- This event has passed.

Investigating the Collapse of FTX, Part I (U.S. House Committee on Financial Services)

December 13, 2022 @ 5:00 am – 9:00 am

| Hearing | Investigating the Collapse of FTX, Part I |

| Committee | U.S. House Committee on Financial Services |

| Date | December 13, 2022 |

Hearing Takeaways:

- The Collapses of FTX and Alameda Research: The hearing focused on the recent collapses of cryptocurrency exchange FTX and its affiliated hedge fund Alameda Research (which was owned by former FTX CEO Sam Bankman-Fried). The hearing focused on how FTX’s former management team had engaged in risky activities with very minimal oversight that had caused as many as one million users to lose access to their cryptocurrency holdings and potentially the holdings themselves. Current FTX CEO John Ray III estimated that FTX’s customer losses were in excess of $7 billion. Of note, Full Committee Ranking Member Patrick McHenry (R-NC) stated that the Committee would continue investigating FTX’s collapse when Republicans retake the majority in the U.S. House of Representatives in the upcoming Congress.

- Improprieties at Alameda Research: Committee Members and Mr. Ray noted how Alameda Research had improperly accessed funds from the customers of FTX.com (which was the exchange for non-U.S. citizens) to support their risky trades and investments. The failure of these risky trades and investments had contributed to FTX’s insolvency. They also highlighted how FTX had requested that its customers deposit their exchange funds with Alameda Research at one point and expressed uncertainty as to whether these deposited funds were ultimately transferred to FTX.

- Lack of Corporate Governance Controls: Committee Members and Mr. Ray also expressed concerns over the lack of corporate governance controls at FTX and Alameda Research. Mr. Ray indicated that these poor controls included a lack of list of bank accounts, a lack of a complete list of employees and their functions, an extensive use of independent contractors (as opposed to employees), and gaps and total absences of insurance. He testified that FTX’s collapse was one of the worst bankruptcies he had managed from a documentation standpoint and commented that this lack of documentation had made it difficult to track and trace assets from FTX and its affiliated entities.

- Minting and Manipulation of FTT Tokens: Several Committee Democrats raised concerns over FTX’s minting of its own tokens (known as FTT tokens) and over how Alameda Research had used these tokens as collateral for their own trades. They suggested that FTX may have manipulated the price of the FTT tokens to enable Alameda Research to engage in riskier trades. Mr. Ray commented that it was very risky for a company to use assets that they had created as collateral. He also speculated that FTX’s customers did not realize that FTX had been using its own assets as a source of collateral.

- FTX’s Bankruptcy Process: Committee Members expressed interest in FTX’s bankruptcy process and potential irregularities at the time of the filing. Current FTX CEO John Ray III testified that FTX had implemented a five-part bankruptcy plan and that he had been able to secure over $1 billion of FTX’s assets as part of the bankruptcy process. He indicated that these assets were being held in cold wallets in a secure location. He stated that this recovery of FTX’s remained an ongoing process that would take weeks or months to complete. He also expressed confidence that the cross-border nature of the bankruptcy would not complicate the resolution of the bankruptcy process.

- Hack of FTX’s Assets Post-Bankruptcy Filing: Committee Members noted how hackers had stolen $477 million in tokens from FTX shortly following FTX’s bankruptcy filing. Mr. Ray stated that his team was relying upon forensic and cybersecurity experts to investigate the hack and to track the stolen cryptocurrencies. He also indicated that law enforcement agencies were involved in addressing this hack.

- The Bahamian Government’s Actions Post-Bankruptcy Filing: Committee Members expressed concerns over how former FTX CEO Sam Bankman-Fried had provided Bahamian regulators with an advanced warning of FTX’s bankruptcy filing. Mr. Ray noted how over $100 million had been released from FTX accounts to approximately 1,500 Bahamian customers. Committee Members also expressed concerns over how the Bahamian government had instructed the previous FTX management team to mint approximately $300 million in FTT tokens and to transfer these new tokens to cold storage. Mr. Ray confirmed that this minting activity and transfer of funds had occurred post-bankruptcy when the automatic stay had been in effect.

- Complications Associated with Digital Assets: Committee Members and Mr. Ray stated that the fluctuating nature of cryptocurrency values would create complications for FTX’s bankruptcy. Mr. Ray indicated that his team would assess FTX customer accounts based on the date of FTX’s bankruptcy filing. He also noted how cryptocurrencies stored in hot wallets were vulnerable to hacking.

- Management of FTX’s Solvent Entities: Mr. Ray mentioned how there were several FTX-affiliated entities (including FTX Japan and LedgerX) that were regulated and solvent. He testified that LedgerX will ultimately be sold.

- Concerns Regarding the Activities of FTX, Alameda Research, and Former FTX CEO Sam Bankman-Fried: Committee Members and Current FTX CEO John Ray III raised concerns over how FTX, Alameda Research, and former FTX CEO Sam Bankman-Fried had operated. They suggested that these activities should have been indicators of poor management or even fraud.

- FTX’s Investments: Mr. Ray noted that FTX had spent $5 billion on a myriad of businesses and investments in 2021 and 2022. He commented that many of these businesses and investments might now only be worth a fraction of what FTX had paid for them.

- FTX’s Questionable Loans to Corporate Insiders: Committee Members and Mr. Ray expressed concerns over how FTX had made loans and other payments to corporate insiders in excess of $1.5 billion. Mr. Ray stated these loans were often provided with minimal documentation and testified that there was no information at the current time regarding the purpose or use of the funds stemming from the loans.

- FTX’s Tax Compliance: Committee Members also expressed interest in whether FTX had properly filed its U.S. taxes with the U.S. Internal Revenue Service (IRS). Mr. Ray mentioned that his team had hired Ernst & Young to review FTX’s tax returns and indicated that this review is ongoing. He also stated that his team would provide FTX’s IRS filings to the regulatory agencies investigating FTX.

- FTX’s Accounting and Auditing Practices: Committee Members contended that FTX’s accounting practices were very basic and minimal for a company of its size. Rep. French Hill (R-AR) raised particular concerns over FTX’s use of two auditing firms: Prager Metis and Armanino.

- FTX’s Relationship with IEX: Rep. Tom Emmer (R-MN) expressed interest in learning more about FTX’s involvement with stock exchange IEX and highlighted how there was uncertainty as to whether FTX’s had acquired or had merely invested in IEX. Mr. Ray stated that he would need to follow up with the Committee regarding the relationship between the two entities.

- FTX’s Expensive Advertising Campaigns and Celebrity Endorsements: Rep. Rashida Tlaib (D-MI) and Rep. Stephen Lynch (D-MA) raised concerns over FTX’s significant expenditures on celebrity endorsements and arena naming rights. They stated that these advertising expenditures were meant to target minority communities.

- Alameda Research’s Investment in Farmington State Bank: Rep. Blaine Luetkemeyer (R-MO) and Rep. Lance Gooden (R-TX) questioned Alameda Research’s 2020 investment in Farmington State Bank (which has since changed its name to Moonstone Bank). They called this investment suspicious given the bank’s small size and asserted that Alameda Research had overpaid for its stake in the bank. Rep. Luetkemeyer expressed interest in exploring whether Alameda Research had made this investment to facilitate money laundering.

- Alameda Research’s Involvement in Unsafe Exchanges: Mr. Ray and Rep. Gooden also discussed how Alameda Research’s business model as a market maker had required funds to be deployed to various third-party exchanges that were inherently unsafe. They noted how many of these exchanges were in foreign jurisdictions that did not provide protections for these funds.

- Ties Between FTX and its Affiliated Non-Profit Organizations: Rep. Andy Barr (R-KY) expressed interest in learning whether the FTX Foundation and its various affiliates had been established properly as non-profit organizations and were completely separate from FTX’s for-profit entities. Mr. Ray stated that his team was looking into the operations of the FTX Foundation and its affiliates. He also noted how the FTX Foundation and its affiliates had received funds from Alameda Research.

