress if it were to issue a CBDC.

- CBDC Policy Considerations: Committee Members and U.S. Federal Reserve Vice Chair Lael Brainard discussed the current CBDC and stablecoin environment and identified various policy areas that would need to be addressed if the U.S. were to move forward on issuing a CBDC.

- International CBDC Landscape: Committee Members and U.S. Federal Reserve Vice Chair Brainard highlighted how other countries (including China) were currently pursuing their own CBDCs. They expressed concerns that these foreign CBDCs could threaten the U.S. dollar’s status as the world’s reserve currency and stated that the U.S. must actively monitor this space. U.S. Federal Reserve Vice Chair Brainard further stated that the U.S. must actively engage in international CBDC standard setting discussions.

- Interaction Between CBDCs and Private Stablecoins: Several Committee Members (particularly Committee Republicans) contended that most of the potential benefits associated with CBDCs could also be realized through private stablecoins. They commented that this dynamic undermined the case that CBDCs were necessary. U.S. Federal Reserve Vice Chair Brainard suggested that a CBDC could create a neutral settlement layer that would support private sector innovation. She also stated that CBDCs would not pose the same fragmentation and interoperability challenges that were currently posed by stablecoins.

- Impact on Banks and Bank Deposits: Committee Members and U.S. Federal Reserve Vice Chair Brainard expressed interest in how a potential CBDC might impact the amount of money held in bank accounts. Committee Members expressed concerns that the advent of a U.S. CBDC would lead many Americans to store their money in CBDCs, which would reduce the U.S.’s overall amount of available credit (especially for rural and underserved areas). U.S. Federal Reserve Vice Chair Brainard suggested that imposing CBDC holding caps and not paying interest on CBDC holdings could help to address the aforementioned risks to bank deposits.

- Impact on Financial Inclusion: Committee Members and U.S. Federal Reserve Vice Chair Brainard expressed particular interest in how CBDCs would impact the financial inclusiveness of the American economy. Several Committee Members highlighted how many Americans were unbanked or underbanked due to distrust of banks and stated that CBDCs would not address this distrust issue. U.S. Federal Reserve Vice Chair Brainard suggested that non-profit organizations and companies could conduct significant innovation within this space to reach unbanked and underbanked consumers. She also stated that other government agencies could support financial inclusion within the CBDC space. Moreover, Rep. Bill Foster (D-IL) and Rep. French Hill (R-AR) remarked that CBDCs could reduce the costs of payments for consumers, which would improve financial inclusion.

- Privacy Protections: Committee Members and U.S. Federal Reserve Vice Chair Brainard stated that any potential U.S. CBDC would need to protect the privacy of users. Committee Members highlighted how CBDCs could become a tool for surveillance and called for the adoption of safeguards to prevent such surveillance. U.S. Federal Reserve Vice Chair Brainard remarked that the U.S. Federal Reserve was seeking to balance privacy concerns with the need for identity verification through relying upon intermediaries (such as banks) to verify identities. She commented that this approach ensured that the U.S. government did not have direct visibility into consumer transactions.

- Politicization Concerns: Committee Republicans further expressed concerns that CBDCs could enable the politicization of the payments and banking system through enabling the U.S. government to restrict the financial activities of political disfavored groups. U.S. Federal Reserve Vice Chair Brainard stated that an intermediated model would provide a layer of protection against overreach between the U.S. government and consumers.

- Acceptance Concerns: Rep. Sean Casten (D-IL) expressed skepticism as to why a private bank would choose to accept CBDC deposits. He commented that the inability for private banks to lend against CBDC deposits should make such deposits unattractive. U.S. Federal Reserve Vice Chair Brainard noted how consumers were moving away from using bank deposit accounts for payments and suggested that banks might want to accept CBDC deposits in order to remain active within the payments space.

- Cybersecurity Concerns: Rep. Barry Loudermilk (R-GA) discussed how CBDCs would raise cybersecurity concerns and highlighted how federal agencies had proven vulnerable to data breaches. U.S. Federal Reserve Vice Chair Brainard remarked that the U.S. Federal Reserve already possessed “very significant” cybersecurity responsibilities and recognized the importance of operational resilience.

- Other Policy Topics: In addition to CBDCs, Committee Members expressed interest in other policy topics related to the U.S. payments and banking systems.

- FedNow Service: Committee Democrats expressed interest in the U.S. Federal Reserve’s development of its FedNow Service, which will serve as a real-time payments service for the central bank. U.S. Federal Reserve Vice Chair Lael Brainard testified that FedNow could be launched as early as 2023. She also cautioned against comparing the settlement times of the FedNow Service and potential CBDCs given how the FedNow Service had very significant operational resilience and security built in.

- Broadband Internet Access Considerations: Rep. Joyce Beatty (D-OH) and Rep. John Rose (R-TN) stated that policymakers ought to consider broadband access in their work on digital currencies. They expressed concerns that poor broadband connectivity in certain parts of the U.S. would render CBDCs impractical for many Americans. U.S. Federal Reserve Vice Chair Brainard suggested that policymakers consider researching offline transactions and stored value cards for areas that might lack broadband connectivity. She stated that offline payment solutions would be necessary for ensuring that CBDCs could serve as an inclusive form of payment.

- Impacts of Cryptocurrencies on Climate Change: Rep. Rashida Tlaib (D-MI) remarked that policymakers ought to account for how CBDCs could impact climate change. She lamented how many companies were reactivating coal-fired power plants in order to support the mining of proof-of-work-validated cryptocurrencies. U.S. Federal Reserve Vice Chair Brainard stated however that any permissioned system involving a central authority (such as a central bank) would not require an energy intensive consensus mechanism. She elaborated that the central authority would determine the issuance of digital currencies and commented that this system would largely resemble the U.S.’s existing payments system (which was not very energy intensive).

Hearing Witnesses:

- The Hon. Lael Brainard, Vice Chair of the Board of Governors of the Federal Reserve System

Member Opening Statements:

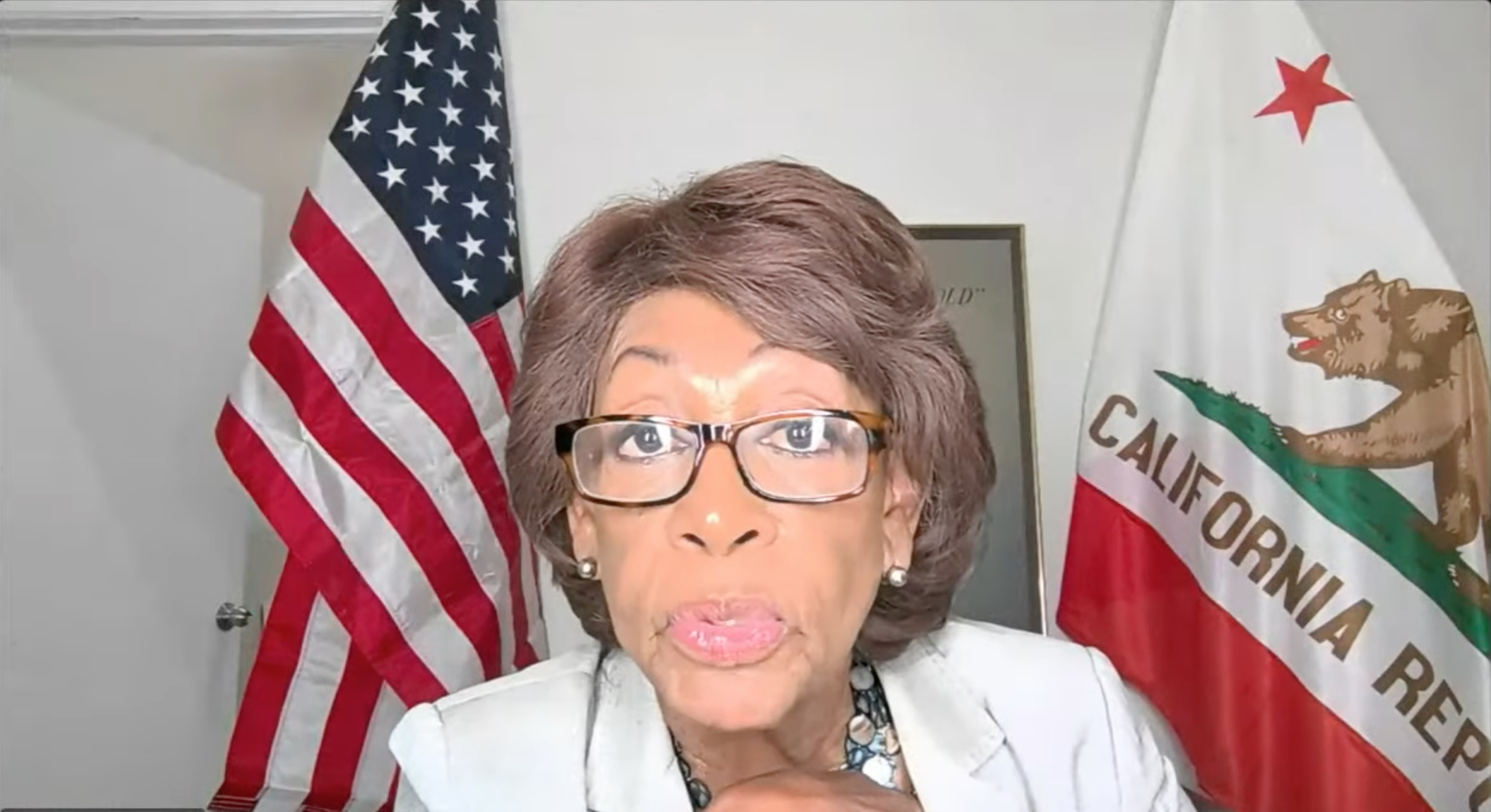

Full Committee Chairman Maxine Waters (D-CA):

- She commented that while cryptocurrencies had the potential to make sending and receiving money more efficient, she remarked that the early innovations within the cryptocurrency space were revealing these assets to be susceptible to risks.

- She also stated that some cryptocurrencies (including stablecoins) had demonstrated themselves to be vulnerable to significant volatility.

- She recounted the recent collapse of the Terra stablecoin and noted how this collapse had reportedly caused investors to lose more than $40 billion.

- She contended that CBDCs had the potential to harness the efficiencies of cryptocurrencies while providing the security and stability of the U.S. dollar.

- She elaborated that CBDCs could provide such security and stability because they would be backed by the full faith and credit of the U.S. government.

- She discussed how other jurisdictions were currently working to deploy digital versions of their own currencies and asserted that the U.S. must compete with these jurisdictions.

- She noted how the U.S. dollar had long served as the world’s reserve currency and commented that this situation had benefited Americans.

- She highlighted how the U.S. dollar’s reserve currency status had made it cheaper for the U.S. government to engage in financing, which in turn led to lower mortgage and credit card rates for consumers.

- She warned that the emergence of a CBDC from a foreign country could undermine the U.S. dollar’s reserve status due to the efficiencies offered by CBDCs.

- She elaborated that CBDCs could enable payments that were instantaneous, secure, and cheap.

- She noted how over 90 nations representing more than 90 percent of global gross domestic product (GDP) were researching, piloting, or developing CBDCs.

- She highlighted how China had rolled out its CBDC during the 2022 Beijing Winter Olympics.

- She remarked that a U.S. CBDC ought to balance the need for privacy protections while also maintaining mechanisms to prevent money laundering and other types of illicit activities.

- She also stated that a U.S. CBDC ought to be designed to promote financial inclusion.

- She commented that while the aforementioned values were bipartisan, she noted how other jurisdictions pursuing CBDCs (including China) did not share these values for CBDCs.

- She called it critical for the U.S. to remain competitive with regard to international efforts to develop CBDCs in order to ensure that its values would prevail within the global financial system.

Full Committee Ranking Member Patrick McHenry (R-NC):

- He discussed how Committee Republicans had developed a set of principles to guide the evaluation of a U.S. CBDC.

- He then mentioned how the U.S. Federal Reserve’s recent report on CBDCs had listed several benefits associated with the development of a CBDC.

- He contended however that most of these benefits could be realized through the development of private sector alternatives.

- He also stated that the impact of CBDCs on the U.S. Federal Reserve’s ability to effectively perform its monetary and regulatory functions remained unknown.

- He asserted that there was no reason to expand the U.S. Federal Reserve’s mandate to encompass retail banking.

- He also raised concerns that the issuance of a CBDC could lead the politicization of the U.S. Federal Reserve.

- He remarked that moving forward on CBDC proposals without first understanding their potential consequences could pose significant harms to the U.S. financial system.

- He mentioned how Committee Republicans had recently sent a letter to U.S. Federal Reserve Chairman Jerome Powell outlining where the U.S. Federal Reserve ought to focus its next steps with regard to CBDCs.

- He noted how U.S. Federal Reserve Chairman Powell had previously emphasized that the U.S. Federal Reserve would not proceed in terms of issuing a CBDC without the clear support of the Executive Branch and Congress.

- He asserted that Congress ought to be thorough in its review of CBDCs and take a deliberate approach regarding the issue.

Witness Opening Statements:

The Hon. Lael Brainard (U.S. Federal Reserve System):

- She remarked that there had occurred “explosive” growth within the digital financial system and commented that this growth was facilitated by digital asset platforms with stablecoins serving as settlement assets.

- She also highlighted how two widely used stablecoins had come under “considerable” pressure in recent weeks.

- She asserted that the U.S. Federal Reserve ought to contemplate the ongoing evolution of the financial system and to consider whether there could exist future conditions that would necessitate a U.S. CBDC.

- She indicated that while the U.S. Federal Reserve had not yet decided whether the U.S. ought to issue a CBDC, she called it important for the U.S. to study this issue and to be prepared to move forward on issuing a CBDC if needed.

- She commented that there were risks associated with both action and inaction on issuing a CBDC.

- She then noted how the share of U.S. payments made by cash had already declined by one-third over the previous five years and indicated that this share was even lower for people under the age of 45.

- She stated that the U.S. needed to consider ways to preserve ready public access to safe central bank money in light of the increasingly digitized nature of the financial landscape.

- She also discussed how the U.S. was experiencing growth in new forms of digital private money (including stablecoins) and commented that these new forms of money did not share the same protections that underpinned the confidence in commercial bank money.

- She elaborated that these protections included deposit insurance, access to central bank liquidity, and banking regulation supervision.

- She remarked that these new forms of digital private money could lose their promise of value relative to fiat currency, which would harm consumers and could create broader financial stability risks.

- She recounted how privately issued paper banknote competition during the 19th century had led to instability, inefficiency, and fraud, which ultimately necessitated a uniform national currency with the aforementioned protections.

- She then warned that the widespread use of stablecoins could lead to fragmentation of the U.S. payment system into “walled gardens.”

- She stated that a CBDC could improve the stability and efficiency of the payment system in this scenario through coexisting with and complementing stablecoins and commercial bank money.

- She added that CBDCs in this scenario could provide a safe central bank liability as the neutral settlement layer in the digital financial ecosystem that would facilitate and enable private sector innovation.

- She also called it important for policymakers to consider the risk of bank intermediation and noted how a widely available CBDC could serve as a substitute for deposits in some circumstances.

- She commented that a CBDC would be attractive to risk averse users during times of stress.

- She further remarked that it was important for policymakers to consider the risks associated with having a global financial system containing CBDCs in which the U.S. did not issue its own CBDC.

- She highlighted how several countries (including China and some European countries) were “pretty far along” in terms of their consideration of their own digital currencies.

- She asserted that the U.S. should not take the U.S. dollar’s dominance as a payment currency for granted.

Congressional Question Period:

Full Committee Chairman Maxine Waters (D-CA):

- Chairman Waters mentioned how the U.S. Federal Reserve’s January 2022 report on CBDCs had highlighted how a CBDC could support the U.S. dollar’s dominant international status. She also noted how this report had suggested that CBDCs could help the U.S. dollar to remain the world’s reserve currency and primary medium of exchange. She mentioned how this report had attributed the U.S. dollar’s current dominance to the depth and liquidity of U.S. financial markets, the size and openness of the U.S. economy, the international trust in U.S. institutions, and the U.S.’s rule of law. She then noted how there were concerns that foreign CBDCs could become more widely used than existing forms of the U.S. dollar, which would reduce the U.S. dollar’s global power. She asked Vice Chair Brainard to indicate whether a U.S. CBDC was essential for preserving the U.S. dollar’s international role.