- Former FTX CEO Sam Bankman-Fried’s Political Influence: Rep. Brad Sherman (D-CA) cautioned that former FTX CEO Sam Bankman-Fried had made significant political contributions to help advance his policy goals. He also suggested that FTX’s bonuses and loans to its management team might have been used to facilitate illegal campaign contributions.

- Involvement of Former FTX CEO Sam Bankman-Fried’s Family in FTX: Rep. Bill Huizenga (R-MI) expressed interest regarding the involvement of former FTX CEO Sam Bankman-Fried’s family in FTX. Mr. Ray noted that Mr. Bankman-Fried’s father Joseph Bankman had provided legal advice to FTX and had received payments from FTX.

- Concerns Regarding the Timing of Former FTX CEO Sam Bankman-Fried’s Arrest: Several Committee Members questioned the U.S.’s decision to arrest and charger former FTX Sam Bankman-Fried immediately preceding the hearing. They noted how Mr. Bankman-Fried had been set to testify under oath at the hearing and that the arrest had prevented this testimony. They stated that Mr. Bankman-Fried’s testimony before the Committee could have provided U.S. prosecutors with information and sworn statements that could help them to build their cases against FTX.

- Concerns Regarding Cryptocurrencies, Digital Assets, and Federal Policies: Committee Members also used the hearing to raise concerns over cryptocurrencies, digital assets, and federal policies. Full Committee Chairman Maxine Waters (D-CA) asserted that the recent failures of many cryptocurrency firms (including TerraUSD, Celsius, BlockFi, FTX, and Alameda Research) highlighted the importance of having the Committee address cryptocurrencies. While current FTX CEO John Ray III generally avoided providing policy recommendations for addressing cryptocurrencies and digital assets, he stated that FTX’s collapse had demonstrated the importance of recordkeeping, controls, and segregation of funds were necessary within the context of cryptocurrency holdings.

- Criticisms of Cryptocurrencies: Several Committee Democrats, including Rep. Brad Sherman (D-CA), Rep. Emanuel Cleaver (D-MO), Rep. Juan Vargas (D-CA), Rep. Rashida Tlaib (D-MI), and Rep. Jesús “Chuy” García (D-IL) expressed hostility towards cryptocurrencies. They stated that these assets lacked any inherent value and facilitated illicit activities. Full Committee Vice Chair Jake Auchincloss (D-MA) added that he was becoming increasingly skeptical of cryptocurrencies and asserted that the purported benefits of blockchain technology were failing to materialize. Moreover, Rep. Sylvia Garcia (D-TX) and Rep. Jesús “Chuy” García (D-IL) expressed concerns that cryptocurrency collapses disproportionately harmed low-income and minority communities given how these communities were overrepresented in the cryptocurrency space. However, Full Committee Ranking Member Patrick McHenry (R-NC) and Rep. Tom Emmer (R-MN) attributed FTX and Alameda Research’s failures to its fraud and management issues. They contended that the failure of these entities should not serve as an indictment on digital assets and blockchain technology.

- Criticism of U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s Regulatory Approach Towards Cryptocurrencies: Committee Republicans and Rep. Josh Gottheimer (D-NJ) criticized the SEC for failing to provide regulatory clarity to the digital assets space and asserted that this inaction was partially responsible for FTX’s collapse. They further contended that this lack of regulatory clarity had driven many cryptocurrencies to domicile outside of the U.S. in jurisdictions with weaker consumer protections.

Hearing Witnesses:

- Mr. John J. Ray III, Chief Executive Officer, FTX Group

Member Opening Statements:

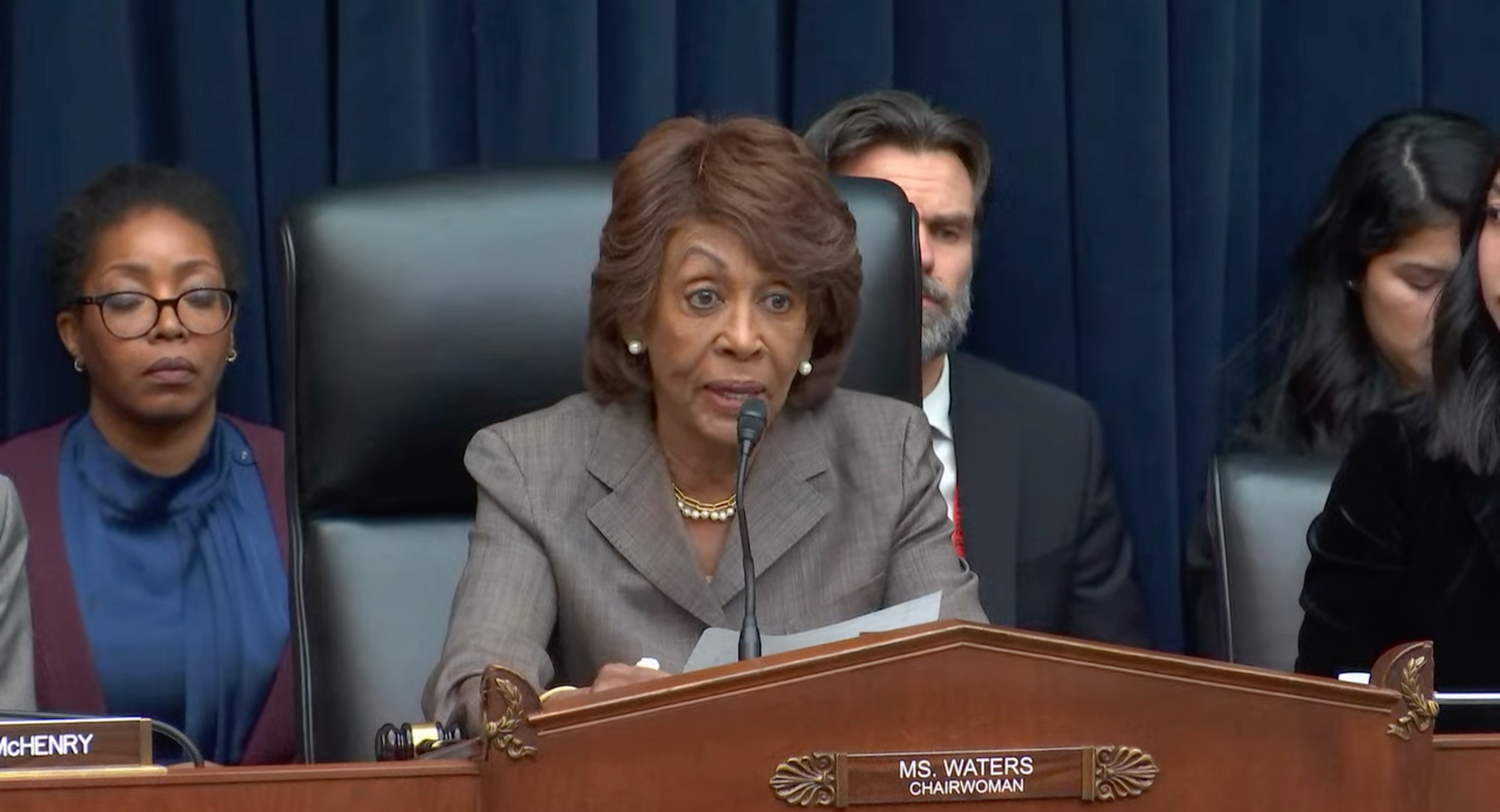

Full Committee Chairman Maxine Waters (D-CA):

- She first expressed hope that the arrest of former FTX CEO Sam Bankman-Fried would mean that he would be held accountable for his fraud.

- She noted how Mr. Bankman-Fried had been scheduled to testify under oath at the current hearing and lamented how the timing of Mr. Bankman-Fried’s arrest had prevented this testimony.

- She then discussed how FTX had recently been one of the largest cryptocurrency exchanges in the world with a valuation of $32 billion and noted how FTX was now bankrupt and possibly looted.

- She stated that FTX had misused approximately $10 billion in customer funds and owed creditors at least $3 billion.

- She mentioned how as many as one million people (including many Americans) were currently locked out of their FTX accounts.

- She indicated that these people may only recover a fraction or even none of the money in their FTX accounts.

- She remarked that FTX’s collapse was also notable considering the company’s “total disregard” for standard business practices, governance, and risk management, as well as the company’s criminal conduct.

- She mentioned how FTX’s current CEO John Ray III had stated that he had never seen such a complete lack of corporate controls and such a complete absence of trustworthy information as had occurred with FTX.

- She stated that she was “deeply troubled” over the ability of FTX employees to steal customer funds to finance their lavish lifestyles.

- She also expressed interest in investigating FTX’s “deep ties” to Alameda Research, which she explained was a cryptocurrency hedge fund that was predominantly owned by former FTX CEO Sam Bankman-Fried.

- She commented that Alameda Research had “gambled away” billions of dollars in customer assets that had been inappropriately transferred from FTX.

- She further expressed interest in exploring how current FTX CEO John Ray III were working to recover funds for FTX’s former customers.

- She then remarked how the Committee under her leadership had focused on the growth and popularity of cryptocurrencies and commented that FTX’s recent failure had highlighted many of the Committee’s concerns regarding cryptocurrencies.

- She mentioned how Committee Democrats had created a Digital Assets Working Group in 2021 to explore the underlying technologies and finance applications for digital assets and to learn about the risks posed by cryptocurrencies to customers, consumers, and the economy.

- She mentioned how she was working on bipartisan legislation with Full Committee Ranking Member Patrick McHenry (R-NC) to address stablecoin risks.

- She asserted that the recent failures of many cryptocurrency firms (including TerraUSD, Celsius, BlockFi, FTX, and Alameda Research) highlighted the importance of addressing cryptocurrencies.

- She lastly highlighted how the Committee’s work on cryptocurrency issues had pushed enforcement agencies across the U.S. to take greater actions against bad actors within the digital assets space.

- She also applauded the SEC for authorizing separate charges relating to former FTX CEO Sam Bankman-Fried.

Full Committee Ranking Member Patrick McHenry (R-NC):

- He remarked that the current hearing was bipartisan in nature and noted how the Committee had invited two witnesses to testify at the hearing: current FTX CEO John Ray III and former FTX CEO Sam Bankman-Fried.

- He noted however that Mr. Bankman-Fried was unable to make the current hearing and expressed interest in having him testify before the Committee at a later date.

- He stated that while former FTX CEO Sam Bankman-Fried’s arrest was “welcome news,” he commented that this arrest did not provide clarity into the full extent of FTX’s misdeeds.

- He expressed interest in having the Committee better understand the flow of funds between FTX, Alameda Research, and FTX’s 130 affiliated entities.

- He also remarked that the Committee must work to prevent future frauds and commented that FTX’s fraud appeared to be different in that it used a new type of technology.

- He asserted however that the fact that FTX’s fraud had involved cryptocurrencies did not mean that cryptocurrencies themselves were fraudulent in nature.

- He expressed his belief in the promise of digital assets and blockchain technology applications and mentioned how he had worked to develop clear rules for the digital assets space.

- He commented that these rules would protect U.S. consumers and investors and support domestic innovation.

- He asserted that SEC Chairman Gary Gensler’s “regulation by enforcement” approach would fail to stop bad actors and expressed interest in providing additional clarity on the application of U.S. securities laws to trading platforms.

- He accused SEC Chairman Gensler of failing to properly apply U.S. securities laws to trading platforms.

Witness Opening Statements:

Mr. John J. Ray III (FTX Group):

- He noted how he had assumed FTX’s CEO role on November 11, 2022 and asserted that Chapter 11 bankruptcy had constituted the best course of action for preserving FTX’s remaining value.

- He testified that FTX had implemented a five-part bankruptcy plan and stated that the overarching objective of this plan was to maximize value for FTX’s customers and creditors.

- He attributed FTX’s collapse to the “absolute” concentration of control in the hands of a small group of grossly inexperienced and unsophisticated individuals that had failed to implement any necessary controls for a company entrusted with other people’s money or assets.

- He indicated that some of FTX’s unacceptable management practices included the use of computer infrastructure that provided individuals in senior management with access to systems that stored customer assets without security controls to prevent them from redirecting the assets, the storing of certain private keys without effective security controls or encryption, the ability of Alameda Research to borrow funds held at FTX.com without any limits, the comingling of assets, the lack of complete documentation for transactions, the absence of audited and reliable financial statements, the lack of personnel in financial and risk management functions, and the absence of independent governance throughout the FTX group.

- He stated that FTX’s previous lack of corporate infrastructure posed challenges for his team as it worked to navigate FTX through the bankruptcy process.

- He testified however that his team had instituted “meaningful” steps to gain command and control of FTX’s finances and that his team was making progress in understanding FTX’s situation.

- He added that his team would share its findings with interested and affected parties throughout the bankruptcy process.

- He remarked that the scope of his team’s investigation was “truly enormous” and noted how it involved detailed tracing of money flows and asset transfers from the time of FTX’s founding and complex technological efforts to identify and trace cryptocurrency assets.

- He testified that his team was currently collecting and reviewing dozens of terabytes of documents and data, including billions of individual transactions.

- He added that his team was leveraging sophisticated technology and expertise to identify and trace additional transactions and assets.

- He stated that customer assets held on the FTX.com were comingled with assets on Alameda Research’s trading platform.

- He also indicated that Alameda Research had used FTX customer funds to engage in margin trading.

- He commented that this margin trading had exposed FTX customer funds to “massive” losses.

- He further testified that FTX had gone on a “spending binge” in 2021 and 2022 and noted how the company had spent $5 billion on a myriad of businesses and investments.

- He commented that many of these businesses and investments might now only be worth a fraction of what FTX had paid for them.

- He indicated that FTX had made loans and other payments to corporate insiders in excess of $1.5 billion.

- He discussed how Alameda Research’s business model as a market maker had required funds to be deployed to various third-party exchanges that were inherently unsafe.

- He noted how many of these exchanges were in foreign jurisdictions that did not provide protections for these funds.

- He lastly stated that his ability to comment on many matters relating to FTX’s collapse would be inherently limited due to the state of FTX’s records, ongoing bankruptcy proceedings, and numerous law enforcement investigations into FTX.

Congressional Question Period:

Full Committee Chairman Maxine Waters (D-CA):

- Chairman Waters noted how FTX had moved customer funds held at its exchange to Alameda Research, which was a hedge fund owned almost entirely by former FTX CEO Sam Bankman-Fried. She commented that this movement of funds had enabled Alameda Research to effectively gamble with FTX customer funds without the knowledge or consent of FTX’s customers. She noted that if FTX had been registered as a securities exchange, then FTX would have been subjected to securities laws requiring the segregation of customer assets. She commented that these laws would have prevented conflicts of interest from arising. She also noted how former FTX CEO Sam Bankman-Fried appears to have tried to hide the linkages between FTX and Alameda Research. She asked Mr. Ray to indicate whether there was any evidence of this coverup. She also asked Mr. Ray to indicate whether there was any evidence that there was any independent governance of Alameda Research that was separate from FTX’s exchange business.

- Mr. Ray stated that the operations of FTX were not segregated from the operations of Alameda Research and commented that both the exchange and the hedge fund were operated as one company. He remarked that there had not existed a distinction between the operations of the company and who controlled those operations.