- Vice Chair Brainard discussed how the U.S. derived important benefits from maintaining the world’s dominant payment currency, including lower borrowing costs and lower transaction costs. She contended that it was therefore very important for the U.S. to maintain a dominant position in international payments. She also mentioned how China had already introduced a digital yuan and how the European Central Bank (ECB) had provided significant consideration to the topic of CBDCs. She remarked that the U.S. must consider how the launch of numerous CBDCs would impact the U.S. dollar. She contended that it would be important for the U.S. to be involved in standard setting in cross-border transactions, regardless of whether the U.S. issued a CBDC. She stated that whether the U.S. issued a CBDC would impact the U.S.’s ability to influence these standards.

- Chairman Waters then noted how President Biden had directed federal agencies to coordinate their policy efforts with regard to CBDCs. She mentioned however that Biden administration officials had indicated that there had yet to occur any discussion amongst federal agencies related to CBDCs. She asked Vice Chair Brainard to address whether federal agencies were working together to address CBDCs.

- Vice Chair Brainard noted that President Biden’s Executive Order (EO) on Ensuring Responsible Development of Digital Assets provided the U.S. Department of the Treasury with an important role in convening agencies to consider the issuance of a CBDC. She commented that it would be very important for the U.S. Department of the Treasury to convene discussions on the topic. She expressed the U.S. Federal Reserve’s commitment to fulfilling its role under the EO.

- Chairman Waters asked Vice Chair Brainard to address whether discussions amongst federal agencies regarding CBDCs had yet to occur.

- Vice Chair Brainard testified that she was unaware about the occurrence of any such discussions. She stated that the U.S. Federal Reserve was working with other federal agencies on the EO. She further indicated her expectation that the U.S. Department of the Treasury would convene discussions on this topic.

Full Committee Ranking Member Patrick McHenry (R-NC):

- Ranking Member McHenry noted how the U.S. Federal Reserve’s recent report on CBDCs had asserted that legislation would be necessary in order for the U.S. Federal Reserve to issue a CBDC. He asked Vice Chair Brainard to indicate whether she agreed with the report’s assertion.

- Vice Chair Brainard mentioned how the U.S. Federal Reserve’s recent report had stated that the U.S. Federal Reserve would not proceed on a CBDC without support from the Executive Branch and Congress. She remarked that this support from Congress would “ideally” take the form of authorizing legislation.

- Ranking Member McHenry asked Vice Chair Brainard to provide her personal view on whether legislation would be a necessary precondition for the U.S. Federal Reserve to issue a CBDC.

- Vice Chair Brainard stated that she lacked expertise regarding what types of authorizing legislation would be necessary for the U.S. Federal Reserve to issue a CBDC. She reiterated how the U.S. Federal Reserve’s report had expressed the view that the U.S. Federal Reserve ought not to issue a CBDC without first receiving support from Congress.

- Ranking Member McHenry interjected to ask Vice Chair Brainard to indicate whether she believed that the U.S. Federal Reserve was constrained by statutes with regard to its ability to issue a CBDC.

- Vice Chair Brainard remarked that the U.S. Federal Reserve currently lacked the authority to establish individual accounts. She stated that it would be important for the U.S. Federal Reserve to have support from both the Executive Branch and Congress before it was to issue a CBDC. She reiterated that this authorizing support would “ideally” come in the form of authorizing legislation.

- Ranking Member McHenry indicated that he would follow-up with Vice Chair Brainard on this topic. He then asked Vice Chair Brainard to discuss the specific problems (if any) that a CBDC would solve.

- Vice Chair Brainard remarked that policymakers ought to consider the future financial system landscape as they evaluate the costs and benefits of CBDCs. She stated that the passage of federal legislation would not result in the immediate development of a CBDC and commented that it could take years for the U.S. Federal Reserve to implement a CBDC with sufficient design and security features. She highlighted how the global financial system had experienced significant changes over the previous five years, which included a drop in cash usage, migrations towards the use of mobile applications for payments, and the launching of foreign CBDCs.

- Ranking Member McHenry interjected to ask Vice Chair Brainard to identify the specific problems that a CBDC would address. He stated that most consumers already made digital payments, that private sector payments were already well-functioning, and that the U.S. Federal Reserve would launch its FedNow Service in 2023. He asked Vice Chair Brainard to explain why the U.S. Federal Reserve would need to launch a CBDC in light of these developments.

- Vice Chair Brainard reiterated how there had occurred a decline in cash usage and suggested that a CBDC could ensure that consumers maintain access to a central bank-issued currency. She also stated that there existed a risk of stablecoins becoming the dominant form of digital U.S. dollars, which could lead to fragmentation of the payments system and currency instability.

- Note: Ranking Member McHenry’s question period time expired at this point.

Rep. Emanuel Cleaver (D-MO):

- Rep. Cleaver mentioned how the U.S. Federal Reserve Bank of Boston had partnered with the Massachusetts Institute of Technology (MIT) to conduct CBDC-related research through Project Hamilton. He explained that Project Hamilton had studied the technological aspects of a potential CBDC. He noted how there were arguments that existing U.S. digital initiatives for real-time payments (such as the FedNow Service) would likely have slower settlement times than CBDCs. He asked Vice Chair Brainard to comment on these arguments and to indicate whether the U.S. Federal Reserve would share its research on the subject with Congress.

- Vice Chair Brainard discussed how the FedNow Service would provide a real-time payments platform that would be cloud-based. She remarked that the U.S. Federal Reserve’s development of the FedNow Service had taught the central bank about the cybersecurity, settlement, and execution requirements associated with developing a new payments service. She further stated that this experience highlighted how long it took to develop a new platform following a decision to pursue such a platform. He then remarked that the U.S. Federal Reserve possessed research regarding its FedNow Service that was “potentially relevant” for understanding the feasibility of CBDCs and private sector stablecoin platforms. She commented that it would be helpful for Project Hamilton to experiment with different throughputs and settlement times in its development of secure payments networks. She called it important for the U.S. Federal Reserve to continue its technological research and experimentation of payments so that it could better understand its own payments capabilities and identify private sector risks and efficiencies.

- Rep. Cleaver asked Vice Chair Brainard to indicate whether the FedNow Service would have slower settlement times than the CBDCs stemming from Project Hamilton.

- Vice Chair Brainard cautioned against comparing the settlement times of the FedNow Service and the CBDCs stemming from Project Hamilton given Project Hamilton’s experimental nature. She also highlighted how the FedNow Service had very significant operational resilience and security built in.

Rep. Bill Posey (R-FL):

- Rep. Posey asked Vice Chair Brainard to indicate whether paying workers in CBDCs would threaten the viability of commercial banks that used deposits to fund their lending activities.

- Vice Chair Brainard remarked that it was important for the U.S. to possess a vibrant and resilient banking system with banks of all sizes. She stated that any CBDC-related policy actions should therefore work to ensure that banks remained intermediaries of the U.S. payments and financial systems. She highlighted how the U.S. Federal Reserve’s recent report on CBDCs had emphasized the need for banks to remain intermediaries of the U.S. payments and financial systems. She then remarked that the U.S. Federal Reserve was considering the implications for bank deposits associated with the potential issuance of CBDCs. She stated that banks currently played a key role in terms of providing credit and monetary policy transmission. She mentioned how the U.S. was already observing significant changes within the payments space related to the increased use of mobile payments applications. She noted how these mobile payments applications held balances largely outside of the banking system. She commented that this increased use of mobile payments applications had implications for cash usage. She predicted that any future evolution of the payments system involving digitalization would result in some diminished use of cash and some diminished use of bank deposits. She stated however that this dynamic would also be present in a payments system based around stablecoins. She recommended that policymakers consider potential limits on CBDC holdings. She suggested that withholding interest on CBDCs could encourage their use in payments and ensure that CBDCs did not become alternatives to bank deposits.