- Chairman Waters then noted how a bankruptcy filing had revealed that former FTX CEO Sam Bankman-Fried had received a $1 billion personal loan from Alameda Research. She noted that Mr. Bankman-Fried had been unaware of the loan’s repayment terms and interest details during a meeting with Committee staff. She also mentioned that Mr. Bankman-Fried had been unable to remember who had authorized this loan during his meeting with Committee staff. She noted how Mr. Bankman-Fried had claimed to have reinvested this money into FTX and had justified the personal loan as a way to avoid directly connecting Alameda Research with FTX. She asked Mr. Ray to discuss any significant findings surrounding this specific loan.

- Mr. Ray stated that numerous loans were provided to former FTX CEO Sam Bankman-Fried and noted that some of these loans were documented by individual promissory notes. He indicated however that there were no descriptions regarding the purposes of these loans. He mentioned how Mr. Bankman-Fried had signed as both the issuer and recipient of a loan in one instance. He testified that there was no information at the current time regarding the purpose or use of the funds stemming from the loans. He stated that his investigation was meant to uncover this purpose and use.

- Chairman Waters asked Mr. Ray to indicate whether he had found any business or operational activities that FTX and Alameda Research had jointly engaged in that could be considered inappropriate or detrimental to FTX.

- Mr. Ray stated that Alameda Research’s operations were dependent on FTX customer funds. He explained that funds from FTX.com (which was the exchange for non-U.S. citizens) had been used at Alameda Research to make investments and other disbursements.

- Chairman Waters asked Mr. Ray to answer whether FTX had maintained sufficient risk management systems and controls to appropriately monitor any leverage that the business had taken on and FTX’s linkages to other businesses (such as Alameda Research).

- Mr. Ray stated that FTX maintained virtually no internal controls or separations amongst businesses.

Full Committee Ranking Member Patrick McHenry (R-NC):

- Ranking Member McHenry noted how Mr. Ray had categorized FTX’s businesses into four silos. He asked Mr. Ray to describe these four silos.

- Mr. Ray highlighted how FTX had over 100 affiliated entities and noted how he had categorized these various entities into four silos for presentation purposes. He indicated that the first silo is the U.S. silo. He explained that this silo involves FTX.US, which was FTX’s exchange for U.S. investors. He indicated that the second silo is the international silo. He explained that FTX had maintained FTX.com, which was their international exchange for non-American investors. He indicated that the third silo is Alameda Research. He explained that Alameda Research was a cryptocurrency hedge fund. He indicated that the fourth silo involved FTX’s investments. He speculated that these investments were made with either Alameda Research’s money or money that came from FTX.com

- Ranking Member McHenry asked Mr. Ray to indicate who owned each of these silos.

- Mr. Ray stated that former FTX CEO Sam Bankman-Fried had owned or controlled all of the entities within the four silos.

- Ranking Member McHenry asked Mr. Ray to explain the differences between the FTX.US and the FTX.com silos.

- Mr. Ray noted that FTX.US was for U.S. citizens that wanted to trade cryptocurrencies and that U.S. citizens were not able to trade on the FTX.com exchange. He also mentioned how FTX had an exchange that existed outside of these two silos, which was LedgerX. He explained that LedgerX is regulated by the U.S. Commodity Futures Trading Commission (CFTC) and noted how LedgerX is currently solvent.

- Ranking Member McHenry then asked Mr. Ray to explain what Alameda Research did.

- Mr. Ray stated that Alameda Research made cryptocurrency investments, engaged in margin trading, and took long and short positions in cryptocurrencies. He noted that Alameda Research had also made over $5 billion in investments across various sectors.

- Ranking Member McHenry asked Mr. Ray to discuss the relationship between Alameda Research and FTX.com.

- Mr. Ray described Alameda Research as a customer of FTX.com.

- Ranking Member McHenry asked Mr. Ray to indicate whether Alameda Research and FTX.com each had their own distinct set of capital.

- Mr. Ray answered no.

- Ranking Member McHenry then asked Mr. Ray to indicate when FTX had begun to experience financial trouble.

- Mr. Ray noted that FTX’s financial troubles were first disclosed to the public beginning around November 2, 2022. He stated however that these financial troubles had preceded this public disclosure by either months or years. He remarked that his investigation into FTX’s problems remained ongoing. He emphasized however that FTX’s financial troubles had preceded their public disclosure.

- Ranking Member McHenry then asked Mr. Ray to describe the relationship between FTX.com and FTX.US.

- Mr. Ray stated that while there existed a public distinction between FTX.com and FTX.US, he noted that the crypto assets for both platforms had been housed in the same database.

- Ranking Member McHenry asked Mr. Ray to indicate whether Alameda Research’s assets had been housed in a distinct database.

- Mr. Ray answered affirmatively.

- Ranking Member McHenry then noted how Mr. Ray’s testimony had asserted that there had been an absence of independent governance throughout the FTX group. He noted however that former FTX CEO Sam Bankman-Fried had claimed that he was neither running Alameda Research nor making decisions for Alameda Research. He asked Mr. Ray to indicate whether Mr. Bankman-Fried’s claim was accurate.

- Mr. Ray stated that he did not know the basis for former FTX CEO Sam Bankman-Fried’s claim. He noted however that Mr. Bankman-Fried had owned 90 percent of Alameda Research.

- Ranking Member McHenry asked Mr. Ray to confirm that there had been no distinction in the governance of FTX and Alameda Research.

- Mr. Ray remarked that there had been no distinction in the governance of FTX and Alameda Research. He stated that FTX’s owners could do whatever they wanted across all four silos of the business.

Rep. Nydia Velázquez (D-NY):

- Rep. Velázquez noted how Mr. Ray had reportedly stated that he had never seen such a complete failure of corporate control and such a level of corporate dysfunction as with FTX. She asked Mr. Ray to expand on these statements and to explain what had caused him to make such statements.

- Mr. Ray attributed the aforementioned statements to FTX’s utter lack of recordkeeping.

- Rep. Velázquez then noted how many of the debtors in the FTX group are located in offshore jurisdictions. She asked Mr. Ray to indicate whether this dynamic would complicate the efforts to retrieve the assets of debtors.

- Mr. Ray answered no. He mentioned how he had been involved in several cross-border bankruptcy situations and stated that different jurisdictions tended to cooperate with one another during bankruptcy proceedings in order to protect the victims of these situations.

- Rep. Velázquez asked Mr. Ray to indicate how much of FTX’s assets his team had been able to secure as part of the bankruptcy process and to indicate where most of these assets were located.

- Mr. Ray testified that his team had been able to secure over $1 billion of FTX’s assets as part of the bankruptcy process and indicated that these assets were being held in cold wallets in a secure location. He stated that this recovery of FTX’s assets remained an ongoing process that would take weeks or months to complete.

- Rep. Velázquez asked Mr. Ray to indicate whether most of FTX’s creditors were located within the U.S. or in foreign locations.

- Mr. Ray noted that the majority of FTX’s creditors had used FTX.com and were outside of the U.S. He noted however that there were some foreign customers that had used FTX.US and some U.S. customers that had used FTX.com.

- Rep. Velázquez then asked Mr. Ray to explain why he had established four silos for FTX. She asked Mr. Ray to explain how this four silo approach would maximize asset recovery recovery. She also asked Mr. Ray to indicate whether this approach could help to determine what had happened to the missing $1 billion.

- Mr. Ray stated that the four silo approach enabled his team to first focus on the impacts of the collapse of FTX.US. He noted how FTX.US had smaller trading volume and fewer customers than FTX.com. He highlighted how the FTX.com silo was for non-U.S. users, which provided an easy distinction for his team’s work. He also stated that the Alameda Research silo was fundamentally different from the FTX.US and FTX.com silos in that it involved a hedge fund.