- Rep. Posey asked Vice Chair Brainard to indicate whether an interest-bearing CBDC could diminish the role of the U.S.’s current banking system.

- Vice Chair Brainard remarked that policymakers ought to consider whether a CBDC should be interest-bearing. She stated that there were several reasons why such a CBDC should not be interest-bearing and commented that interest-bearing CBDCs could adversely impact the U.S.’s banking system. She also highlighted how consumers were already accustomed to making payments via mobile applications and noted how these applications were not interest-bearing. She indicated that the U.S. Federal Reserve was still soliciting feedback on this particular topic.

Rep. Brad Sherman (D-CA):

- Rep. Sherman contended that cryptocurrencies were intended to evade detection and commented that CBDCs would therefore not satisfy the needs of cryptocurrency users. He stated that cryptocurrencies were very popular amongst drug dealers, sanctions evaders, human traffickers, and tax evaders. He also contended that many people were interested in cryptocurrencies as a form of wagering. He then expressed uncertainty regarding the usefulness of CBDCs and noted how accounts of money over $250,000 were not eligible for federal deposit insurance. He commented that consumers would therefore be better off holding their money in bank accounts than in CBDCs. He then discussed how many popular stablecoins had been found to not hold their promised backing assets or held volatile backing assets. He expressed doubts regarding Congress’s ability to take action to address the stablecoin space. He asked Vice Chair Brainard to address whether federal regulatory agencies could take actions on their own to protect stablecoin users.

- Vice Chair Brainard remarked that Congress would ideally pass legislation to provide a regulatory regime for stablecoins. She highlighted how many risks associated with stablecoins had recently manifested, including runs on stablecoin platforms, stablecoin value collapses, and stablecoins changing their reserve asset ratios. She expressed support for the principles outlined in the recent President’s Working Group on Financial Markets (PWG) Report on Stablecoins. She stated that stablecoins posed consumer protection risks, investor protection risks, and financial stability risks.

- Rep. Sherman then asked Vice Chair Brainard to address whether the establishment of a CBDC would cause deposits to move out of banks and credit unions in a way that reduced the ability of these financial institutions to make loans.

- Vice Chair Brainard stated that CBDCs could be designed in a manner that did not impede the ability of financial institutions to make loans. She noted how there already existed mobile payments applications that operated in a manner similar to how CBDCs would operate. She stated that making CBDCs non-interest-bearing and imposing limits on CBDC holdings could confine CBDC usage to payments. She emphasized the importance of ensuring that banks remained intermediaries within the U.S. payments and financial systems.

Rep. Blaine Luetkemeyer (R-MO):

- Rep. Luetkemeyer noted how Vice Chair Brainard had stated that the U.S. Federal Reserve would not move forward on issuing a CBDC absent Congressional approval and that this approval would “ideally” come in the form of legislation. He asked Vice Chair Brainard to clarify whether she believed that legislation would be a necessary prerequisite for the U.S. Federal Reserve to issue a CBDC. He also asked Vice Chair Brainard to identify the types of Congressional approval that the U.S. Federal Reserve would accept as a prerequisite for moving forward on issuing a CBDC.

- Vice Chair Brainard mentioned how the U.S. Federal Reserve’s January 2022 report on CBDCs had stated that the U.S. Federal Reserve would not move forward on issuing CBDCs without “strong support” from the Executive Branch and Congress. She commented that this support from Congress would “ideally” come in the form of authorizing legislation. She stated that the U.S. Department of Justice would determine whether and how the U.S. Federal Reserve could move forward on issuing CBDCs. She expressed the U.S. Federal Reserve’s belief that Congress ought to be engaged on the issue of CBDCs. She stated that the U.S. Federal Reserve was working to ensure that Congressional action on CBDCs would be well-informed through proactively providing research on the topic.

- Rep. Luetkemeyer then asked Vice Chair Brainard to indicate whether the U.S. Federal Reserve could move forward on issuing a CBDC fast enough to compete with international CBDCs currently under development. He also asked Vice Chair Brainard to address whether the private sector could launch digital currencies that could sufficiently compete with international CBDCs.

- Vice Chair Brainard remarked that the U.S. Federal Reserve operated all of its payments systems alongside the private sector and called this a strength of the U.S. Federal Reserve System. She stated that a potential digital U.S. dollar would create a neutral settlement layer that would support private sector innovation. She also remarked that the U.S. Federal Reserve’s proactive policy research, technology research, and input solicitation would better position the private sector to approach CBDCs.

- Rep. Luetkemeyer interjected to ask Vice Chair Brainard to provide an example of how the U.S. Federal Reserve was currently working with the private sector.

- Vice Chair Brainard remarked that private sector partners were involved in all of the U.S. Federal Reserve’s work. She highlighted how a group of private sector partners had helped to inform the design of the FedNow Service. She further noted how the U.S. Federal Reserve’s payments infrastructure was neutral and allowed for interoperability between private sector solutions. She stated that the U.S. Federal Reserve would continue to take this approach in working with the private sector moving forward.

Rep. Jim Himes (D-CT):

- Rep. Himes noted that Committee Republicans had accused the U.S. Federal Reserve of failing to identify payments system inefficiencies. He asked Vice Chair Brainard to confirm that there were currently millions of Americans that did not feel comfortable using commercially-backed payments systems.

- Vice Chair Brainard answered affirmatively.

- Rep. Himes commented that the U.S. would likely always have people that did not feel comfortable using the commercially-backed payments system. He then recounted his experience working as a technology banker during the internet’s early years and discussed how the internet’s potential benefits were not fully understood during this period. He asserted that the future of CBDCs was currently unknowable and that policymakers should work to not impede innovation within this space. He then discussed how the U.S. government often provided a foundation upon which the private sector could innovate. He raised concerns that other countries might launch their CBDCs before the U.S., which would enable foreign companies to pursue digital payments innovations earlier. He commented that this situation could disadvantage U.S. companies within the digital payments space.

- Vice Chair Brainard expressed agreement with Rep. Himes’s concerns.

- Rep. Himes asked Vice Chair Brainard to indicate whether popular applications built upon foreign CBDCs could lead people around the world to migrate away from the U.S. dollar as both a reserve and use currency.

- Vice Chair Brainard answered affirmatively.

- Rep. Himes contended that foreign progress in CBDCs could pose risks to the U.S. dollar’s current global dominance. He asked Vice Chair Brainard to assess the viability of an intermediated CBDC system with private wallets that were capped and non-interest-bearing. He commented that such a system would not pose risks to the existing financial services system.

- Vice Chair Brainard remarked that a CBDC system with wallets that were capped and non-interest-bearing would protect the banking system from any disintermediation of deposits.

Rep. Andy Barr (R-KY):

- Rep. Barr mentioned how Vice Chair Brainard had stated that the U.S. Federal Reserve would issue a CBDC without Congressional support. He noted that the U.S. Federal Reserve had previously stated that this support would “ideally” come in the form of a specific authorizing law. He indicated that President Biden’s March 2022 EO on Ensuring Responsible Development of Digital Assets would require the U.S. Attorney General (in consultation with the U.S. Secretary of the Treasury and the U.S. Federal Reserve Chairman) to provide an assessment regarding whether legislative changes would be necessary to issue a CBDC. He commented that this EO suggested that the Biden administration did not fully believe that Congress had a role in issuing a U.S. CBDC. He asked Vice Chair Brainard to discuss how the U.S. Federal Reserve was coordinating with the U.S. Department of the Treasury on this matter. He also asked Vice Chair Brainard to indicate whether she would commit to ensure that Congress would play a role in issuing a U.S. CBDC, even if the U.S. Attorney General and U.S. Secretary of the Treasury were to conclude that Congress did not need to be involved in issuing a U.S. CBDC.

- Vice Chair Brainard testified that she personally had not been engaged in any conversations with the U.S. Department of the Treasury and the DoJ regarding whether the U.S. Federal Reserve could unilaterally issue a CBDC. She indicated that there had occurred staff level discussions between the bodies. She stated that she could not predict the outcomes of these discussions.

- Rep. Barr requested that the U.S. Federal Reserve advocate for the position that authorizing legislation be required before the issuance of a U.S. CBDC. He then noted how there were concerns that a CBDC could compromise access to credit through moving deposits out of banks. He commented that these access to credit concerns were especially present in rural areas and areas that depended on community banks. He asked Vice Chair Brainard to address these concerns.

- Vice Chair Brainard remarked that she was very focused on ensuring the viability of community banks and promoting rural banking access.

- Rep. Barr interjected to raise concerns that an intermediated CBDC with deposit caps would still result in $720 billion in deposits leaving the banking system. He commented that this reduction in bank deposits would especially impact community banks given how the accounts in these banks tended to have lower balances.

- Vice Chair Brainard discussed how there was already occurring a significant migration amongst consumers (particularly younger consumers) toward mobile payments applications. She noted how the balances being held in mobile payments applications were by nature not being held in bank accounts. She further stated that an increased demand for stablecoins would result in a similar migration away from bank deposits. She remarked that policymakers needed to consider the challenges faced by community banks and their deposits in the face of payments digitalization trends. She stated that banks of all sizes ought to play a role in a CBDC system as intermediaries. She also mentioned how the U.S. Federal Reserve was considering restrictions for CBDCs (such as providing no interest and setting holding caps) that would guard against instability risks.

- Note: Rep. Barr’s question period time expired here.

Rep. Bill Foster (D-IL):

- Rep. Foster asked Vice Chair Brainard to indicate how much consumers and vendors would save in credit card fees if there was universal access to CBDCs that were widely used for consumer and commercial payments and that had “negligible” transaction costs.

- Vice Chair Brainard indicated that while she could not provide a specific estimate regarding the savings, she highlighted how transaction costs were currently very high.

- Rep. Foster interjected to request that Vice Chair Brainard follow-up with the Committee to provide an estimate of these expected savings. He then remarked that the safest approach that the U.S. could take to enter the stablecoins space would be to have stablecoins issued by a regulated financial institutions that were fully backed by reserves from the U.S. Federal Reserve. He stated that this approach would rely upon the U.S. Federal Reserve providing an application program interface (API) that could verify reserve account balances in real time. He commented that it would not be technically difficult for the U.S. Federal Reserve to develop this type of API. He also stated that this approach would neutralize any effects of changing stablecoin balances. He asked Vice Chair Brainard to identify any residual dangers that would be associated with this approach and to indicate whether this type of approach would take five years to complete.

- Vice Chair Brainard noted how the usage of private stablecoins was currently growing. She stated that while regulated private stablecoins backed by reserves would mitigate financial stability risks, she asserted that such stablecoins would not mitigate fragmentation risks for the payments system. She suggested that a neutral settlement layer that could underpin private stablecoins could address these fragmentation risks. She commented that history had demonstrated how fragmentation of the payments system could be costly and create inefficiencies. She also stated that a situation could arise in which one stablecoin became dominant, which could lead to disintermediation risks.

- Rep. Foster noted how the U.S. Federal Reserve’s report on CBDCs had asserted that a U.S. Federal Reserve-issued CBDC would best serve the needs of the U.S. through being privacy protected, intermediated, widely transferable, and identity verified. He asked Vice Chair Brainard to indicate whether the U.S. Federal Reserve would need legislation to address the topic of digital identity.

- Vice Chair Brainard remarked that the U.S. Federal Reserve was seeking to balance privacy concerns with the need for identity verification through relying upon intermediaries (such as banks) to verify identities. She commented that this approach ensured that the U.S. government did not have direct visibility into consumer transactions. She then stated that the specific issue of digital identities was outside of the U.S. Federal Reserve’s purview.

- Note: Rep. Foster’s question period time expired here.

Rep. French Hill (R-AR):

- Rep. Hill stated that he had supported the consideration of a CBDC for the past three years. He mentioned how he had introduced the bipartisan 21st Century Dollar Act, which he commented would ensure that the U.S. possessed a strategy for maintaining the U.S. dollar as the world’s primary reserve currency. He also mentioned how he had coauthored the bipartisan Central Bank Digital Currency Study Act of 2021, which would direct the U.S. Federal Reserve to study a potential CBDC. He noted that while this bill had not been passed into law, he highlighted how the U.S. Federal Reserve had since conducted such a study. He also commended the U.S. Federal Reserve for its decision to wait for authorizing legislation before it issued a CBDC. He then discussed how the U.S. Federal Reserve’s recent report on CBDCs had stated that the Federal Reserve Act did not authorize direct U.S. Federal Reserve accounts for consumers. He asked Vice Chair Brainard to indicate whether she agreed with this statement from the report.

- Vice Chair Brainard expressed agreement with the report’s statement regarding the U.S. Federal Reserve’s inability to provide direct accounts for consumers.

- Rep. Hill then stated that any potential CBDC ought to be intermediated through the private sector. He explained that this would involve companies (rather than the U.S. government) offering accounts and digital wallets to facilitate the management of CBDC holdings, payments, and innovations. He also discussed how CBDCs had the potential to reduce the cost of payments for consumers. He commented however that digital asset transfers on blockchains were currently not cheap. He asked Vice Chair Brainard to indicate whether she agreed with this assessment.

- Vice Chair Brainard stated that the cost of digital asset transfers on blockchains appeared to be “quite expensive.”

- Rep. Hill also asked Vice Chair Brainard to confirm that blockchain settlement times were not instantaneous.

- Vice Chair Brainard confirmed that blockchain settlement times were not instantaneous.

- Rep. Hill remarked that there were several operational issues that would need to be addressed before the U.S. could issue a CBDC. He asked Vice Chair Brainard to indicate whether she preferred a CBDC over a private sector stablecoin.

- Vice Chair Brainard remarked that a CBDC could complement a system involving stablecoins and commercial bank money. She also stated that the proof-of-work validation method for blockchains created settlement inefficiencies and asserted that a CBDC would not have these types of settlement inefficiencies.

- Rep. Hill acknowledged that his question period time had expired and indicated that he would submit additional questions for the hearing’s record.

Rep. David Scott (D-GA):

- Rep. Scott expressed concerns with the prevalence of unbanked and underbanked individuals in the U.S. He further expressed concerns with the U.S.’s lack of adequate financial education. He asked Vice Chair Brainard to discuss how a CBDC could address the U.S.’s banking access challenges. He mentioned how many low-income Americans had cited the absence of physical bank branches, minimum balance requirements, and general distrust towards the financial system as reasons for their non-participation in the U.S.’s formal banking system. He further highlighted how the U.S. Federal Reserve’s recent report on CBDCs had claimed that CBDCs could have supported the distribution of COVID-19 pandemic relief to individuals without bank accounts. He asked Vice Chair Brainard to justify the report’s claim.

- Vice Chair Brainard discussed how many Americans did not possess bank accounts due to cost-related concerns (such as minimum balance requirements and fees), lack of trust in banking institutions, and lack of convenience. She noted how banks were working to respond to these concerns through offering low-cost and low-risk consumer checking accounts. She expressed hope that these offerings would bolster financial inclusion. She also highlighted how many consumers were moving toward payments methods outside of the banking system that were more accessible and that did not impose minimum balance requirements. She remarked that a CBDC could help to lower transaction costs.

- Rep. Scott interjected to ask Vice Chair Brainard to address how the U.S. could get unbanked and underbanked communities to view CBDCs the same as bank accounts.

- Vice Chair Brainard described a CBDC as a “cash analog.”

- Rep. Scott interjected to acknowledge that his question period time had expired and requested that the U.S. Federal Reserve work to address unbanked and underbanked individuals as part of their work on CBDCs.

Rep. Warren Davidson (R-OH):

- Rep. Davidson asked Vice Chair Brainard to clarify why she was not involved in the U.S. Federal Reserve’s discussions with the U.S. Department of the Treasury and the DoJ regarding the U.S. Federal Reserve’s ability to unilaterally issue a CBDC. He asked Vice Chair Brainard to identify who at the U.S. Federal Reserve was working on this matter.

- Vice Chair Brainard indicated that the U.S. Federal Reserve’s Office of the General Counsel was leading the central bank’s discussions with the U.S. Department of the Treasury and the DoJ regarding the U.S. Federal Reserve’s ability to unilaterally issue a CBDC. She explained that the discussions related to whether such authority could be drawn from existing statutes.