- Rep. Velázquez asked Mr. Ray to identify any lessons learned from his time at FTX that should inform future legislative efforts on cryptocurrency issues.

- Mr. Ray commented that he was not an expert in cryptocurrency regulation. He stated however that recordkeeping, controls, and segregation of funds were necessary within the context of cryptocurrency holdings.

Full Committee Vice Ranking Member Ann Wagner (R-MO):

- Vice Ranking Member Wagner asked Mr. Ray to elaborate on his assertion that FTX’s collapse was worse than Enron’s collapse.

- Mr. Ray stated that FTX’s collapse was unusual in that there was a total absence of recordkeeping. He noted how FTX employees had communicated their invoices and expenses using the Slack application. He also noted how FTX had used QuickBooks accounting software, which he called very unusual for a multibillion dollar company. He further highlighted that FTX had no independent board of directors and called this situation “highly unusual” given FTX’s size. He remarked that the fact that FTX’s products and services involved intangible assets had made its collapse even more complex.

- Vice Ranking Member Wagner noted how former FTX CEO Sam Bankman-Fried had apologized for “mistakes.” She asked Mr. Ray to indicate whether the transfer of customer funds from FTX to Alameda Research had been done by mistake.

- Mr. Ray stated that he did not find the statement that customer funds had been mistakenly transferred from FTX to Alameda Research to be credible.

- Vice Ranking Member Wagner noted how reports suggest that FTX.com had transferred more than half of its customer’s funds (which amounted to roughly $10 billion) to Alameda Research. She asked Mr. Ray to indicate whether these reports were accurate.

- Mr. Ray testified that his team’s work remained unfinished and commented that he could therefore not provide exact transfer amounts. He stated however that the transfer amount was several billion dollars and called the size of the harm “significant.”

- Vice Ranking Member Wagner noted how FTX.com had claimed to possess a sophisticated risk management system that was commensurate with the size of its operations. She asked Mr. Ray to indicate whether this claim had been accurate and to explain the sophistication of this risk management system.

- Mr. Ray described FTX.com’s claim that it possessed a sophisticated risk management system as “absolutely false.” He asserted that there was no sophistication in FTX.com’s risk management system.

- Vice Ranking Member Wagner asked Mr. Ray to provide a breakdown of the various business activities of FTX.com.

- Mr. Ray noted how FTX had two exchanges that allowed for users to trade cryptocurrencies and a hedge fund. He explained that non-U.S. citizens had a more expansive ability to trade cryptocurrencies using FTX.com. He also noted how there did exist regulated entities within the FTX.US silo and the FTX.com silo. He mentioned how FTX has a regulated entity in Japan that is solvent and how LedgerX is an FTX-affiliated U.S. regulated entity that is also solvent. He stated that these regulated entities were distinct from the aforementioned exchanges.

- Vice Ranking Member Wagner submitted an op-ed for the hearing’s record that described an existing SEC rule that could have been employed to prevent the misuse of customer assets.

Rep. Brad Sherman (D-CA):

- Rep. Sherman mentioned how he had worked to ban U.S. investments in cryptocurrencies for five years. He expressed concerns that the Committee would view former FTX CEO Sam Bankman-Fried as an anomalous character. He asserted that the cryptocurrency space was inherently dangerous and stated that cryptocurrencies had no inherent value. He remarked that the goal of cryptocurrencies was to eventually become widely used currencies that would compete with the U.S. dollar. He stated that the secretive nature of cryptocurrencies facilitated a variety of illicit activities, including drug dealing, human trafficking, and sanctions evasions. He asserted that the biggest market for cryptocurrencies was among tax evaders. He also discussed how cryptocurrencies sought to challenge the U.S. dollar’s current position as the world’s reserve currency. He asserted that the dethroning of the U.S. dollar’s world reserve currency status would enrich already wealthy individuals at the expense of American families. He then remarked that former FTX CEO Sam Bankman-Fried’s main policy goals were to keep the SEC from regulating the cryptocurrency space and to have the CFTC provide a “patina” of regulation. He raised concerns that the Committee would criticize Mr. Bankman-Fried and then advance his policy agenda. He criticized the cryptocurrency industry for their outsized political influence and stated that this influence could harm the U.S.’s ability to efficiently enforce its tax code and sanctions regime. He then submitted a previous letter from 19 Republican Committee Members that had criticized the SEC for focusing on the “purported” risks of digital assets. He also stated that several Committee Republicans had accused the SEC of being “anti-innovation” for its aggressive scrutiny of certain cryptocurrency firms. He then asked Mr. Ray to indicate whether his team would turn over its investigation’s findings about other top FTX executives, including Ryan Salame and Caroline Ellison, to U.S. law enforcement authorities.

- Mr. Ray remarked that his team was conducting a thorough investigation into FTX’s collapse and was cooperating with U.S. regulators and law enforcement agencies. He stated that his team would turn over any relevant information found in this investigation to U.S. regulators and law enforcement agencies.

- Rep. Sherman then noted how former FTX CEO Sam Bankman-Fried had been indicted for violating U.S. campaign finance laws. He expressed hope that Mr. Ray’s team would turnover information about FTX’s bonuses and loans. He suggested that these bonuses and loans might have been used to facilitate illegal campaign contributions. He asked Mr. Ray to indicate whether his team would be able to turnover this information.

- Mr. Ray answered affirmatively.

Rep. Frank Lucas (R-OK):

- Rep. Lucas noted how some FTX-affiliated entities (such as LedgerX) were not included in FTX’s bankruptcy process. He asked Mr. Ray to explain why these entities were not included in FTX’s bankruptcy process and to indicate what would ultimately happen with these entities.

- Mr. Ray noted how LedgerX had been kept out of FTX’s bankruptcy filing. He indicated that LedgerX is a fully solvent regulated entity and noted that it has segregated its customer funds. He stated that LedgerX customers had not been harmed and that there was no reason to put LedgerX into bankruptcy. He remarked that LedgerX will ultimately be sold.

- Rep. Lucas asked Mr. Ray to discuss how U.S. bankruptcy proceedings interact with international proceedings.

- Mr. Ray remarked that the U.S. bankruptcy system was designed to have a cooperative relationship with liquidators in other jurisdictions. He stated that the U.S. worked with other jurisdictions to share information and facilitate distributions to creditors.

- Rep. Lucas then mentioned how the SEC, the CFTC, and the U.S. Department of Justice (DoJ) had brought charges against former FTX CEO Sam Bankman-Fried. He noted how Mr. Ray’s testimony had described FTX as maintaining “unacceptable” management practices. He mentioned how the SEC had alleged that Mr. Bankman-Fried had directed FTX customers to deposit cash in Alameda Research-controlled bank accounts. He asked Mr. Ray to explain how FTX had been able to conceal this tactic.

- Mr. Ray stated that FTX customer funds were deposited directly into Alameda Research (as opposed to FTX’s bank accounts). He called this situation unfortunate.

- Rep. Lucas noted that FTX Digital Markets and FTX Australia had not been included in FTX’s bankruptcy filing because local regulators had initiated their own proceedings for these entities. He asked Mr. Ray to confirm that these entities could not be included in FTX’s bankruptcy filing.

- Mr. Ray answered affirmatively. He noted how FTX had filed for bankruptcy protection on November 11, 2022 and indicated that these other entities had made their own filings before this date.

- Rep. Lucas asked Mr. Ray to compare FTX’s collapse to the other bankruptcies that he had managed during his professional career.

- Mr. Ray remarked that FTX’s collapse was one of the worst bankruptcies he had managed from a documentation standpoint. He noted that companies tended to have documentation that described what had gone wrong and stated that FTX lacked such documentation. He commented that this lack of documentation had made it difficult to track and trace assets.