- Rep. Davidson then stated that a CBDC’s analog should be considered cash. He asked Vice Chair Brainard to answer whether a consumer’s modest cash holdings ought to be considered a vulnerability to public safety that would warrant reporting and monitoring.

- Vice Chair Brainard answered no. She also stated that cash would remain a payment option for consumers, even if the U.S. were to issue a CBDC.

- Rep. Davidson asked Vice Chair Brainard to indicate whether there existed a threshold of cash holdings that would create a vulnerability to the financial system.

- Vice Chair Brainard remarked that the financial system and consumer preferences were moving away from cash.

- Rep. Davidson noted how physical cash was fully legal and mentioned how there were currently efforts underway to make the digital equivalent of cash illegal. He specifically highlighted how both the Trump and Biden administrations had considered banning the practice of self-custody for digital currency. He asserted that self-custody of digital currency was essentially the same as self-custody of physical currency. He asked Vice Chair Brainard to address why the U.S. Department of the Treasury was attempting to impose additional scrutiny on digital currency holdings.

- Vice Chair Brainard remarked that the U.S. Department of the Treasury would be best suited to address Rep. Davidson’s concerns.

- Rep. Davidson then asked Vice Chair Brainard to indicate how the U.S. Federal Reserve defined permissionless peer-to-peer transactions. He commented that cash transactions were permissionless peer-to-peer transactions in nature. He asked Vice Chair Brainard to indicate whether CBDCs ought to possess the same characteristics.

- Vice Chair Brainard stated that CBDCs had a tension associated with them between preserving anonymity and combating illicit activity.

- Rep. Davidson interjected to highlight how many unbanked and underbanked individuals were distrustful of banks and therefore sought out cash. He commented that many of these individuals were not interested in using cash for illicit activities. He mentioned how Congressional Democrats had sent a letter to Google raising concerns with the company’s geolocation capabilities. He raised concerns that a CBDC could be used to surveille consumers, which would especially harm unbanked and underbanked individuals. He highlighted how China’s CBDC had surveillance capabilities and contended that the U.S. should not emulate these capabilities.

Rep. Joyce Beatty (D-OH):

- Rep. Beatty asked Vice Chair Brainard to provide recommendations for ensuring that unbanked and underbanked individuals would have sufficient education regarding CBDCs. She then discussed how other countries were exploring and issuing their own CBDCs. She asked Vice Chair Brainard to address how the pursuit of CBDCs by other countries would impact the U.S.’s international competitiveness (especially in the event that the U.S. did not issue its own CBDC).

- Vice Chair Brainard remarked that the U.S. could not take the U.S. dollar’s global status for granted given how other jurisdictions were considering their own CBDCs.

- Rep. Beatty interjected to ask Vice Chair Brainard to indicate whether policymakers ought to consider broadband access in their work on digital currencies.

- Vice Chair Brainard answered affirmatively. She stated however that offline usage of digital currencies would be important to explore for areas without adequate broadband coverage.

- Rep. Beatty highlighted how the recently enacted Infrastructure Investment and Jobs Act (IIJA) included provisions to expand access to broadband services.

Rep. Anthony Gonzalez (R-OH):

- Rep. Gonzalez noted how Vice Chair Brainard had previously stated that two key benefits of a CBDC were the avoidance of fragmentation within the U.S. payments system and reduced currency instability. He also noted how Vice Chair Brainard had highlighted recent instability in the stablecoin market. He asked Vice Chair Brainard to indicate whether recent stablecoin challenges were attributable to stablecoins backed by low quality and volatile assets.

- Vice Chair Brainard answered affirmatively.

- Rep. Gonzalez asked Vice Chair Brainard to indicate whether recent stablecoin challenges were also attributable to transparency deficiencies related to the backing assets of certain stablecoins.

- Vice Chair Brainard answered affirmatively.

- Rep. Gonzalez further asked Vice Chair Brainard to indicate whether stablecoins backed by higher quality assets and with greater levels of transparency tended to not experience similar challenges as compared to the aforementioned stablecoins.

- Vice Chair Brainard answered affirmatively.

- Rep. Gonzalez asserted that a well-regulated stablecoin with high standards for quality of backing assets, liquidity, transparency, and redemption rights could address the aforementioned instability issue.

- Vice Chair Brainard remarked that very strong bank-like regulations would sufficiently address instability risks within the stablecoin space. She stated however that these regulations would not address the fragmentation and interoperability challenges associated with stablecoins.

- Rep. Gonzalez then noted how Vice Chair Brainard had expressed support for a financial and payments system in which CBDCs would coexist with private stablecoins. He asked Vice Chair Brainard to reconcile her support for coexistence between CBDCs and private stablecoins with her contention that private stablecoins caused fragmentation within the U.S. payments system.

- Vice Chair Brainard first indicated that she did not have an opinion on having the U.S. issue a CBDC at the present time. She stated that CBDCs could play a “complementary” role to private stablecoins. She elaborated that a U.S. CBDC (which would be backed by the full faith and credit of the U.S. government) would provide interoperability between different platforms. She stated that CBDCs in this scenario would serve as a neutral settlement asset layer and thus address fragmentation concerns.

- Rep. Gonzalez then asked Vice Chair Brainard to indicate whether other central banks had expressed concerns to the U.S. Federal Reserve that the absence of a U.S. CBDC could impact the U.S. dollar’s reserve currency status.

- Vice Chair Brainard indicated that other central banks had requested that the U.S. Federal Reserve participate in their CBDC exploration efforts.

- Note: Rep. Gonzalez’s question period time expired here.

Rep. Sean Casten (D-IL):

- Rep. Casten asked Vice Chair Brainard to confirm that a U.S. CBDC would need to be considered a liability of the U.S. Federal Reserve.

- Vice Chair Brainard confirmed that a U.S. CBDC would need to be considered a liability of the U.S. Federal Reserve.

- Rep. Casten asked Vice Chair Brainard to indicate whether CBDCs would always be limited to the M1 money supply (which meant that there would be no multiplier effect).

- Vice Chair Brainard stated that a CBDC would be the “digital analog” of cash.

- Rep. Casten asked Vice Chair Brainard to explain why a private bank would choose to accept CBDC deposits. He commented that the inability for private banks to lend against CBDC deposits should make such deposits unattractive.

- Vice Chair Brainard discussed how consumers were moving away from using bank deposit accounts for payments and moving towards mobile applications for payments. She suggested that banks might want to accept CBDC deposits in order to remain active within the payments space. She stated however that whether banks would actually want to accept CBDCs was unknowable at the current time.

- Rep. Casten interjected to reiterate his skepticism that banks would accept CBDC deposits given their inability to lend against the deposits. He then asked Vice Chair Brainard to indicate whether stablecoins presented the same liquidity and risk issues as money market funds and should therefore be subject to similar deposit and investor protections.

- Vice Chair Brainard answered affirmatively.

- Rep. Casten raised concerns that stablecoins presented opportunities for grift given their attractiveness to unsophisticated users. He asked Vice Chair Brainard to indicate whether there was currently sufficient transparency into stablecoin transactions (either inside exchanges or inside digital wallets) to protect against fraudulent activities.

- Vice Chair Brainard remarked that the U.S. Federal Reserve did not have transparency into stablecoin transactions. She stated that other financial regulators likely shared Rep. Casten’s concerns about stablecoins.

Rep. Barry Loudermilk (R-GA):

- Rep. Loudermilk discussed how the U.S. Federal Reserve’s January 2022 report on CBDCs had stated that the U.S. Federal Reserve did not intend to move forward on issuing a CBDC without clear support from the Executive Branch and Congress. He highlighted how this report had stated that this support from Congress would “ideally” come in the form of a specific authorizing law. He asked Vice Chair Brainard to confirm that the U.S. Federal Reserve would not move forward on issuing a CBDC without a specific authorizing law.

- Vice Chair Brainard remarked that the U.S. Federal Reserve did not intend to proceed on issuing a CBDC without the support of the Executive Branch and Congress and stated that it would be “ideal” to have authorizing legislation that specifically addressed CBDCs.

- Rep. Loudermilk asked Vice Chair Brainard to indicate whether the U.S. Federal Reserve would move forward on issuing a CBDC in the absence of a specific authorizing law.

- Vice Chair Brainard remarked that the U.S. Federal Reserve desired clear support from the Executive Branch and Congress before it proceeded on issuing a CBDC.

- Rep. Loudermilk expressed concerns over how the U.S. Federal Reserve had not definitively ruled out proceeding on the issuance of a CBDC absent an authorizing law. He then mentioned how the U.S. Federal Reserve had argued that a CBDC could help to support unbanked households. He noted however that the U.S. Federal Deposit Insurance Corporation (FDIC) had found that many unbanked households actively avoided bank accounts for various reasons. He contended that the significant effort needed to issue a CBDC would not be worth it given how few unbanked households were likely to take advantage of a CBDC. He stated that a CBDC would need to be paired with some form of U.S. Federal Reserve-sponsored checking accounts to meaningfully address unbanked households. He called such an approach “wildly misguided.” He contended that the U.S. ought to focus on improving its payments system rather than completely overhauling it. He then discussed how CBDCs would raise cybersecurity concerns and highlighted how federal agencies had proven vulnerable to data breaches. He stated that the hacking of CBDCs would have “catastrophic” effects for the U.S. He asked Vice Chair Brainard to address how the U.S. Federal Reserve could ensure that a CBDC would be protected from cyberattacks.

- Vice Chair Brainard remarked that operational and cybersecurity risks were ongoing challenges for all payments systems and commented that a CBDC would carry such risks. She noted how the U.S. Federal Reserve was already responsible for providing “critical pieces” of the wholesale payments infrastructure and the retail payments infrastructure. She highlighted how the U.S. Federal Reserve maintained Fedwire and FedACH Services and added that the U.S. Federal Reserve was currently working on the FedNow Service. She remarked that the U.S. Federal Reserve already possessed “very significant” cybersecurity responsibilities and recognized the importance of operational resilience.

Rep. Josh Gottheimer (D-NJ):

- Rep. Gottheimer discussed how many Americans were already storing their assets in privately-issued digital assets (such as stablecoins). He remarked that the U.S. could establish guardrails to ensure that Americans could distinguish stablecoins backed on a 1:1 basis with liquid assets from other stablecoins that have questionable or non-existing backing. He mentioned how he had proposed the Stablecoin Innovation and Protection Act of 2022, which would establish a definition and requirements for qualified stablecoins. He elaborated that the bill defined qualified stablecoins as cryptocurrencies redeemable on a 1:1 basis with U.S. dollars. He remarked that this bill would reduce financial instability in markets, protect consumers, and support innovation. He further stated that the bill would create a pathway for both banks and non-banks to acquire a qualified status for the stablecoins that they issue. He asked Vice Chair Brainard to indicate whether federal oversight would allow for non-bank entities to become reliable issuers of non-bank stablecoins if they could prove that they were fully backed by cash or cash equivalents.

- Vice Chair Brainard answered affirmatively.

- Rep. Gotthemier asked Vice Chair Brainard to identify specific requirements that ought to be in place for non-bank stablecoin issuers if a system of qualifying stablecoins were implemented.

- Vice Chair Brainard mentioned how the PWG Report on Stablecoins had proposed several requirements for stablecoins. She noted that while the PWG Report on Stablecoins was focused on bank issued stablecoins, she stated that any set of stablecoins would need to maintain similar asset protections, consumer protections, and investor protections, as well as transparency standards.

- Rep. Gottheimer then mentioned how the U.S. Federal Reserve’s recent report on CBDCs had explored the potential benefits and drawbacks associated with issuing a CBDC. He asked Vice Chair Brainard to address how she foresaw a CBDC interacting with privately-issued digital assets (such as stablecoins).

- Vice Chair Brainard remarked that a digital currency that was backed by the full faith and credit of the U.S. government would be unique and could support private sector innovation more broadly. She mentioned how the U.S. Federal Reserve had received comments from innovators and payments providers that discussed the potential for a CBDC to provide a neutral settlement asset and a neutral layer in the technology stack that would enable interoperability.

Rep. Ted Budd (R-NC):

- Rep. Budd remarked that the private sector had historically proven itself to be better at pursuing innovation than the U.S. government. He asked Vice Chair Brainard to explain the objectives of a CBDC that could not be achieved via the private sector. He commented that private stablecoins were already achieving many of the stated objectives of a potential CBDC.

- Vice Chair Brainard first testified that the U.S. Federal Reserve had not yet decided whether to move forward on issuing a CBDC and indicated that the central bank was still exploring the feasibility of CBDCs. She then remarked that the U.S. Federal Reserve had the unique ability to issue currency that would be backed by the full faith and credit of the U.S. government. She stated that the U.S. Federal Reserve typically worked alongside the private sector and highlighted how the U.S. Federal Reserve maintained several services (including Fedwire) to support the private sector. She also remarked that a completely secure and trusted asset underpinning the payments system could foster more robust private innovation.

- Rep. Budd asked Vice Chair Brainard to indicate whether the U.S. Federal Reserve could ultimately decide not to issue a CBDC.

- Vice Chair Brainard answered affirmatively. She stated however that it would constitute a different approach for the U.S. to go into the international payments space relying upon private stablecoins if other jurisdictions were to use CBDCs.

- Rep. Budd then expressed concerns that a CBDC could reduce financial freedom and privacy. He expressed doubts that a centralized digital payments system issued by the U.S. government would fully protect the privacy of users. He asked Vice Chair Brainard to discuss the steps that the U.S. Federal Reserve would take to prevent the U.S. government from monitoring the financial transactions of Americans or from blocking Americans from engaging in legal transactions.

- Vice Chair Brainard highlighted how the U.S. Federal Reserve’s January 2022 report on CBDCs had called privacy protections a core principle of any CBDC. She noted that the report had suggested that privacy for CBDCs be treated similarly to privacy for bank deposits. She indicated that the report proposed no direct connection between the U.S. Federal Reserve and consumers and had instead called for an intermediated system. She elaborated that banks would possess transaction records, which would entail privacy and identity verification obligations.

Rep. Ayanna Pressley (D-MA):

- Rep. Pressley remarked that a properly designed digital U.S. dollar had the potential to promote financial inclusion, enhance consumer protection, and revitalize public payment and banking services. She contended that the U.S.’s current payments system was outdated. She highlighted how the U.S. lacked a real-time payments system, which often forced families to wait days to access their funds. She noted that while other countries, such as the United Kingdom (UK), had long ago switched to real-time payments systems, she indicated that the U.S. Federal Reserve’s FedNow Service was not expected to be launched until 2023 at the earliest. She suggested that the U.S.’s lack of a real-time payments system had likely caused many Americans to use cryptocurrencies, stablecoins, and other private options as a means of obtaining faster payments. She asked Vice Chair Brainard to address why the U.S. should trust the U.S. Federal Reserve with developing a CBDC. She expressed concerns that a U.S. Federal Reserve-developed CBDC could experience significant delays.

- Vice Chair Brainard remarked that the FedNow Service would play an important role in terms of offering real-time payments and commented that real-time payments would especially benefit small businesses and families. She attributed the FedNow Service’s delayed development to public debate surrounding the service. She stated that the U.S. Federal Reserve’s status as a public institution necessitated support from Congress and stakeholders before the central bank moved forward on a new project. She testified that the FedNow Service was on track to be launched “this time next year.” She indicated that while the private sector was now excited regarding the FedNow Service’s impending launch, she stated that the private sector had previously exhibited ambivalence regarding the project. She remarked that the financial system was evolving very rapidly and commented that this pace of evolution made it difficult for the U.S. Federal Reserve to project future trends. She stated that it would take time to implement innovations once a decision was made, which underscored the importance of proactively looking into innovations.