Rep. Al Green (D-TX):

- Rep. Green noted how the DoJ had filed several criminal charges against former FTX CEO Sam Bankman-Fried, including wire fraud on customers, conspiracy to commit wire fraud on lenders, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, and conspiracy to commit money laundering. He noted how Mr. Bankman-Fried had claimed that he had merely made business mistakes and had not intentionally broken the law. He asked Mr. Ray to assess whether Mr. Bankman-Fried had simply made mistakes in his management of FTX. He commented that Mr. Bankman-Fried appeared to have engaged in some malfeasance during his tenure running FTX.

- Mr. Ray stated that his team’s investigation remained in the early stages. He expressed his desire to refrain from passing judgement on former FTX CEO Sam Bankman-Fried’s actions at the current time. He remarked that his team was currently focused on accumulating and maximizing assets for the victims of FTX’s collapse. He stated that his team would investigate potential courses of action to maximize value for these victims, which would entail an investigation into the underlying facts and motivations surrounding FTX’s collapse.

- Rep. Green asked Mr. Ray to indicate whether former FTX CEO Sam Bankman-Fried’s denials that he had intentionally broken the law should be considered “sincere ignorance.”

- Mr. Ray remarked that he did not want to pass judgment on former FTX CEO Sam Bankman-Fried’s intention at the current time. He stated that FTX had a significant failure and that other parties would judge Mr. Bankman-Fried’s actions.

- Rep. Green stated that former FTX CEO Sam Bankman-Fried had likely been intentional in committing his illegal actions. He remarked that the U.S. must aggressively pursue Mr. Bankman-Fried to deter other bad actors.

Rep. Pete Sessions (R-TX):

- Rep. Sessions asked Mr. Ray to indicate what the largest amount of money held by a single investor at FTX was.

- Mr. Ray stated that he could not provide individual numbers at this point. He mentioned how hundreds of millions of dollars had been held at FTX.US and how billions of dollars had been held at FTX.com. He noted how there existed millions of FTX accounts and commented that multiple users could hold many of these accounts. He stated that his team was currently assessing the relationships between individual customers and FTX accounts.

- Rep. Sessions asked Mr. Ray to indicate whether the SEC had looked into the exposure of U.S. customer funds to FTX.

- Mr. Ray testified that he was not aware of any SEC investigations into this exposure. He emphasized that he had joined FTX as its CEO on November 11, 2022 and suggested that an SEC investigation could have been possible prior to him joining the company.

- Rep. Sessions asked Mr. Ray to indicate whether FTX had taken actions to avoid its current issues with the SEC.

- Mr. Ray stated that he was not privy to FTX’s actions from before the company’s bankruptcy filing.

- Rep. Sessions asked Mr. Ray to indicate the value of the assets that were lent by FTX and Alameda Research to former FTX CEO Sam Bankman-Fried.

- Mr. Ray indicated that the size of the loss associated with FTX’s collapse was several billion dollars. He noted however that asset values tend to fluctuate, which makes it difficult to determine the true value of the assets that were lent by FTX and Almeda Research to former FTX CEO Sam Bankman-Fried. He stated that his team would assess the loss information, FTX’s loans, and FTX’s investments to determine the value of the assets that had been lent by FTX and Alameda Research to Mr. Bankman-Fried.

- Rep. Sessions asked Mr. Ray to indicate whether FTX had properly filled its taxes with the IRS.

- Mr. Ray stated that his team was currently looking into FTX’s compliance with U.S. tax laws. He mentioned how his team had hired Ernst & Young to review FTX’s tax returns and indicated that this review is ongoing.

- Rep. Sessions asked Mr. Ray to indicate whether the SEC should have access to FTX’s IRS filings to determine whether FTX was following the law.

- Mr. Ray stated that his team would provide FTX’s IRS filings to the regulatory agencies investigating FTX.

- Rep. Sessions asked Mr. Ray to indicate whether FTX’s IRS filings would be pertinent for the Committee as it worked to assess whether FTX had received proper oversight from federal regulators.

- Mr. Ray expressed his interest in being cooperative with the Committee and stated that his team could work with the Committee staff to address the Committee’s needs.

Rep. Emanuel Cleaver (D-MO):

- Rep. Cleaver asked Mr. Ray to indicate whether he had read former FTX CEO Sam Bankman-Fried’s prepared testimony for the hearing.

- Mr. Ray answered no. He indicated that parts of the testimony had been relayed to him.

- Rep. Cleaver called former FTX CEO Sam Bankman-Fried’s prepared testimony for the hearing disrespectful and criticized the testimony for its use of obscene language. He then noted how exchanges were required to provide both customers and the IRS with IRS Form 1099-B. He asked Mr. Ray to indicate whether exchanges were subject to additional IRS requirements.

- Mr. Ray stated that he would need to defer to tax experts on this question. He expressed confidence that tax experts would conduct a thorough review of what FTX should have submitted to the IRS.

- Rep. Cleaver then asked Mr. Ray to provide updates on the extent of FTX’s poor controls that had previously been identified in the November 17, 2022 bankruptcy declaration.

- Mr. Ray remarked that the list of FTX’s poor controls was extensive and that these poor controls were pervasive throughout the entire company. He indicated that these poor controls included a lack of a list of bank accounts, a lack of a complete list of employees and their functions, an extensive use of independent contractors (as opposed to employees), and gaps and total absences of insurance. He highlighted how Alameda Research had no insurance whatsoever. He also stated that there were additional poor controls at FTX beyond those that he had just mentioned.

- Rep. Cleaver suggested that the name “cryptocurrency” ought to be changed to “creepy dough currency.”

Rep. Blaine Luetkemeyer (R-MO):

- Rep. Luetkemeyer noted how FTX had reportedly used Alameda Research’s bank account because FTX could not obtain one for itself. He asked Mr. Ray to indicate whether FTX’s inability to obtain a bank account should have been a cause for concern.

- Mr. Ray stated that FTX’s requests of customers to deposit funds into Alameda Research’s bank account should have been a “red flag” for customers.

- Rep. Luetkemeyer asked Mr. Ray to indicate whether Alameda Research’s bank was a U.S. chartered bank or was an offshore bank.

- Mr. Ray indicated that Alameda Research had bank accounts in the U.S.

- Rep. Luetkemeyer noted how cryptocurrency firms need to be able to exchange their digital assets into U.S. dollars. He highlighted how FTX had relied upon Alameda Research to provide this function.

- Mr. Ray noted that FTX’s various silos had bank accounts. He stated that the main issue with FTX had been the internal transfers across the bank accounts of FTX’s affiliated entities without limits.

- Rep. Luetkemeyer remarked that the unusual accounting systems among cryptocurrency firms should be concerning for policymakers within the financial services space. He stated that these accounting issues prevent the U.S. from monitoring Chinese investments within the cryptocurrency space. He then recounted how Alameda Research had made an investment in Farmington State Bank, which was the U.S.’s 26th smallest bank. He noted how Alameda Research had paid $11.5 million for about 10 percent ownership of the bank in 2020. He indicated that the bank had a net worth of $5.7 million and called Alameda Research’s valuation of this bank “off the charts outrageous.” He highlighted that the U.S. Federal Deposit Insurance Corporation (FDIC) had permitted this investment. He also noted that Farmington State Bank had subsequently changed its name to Moonstone Bank. He asked Mr. Ray to address whether he had looked into the relationship between Alameda Research and Moonstone Bank.

- Mr. Ray testified that his team was looking into the relationship between Alameda Research and Moonstone Bank. He specifically stated that his team was looking into the amount of money transferred from FTX into Moonstone Bank and the connection of that bank to the Bahamas.

- Rep. Luetkemeyer asked Mr. Ray to indicate whether it was common for FTX to overpay for businesses. He also asked Mr. Ray to indicate whether FTX had purchased a stake in a bank to facilitate money laundering activities.

- Mr. Ray stated that FTX’s acquisition of Farmington State Bank raised questions and called this transaction “highly irregular.”

- Rep. Luetkemeyer called FTX’s lack of accounting, heavy spending, and heavy use of internal funds transfers concerning. He also raised concerns that FTX might have used offshore bank accounts to conceal their funds.

Rep. Ed Perlmutter (D-CO):

- Rep. Perlmutter predicted that it would take a very long time to make sense of FTX’s situation. He mentioned how several cryptocurrency firms (including FTX) had begun to experience financial problems starting 12 months ago and indicated that these firms had engaged in numerous transactions amongst one another to conceal their financial situations. He noted that Mr. Ray’s job was to gather as many of FTX’s assets as possible and to then distribute these assets to FTX’s creditors. He highlighted how some of these assets would be taken from innocent people that FTX had paid and commented that it would be difficult for Mr. Ray’s team to discern how much money it should claw back in these instances. He asked Mr. Ray to indicate whether his team had an estimate regarding FTX’s total inflows and outflows.

- Mr. Ray testified that his team did not have a full accounting of FTX’s total inflows and outflows at the current time.

- Rep. Perlmutter asked Mr. Ray to indicate how much of FTX’s holdings were in tokens. He noted how the value of cryptocurrencies tends to fluctuate. He asked Mr. Ray to address how his team would consider the fluctuating nature of cryptocurrency values when making its distribution determinations.

- Mr. Ray stated that his team would first need to account for all of FTX’s inflows and outflows and commented that FTX’s commingling of assets would complicate this process. He indicated that his team would assess FTX customer accounts based on the date of FTX’s bankruptcy filing. He stated that the fluctuations in asset values, FTX’s lack of documentation, the comingling of FTX’s customer funds across silos, and the transfers of funds from FTX.com to Alameda Research made it difficult to assess the value of a given FTX customer account.

Rep. Bill Huizenga (R-MI):

- Rep. Huizenga first asked Mr. Ray to indicate whether his team had shared its findings about FTX with the SEC and the U.S. Attorney’s Office for the Southern District of New York.

- Mr. Ray answered affirmatively.

- Rep. Huizenga then noted how Mr. Ray had stated that the FTX.com platform had not been available to U.S. users. He noted however that CFTC Chairman Rostin Behnam had told the U.S. Senate Committee on Agriculture, Nutrition, and Forestry that 2 percent of funds housed at FTX.com were from U.S. individuals. He asked Mr. Ray to confirm whether FTX.com had U.S. customers.

- Mr. Ray stated that there was a “small number” of Americans that had been customers of FTX.com.

- Rep. Huizenga asked Mr. Ray to confirm the veracity of the 2 percent figure previously offered by CFTC Chairman Rostin Behnam.

- Mr. Ray stated that his team’s information was based on the total number of customers (rather than the value of the investments of these customers). He indicated that the number of U.S. customers of FTX.com was “less than a couple hundred.”

- Rep. Huizenga commented that the value of the U.S. customer losses from FTX.com’s collapse could be as much as billions of dollars.

- Mr. Ray stated that he did not know the precise amount of money that U.S. customers had lost from FTX.com’s collapse. He commented however that the amount was likely not billions of dollars.

- Rep. Huizenga asked Mr. Ray to indicate whether his team would work to determine the amount of money that U.S. customers had lost from FTX.com’s collapse.

- Mr. Ray answered affirmatively.

- Rep. Huizenga asked Mr. Ray to indicate whether his team would work to determine which assets belong to U.S. customers of FTX.com.

- Mr. Ray answered affirmatively. He stated that his team would conduct a tracing analysis to determine the sources and uses of all of FTX’s funds.

- Rep. Huizenga asked Mr. Ray to indicate whether customer funds held on FTX.com had been transferred to Alameda Research.

- Mr. Ray answered affirmatively. He testified that his team had not yet observed any instances of customer funds held at FTX.US being transferred to Alameda Research. He stated however that his team was still working to determine whether there had occurred a comingling of funds held at FTX.com and funds held at FTX.US. He noted that FTX senior management could access and control all of the funds held on FTX’s various platforms. He indicated that there was no evidence thus far that such comingling of funds had occurred between FTX.US and FTX.com.

- Rep. Huizenga then asked Mr. Ray to indicate whether there was any evidence that former FTX CEO Sam Bankman-Fried’s parents had been involved in FTX’s operations.

- Mr. Ray stated that his team was investigating this question. He noted that Mr. Bankman-Fried’s father Joseph Bankman had provided legal advice to FTX.

- Rep. Huizenga asked Mr. Ray to indicate whether Joseph Bankman had been an employee of FTX.

- Mr. Ray stated that while he was unsure whether Joseph Bankman was an official employee of FTX, he indicated that Joseph Bankman had received payments from FTX.

- Rep. Huizenga recounted how he had met with former FTX CEO Sam Bankman-Fried in his office on December 8, 2021. He noted that Joseph Bankman had accompanied Sam Bankman-Fried to this meeting. He lastly stated that he was glad to see FTX’s fraud finally unravel.

Rep. Joyce Beatty (D-OH):

- Rep. Beatty noted how Mr. Ray had expressed his desire to limit the harms suffered by FTX customers to the greatest extent possible. She highlighted how hundreds of millions of dollars had been removed from cryptocurrency wallets as a result of FTX’s collapse and indicated that an estimated one million people had their funds frozen in FTX’s exchanges. She asked Mr. Ray to indicate how many users had lost money on FTX’s platforms and to indicate when these users would recover this money.

- Mr. Ray stated that his team was working every day to secure assets through looking for cryptocurrency wallets and their keys. He testified that his team had secured all of the cash in FTX’s bank accounts to the greatest extent possible. He predicted that it would take months to secure all of the crypto assets associated with FTX. He stated however that the litigation associated with FTX’s assets would take a long time to resolve. He remarked that his team’s top priority was to generate value to repay FTX’s customers. He then indicated that he did not know how many customers had lost money on FTX’s platforms. He noted that FTX.US had 2.7 million users. He acknowledged however that this user amount overstates the total number of customers because several customers had multiple accounts on FTX.US. He also noted that FTX.com had over 7.6 million users. He commented that the aforementioned dynamic of customers having multiple accounts was also present in FTX.com. He stated that his team was working to determine how many customers there were across FTX’s various platforms.

- Rep. Beatty then noted how FTX had loaned out $10 billion in customer assets to Alameda Research for proprietary trading, despite making assurances that it would not trade customer funds. She asked Mr. Ray to address how FTX had been able to access client funds in violation of its own terms of service.

- Mr. Ray noted how FTX had lacked corporate controls, corporate oversight, and an independent board of directors. He also noted how FTX’s senior management had total control over the accounts of each of the company’s silos and could therefore move money and assets across silos at will.

- Rep. Beatty then asked Mr. Ray to recommend regulatory changes for preventing unauthorized transfers of customer funds at financial exchanges.

- Mr. Ray stated that segregation of customer funds and transparency were key for financial exchanges.

- Rep. Beatty lastly asked Mr. Ray to indicate whether he could provide a timeframe for meeting his objectives.

- Mr. Ray indicated that he did not have a timeframe for meeting his objectives and would work to meet the objectives as quickly as possible. He clarified that it would likely take months to achieve his objectives and stated that action could take even longer. He expressed his team’s commitment to marshaling assets as quickly as possible to meet its objectives.

Rep. Andy Barr (R-KY):

- Rep. Barr noted how Mr. Ray had asserted that many of FTX’s affiliated entities lacked appropriate corporate governance. He also noted how Mr. Ray had attributed FTX’s collapse to the company’s lack of an independent board of directors and its complete failure of any internal controls and governance. He asked Mr. Ray to elaborate on how FTX.com’s governance structure issues had led him to reach the aforementioned conclusions.