- Rep. Pressley reiterated how other countries had been able to set up real-time payments systems more quickly and more efficiently than the U.S. She then noted how the U.S. Federal Reserve had never been the sole federal entity responsible for issuing currency or administering public payments. She highlighted how the U.S. Mint issued coins and how the U.S. Postal Service (USPS) had previously provided banking services. She also mentioned how the U.S. Bureau of the Fiscal Service partnered with banks to issue prepaid debit cards to millions of unbanked and underbanked individuals. She asked Vice Chair Brainard to indicate whether the U.S. Federal Reserve should involve other key agencies and actors as part of its efforts to develop and support a CBDC architecture.

- Vice Chair Brainard mentioned how the U.S. Federal Reserve currently partnered with other federal agencies on various programs and expressed support for having the U.S. Federal Reserve work with other agencies and actors on a CBDC architecture.

- Rep. Pressley remarked that the U.S. Federal Reserve ought to involve other federal departments and agencies (including the U.S. Department of the Treasury and the USPS) in designing and building the U.S.’s CBDC architecture. She stated that this process should be as inclusive and as democratic as possible with an explicit focus on financial equity.

Rep. John Rose (R-TN):

- Rep. Rose noted how the U.S. Federal Reserve’s January 2022 report on CBDCs had solicited public comments on whether the U.S. ought to issue a CBDC. He specifically highlighted how the report had asked about the importance of preserving the general public’s access to a form of central bank money that could be widely used for payments if the use of cash were to decline. He noted how this question raised concerns from commenters that the U.S. Federal Reserve might decide to phase out cash over time. He asked Vice Chair Brainard to address how individuals living in areas that lacked access to broadband connectivity could make use of a CBDC.

- Vice Chair Brainard first expressed the U.S. Federal Reserve’s commitment to continue issuing currency and mentioned how the U.S. Federal Reserve maintained several investments related to the issuance of cash. She noted however that the U.S. Federal Reserve would not have any control over a diminishing acceptance of cash in payments over time. She then suggested that policymakers consider researching offline transactions and stored value cards for areas that lack broadband connectivity.

- Rep. Rose asked Vice Chair Brainard to indicate whether the U.S. Federal Reserve had any work streams regarding the central bank’s ability to issue a CBDC and maintain an offline option for payments and transmissions.

- Vice Chair Brainard testified that the U.S. Federal Reserve did have a work stream regarding its ability to issue a CBDC and maintain an offline option for payments and transmissions. She also indicated that the U.S. Federal Reserve was collaborating with peer central banks to address the issue. She stated that offline payment solutions would be necessary for ensuring that CBDCs could serve as an inclusive form of payment.

- Rep. Rose then noted how some stakeholders had raised concerns that the launch of a CBDC could lead to the politicization of monetary policy. He asserted that the Obama administration’s Operation Choke Point had weaponized the financial system for political purposes. He also highlighted how the Canadian government had instructed banks to freeze accounts linked to protests over COVID-19 vaccine mandates. He asked Vice Chair Brainard to address whether a CBDC would make it easier for the U.S. government to block individuals that it disagreed with from accessing the financial system if appropriate safeguards were not adopted.

- Vice Chair Brainard contended that CBDCs would constitute not a departure from deposits in bank accounts. She noted how the U.S. Federal Reserve’s January 2022 report on CBDCs had called for an intermediated model akin to the model used for commercial bank deposits. She noted that the U.S. Federal Reserve did not have any direct interaction with commercial bank consumers and did not view consumer transactions. She indicated however that banks served as intermediaries that were responsible for identity verification and consumer privacy. She remarked that policymakers would need to consider the privacy implications of any CBDC.

Rep. Rashida Tlaib (D-MI):

- Rep. Tlaib remarked that policymakers ought to account for how CBDCs could impact climate change. She lamented how many companies were reactivating coal-fired power plants in order to support the mining of proof-of-work-validated cryptocurrencies. She asked Vice Chair Brainard to discuss how the U.S. Federal Reserve was considering climate change-related challenges in its development of a CBDC.

- Vice Chair Brainard discussed how the proof-of-work consensus mechanisms needed for certain blockchains were “extremely” energy intensive. She stated that permissioned systems involving a central authority (such as a central bank) would not require energy intensive consensus mechanisms. She elaborated that the central authority would determine the issuance of digital currencies and commented that this system would largely resemble the U.S.’s existing payments system (which was not very energy intensive).

- Rep. Tlaib then discussed how her Congressional District had a significant unbanked and underbanked population. She highlighted how this population had experienced challenges with receiving stimulus checks and collecting unemployment checks during the COVID-19 pandemic. She noted how the U.S. Federal Reserve’s current CBDC proposal required the use of bank accounts. She also noted how Vice Chair Brainard had previously stated that the U.S. Federal Reserve could not authorize direct accounts for individuals. She asked Vice Chair Brainard to indicate whether a digital U.S. dollar could truly function as a “cash analog.” She also asked Vice Chair Brainard to discuss how the U.S. Federal Reserve could ensure that it was removing barriers to financial inclusion with regard to CBDCs.

- Vice Chair Brainard remarked that a CBDC could help to reduce transaction costs and provide real-time payments capabilities. She stated that non-profit and public partners would need to serve as intermediaries in order to address unbanked and underbanked customers. She highlighted how banks were beginning to offer low-cost accounts under the Bank On initiative.

- Rep. Tlaib interjected to comment that bank fees often served as the greatest barrier to financial inclusion. She highlighted how the U.S. Federal Reserve’s recent report on the Economic Well-Being of U.S. Households had found that low-income and underbanked Americans were more likely to use cryptocurrencies for transactions while high-income Americans were more likely to use cryptocurrencies purely for investment purposes. She raised concerns that many Americans using cryptocurrencies for transactions were being subjected to a “highly volatile ecosystem” due to their inability to access the financial system. She asked Vice Chair Brainard to indicate whether the U.S. Federal Reserve was working to address this concern.

- Vice Chair Brainard expressed agreement with Rep. Tlaib assertion that non-bank entities that focused on unbanked and underbanked consumers serve as intermediaries.

Rep. Bryan Steil (R-WI):

- Rep. Steil remarked that much of the hearing’s conversation was premised on the belief that the ease of use of foreign CBDCs would pose a threat to the U.S. dollar’s future dominance. He stated that the U.S. dollar’s appeal as a global reserve currency was largely attributable to the U.S.’s strong and stable position. He raised concerns that the U.S.’s deteriorating fiscal position could threaten the U.S. dollar’s central role in global finance. He highlighted how the U.S. had increased its debt levels and was experiencing rising interest rates. He stated that rising inflation would likely make it more expensive for the U.S. to borrow money to service its debt. He then remarked that much of the hearing’s disagreement regarding CBDC structures stemmed from different views regarding the types of problems that CBDCs were meant to solve. He mentioned how an FDIC survey had found that 36.3 percent of unbanked respondents had stated that they did not possess a bank account because they did not trust banks. He further noted how the survey had found that 19.6 percent of unbanked respondents believed that banks did not offer the products or services that they needed. He stated that it was unclear whether a CBDC would address these problems. He asked Vice Chair Brainard to discuss the problems that other countries are attempting to solve through their pursuits of CBDCs.

- Vice Chair Brainard remarked that there existed a variety of motivations for pursuing CBDCs and indicated that financial inclusion was one area that other jurisdictions were attempting to address through CBDCs. She also identified the declining use of cash as another motivation for pursuing CBDCs and stated that CBDCs could ensure that consumers and businesses maintained direct access to safe central bank money in light of this declining use. She further discussed how many central banks were pursuing CBDCs in order to address concerns related to payments system fragmentation and instability caused by stablecoin use. She lastly noted how many central banks were pursuing CBDCs in order to address the opaque and costly nature of cross-border transactions.

- Rep. Steil reiterated how privacy concerns had led many Americans to forgo banking services. He stated that the Biden administration’s financial surveillance proposals would only exacerbate these privacy concerns. He asked Vice Chair Brainard to indicate whether other countries had been able to bolster financial inclusion through their pursuits of CBDCs.

- Vice Chair Brainard remarked that it remained too early to assess whether other countries had been able to bolster financial inclusion through their pursuits of CBDCs. She noted how foreign jurisdictions had only just recently begun to issue CBDCs. She stated however that some jurisdictions (such as Brazil) had observed great improvements in financial inclusion stemming from government-provided payments applications.

Rep. Jesús “Chuy” García (D-IL):