- Mr. Ray noted how FTX had lacked an independent board of directors and testified that one of his first actions as CEO of FTX was establishing an independent board of directors. He also highlighted how he had put in new officers at the company, including a chief financial officer (CFO), a chief information officer (CIO), and a head of administration. He indicated that these officers were all independent and had relevant professional experience. He stated that FTX’s previous management lacked sufficient professional experience.

- Rep. Barr asked Mr. Ray to explain how FTX.com’s governance structure had differed from FTX.US’s governance structure.

- Mr. Ray remarked that there was “virtually no difference” between the governance structures of FTX.com and FTX.US. He commented that neither entity had a governance structure.

- Rep. Barr asked Mr. Ray to indicate whether he had examined the governance structure or flow of assets to the FTX Foundation or its various affiliates, including FTX Community, FTX Climate, or the Future Fund.

- Mr. Ray stated that his team was looking into the FTX Foundation and its various affiliates. He indicated that his team had not completed its review regarding these affiliates.

- Rep. Barr expressed interest in learning whether the FTX Foundation and its various affiliates had been established properly as non-profit organizations or whether customer funds had been improperly transferred into these groups. He asked Mr. Ray to indicate whether his team currently had any visibility into the FTX Foundation and its affiliates.

- Mr. Ray reiterated that his team was currently looking into the FTX Foundation and its various affiliates. He testified that he had requested that Ernst & Young look into the tax compliance of these groups. He also testified that his team was investigating FTX’s various money transfers.

- Rep. Barr asked Mr. Ray to indicate whether the FTX Foundation and its various affiliates were completely separate from FTX’s for-profit entities.

- Mr. Ray stated that former FTX CEO Sam Bankman-Fried had owned the FTX Foundation and its various affiliates. He also noted how these groups had received funds from Alameda Research, which meant that the groups were not entirely separate from FTX’s for-profit entities.

- Rep. Barr then mentioned how at least one environmental, social, and governance (ESG) ratings firm had given FTX a higher score for governance than ExxonMobil. He noted that Mr. Ray had attributed FTX’s collapse to the concentration of control amongst a small number of inexperienced and unsophisticated individuals that had failed to implement proper corporate controls. He asked Mr. Ray to comment on the aforementioned ESG ratings firm’s score of FTX.

- Mr. Ray criticized the ESG ratings firm that had provided FTX with a higher corporate governance score than ExxonMobil.

- Rep. Barr then asked Mr. Ray to identify which FTX entities had audited financial statements.

- Mr. Ray noted how Alamada Research and FTX’s investment silo had received no audits while FTX.US and FTX.com had received audits. He stated that he could not speak to the integrity or quality of these audits. He indicated that his team was currently reviewing the books and records of these entities and commented that many of these books and records were maintained on unsophisticated ledgers and workbooks.

- Rep. Barr asked Mr. Ray to confirm that FTX had many financial statements that were not audited or not available.

- Mr. Ray confirmed that FTX had many financial statements that were not audited or not available.

- Rep. Barr asked Mr. Ray to elaborate on his assertion that many of FTX’s audited financial statements did not appear reliable.

- Mr. Ray noted how FTX had lost $8 billion of customer funds and commented that this loss of customer funds had made him distrustful of FTX’s statements.

- Rep. Barr then noted how former FTX CEO Sam Bankman-Fried had told the Committee in December 2021 that the market structure on FTX’s platform was risk reducing. He asked Mr. Ray to indicate wither Mr. Bankman-Fried’s statement was incorrect.

- Mr. Ray answered affirmatively.

- Rep. Barr stated that former FTX CEO Sam Bankman-Fried had set up a cryptocurrency exchange where his company served as the market maker, issuer, and prime broker and then traded against his exchange’s own customers. He commented that this dynamic left Mr. Bankman-Fried with a vested interest in creating crypto assets, promoting crypto assets, and manipulating the price of the crypto assets.

Rep. Juan Vargas (D-CA):

- Rep. Vargas remarked that he did not understand the purpose of blockchain technology and cryptocurrencies and commented that there exist less fraudulent means for making transactions. He stated that Committee Republicans had previously been very supportive of the cryptocurrency industry and accused them of muting their support for cryptocurrencies during the hearing. He remarked that the cryptocurrency market required order and transparency and asserted that cryptocurrency exchanges and issuers ought to come into compliance with federal and state securities laws. He asserted that citizens would need to be informed, regulators would need to uphold the laws, and companies would need to comply with the laws for the U.S. cryptocurrency industry to continue. He asked Mr. Ray to address why FTX had failed to comply with existing laws.

- Mr. Ray stated that a small group of individuals had exerted total control over FTX without any oversight from either an independent board of directors or experienced managers. He called this situation a “recipe for problems.”

- Rep. Vargas asked Mr. Ray to identify the government entity that was responsible for FTX’s collapse.

- Mr. Ray stated that he was not a regulatory lawyer and that he did not feel comfortable providing recommendations as to which government entity should regulate cryptocurrencies. He remarked that the U.S. needed to provide transparency for cryptocurrencies and that customers need segregated accounts and ownership over their assets. He commented that customers should have the same level of protection for their funds held on a cryptocurrency exchange as they would have for their funds in a traditional bank.

- Rep. Vargas stated that he agreed with Mr. Ray’s response. He also stated that cryptocurrencies constitute hybrid products. He asked Mr. Ray to indicate which government entity should regulate cryptocurrencies.

- Mr. Ray stated that he did not have an opinion as to which government entity should regulate cryptocurrencies.

- Rep. Vargas remarked that cryptocurrencies only made sense for bad actors (such as terrorists and money launderers) and do not provide legitimate uses. He stated however that the U.S. would need to regulate cryptocurrencies if it were to permit their existence. He contended that the SEC should oversee cryptocurrencies. He asked Mr. Ray to indicate whether cryptocurrencies ought to be regulated.

- Mr. Ray remarked that there needed to exist more controls within the cryptocurrency space. He stated that he would defer to the Committee regarding which government entity ought to regulate cryptocurrencies.

Rep. Roger Williams (R-TX):

- Rep. Williams commented that FTX will likely be considered one of the greatest financial frauds in history. He noted how Mr. Ray had worked on Enron’s bankruptcy and asked Mr. Ray to compare Enron’s bankruptcy to FTX’s collapse.

- Mr. Ray remarked that Enron was a very different company than FTX. He stated that the crimes committed at Enron involved highly orchestrated machinations from highly sophisticated people to keep transactions off of balance sheets. He stated that the crimes committed at FTX involved the embezzlement of customer funds. He commented that FTX’s crimes were not sophisticated.

- Rep. Williams then noted how former FTX CEO Sam Bankman-Fried reportedly wants to be retained by FTX as an outside consultant and has criticized Mr. Ray’s appointment as CEO of FTX. He commented that Mr. Bankman-Fried’s desire to be retained by FTX appeared very unlikely considering his recent arrest. He asked Mr. Ray to address the role that Mr. Bankman-Fried should play in FTX moving forward.

- Mr. Ray stated that former FTX CEO Sam Bankman-Fried should play no role in FTX moving forward.

- Rep. Williams then asked Mr. Ray to indicate whether FTX had enabled its users to engage in leveraged and complex transactions involving digital assets.

- Mr. Ray answered affirmatively.

- Rep. Williams also noted how Mr. Ray had stated that his team had recovered over $1 billion relating to FTX’s collapse. He asked Mr. Ray to provide a description of the nature and the type of assets that his team had recovered to date.

- Mr. Ray testified that his team had recovered over $1 billion in crypto assets and indicated that these were coins of various natures. He also stated that his team had secured FTX’s bank accounts. He remarked that his team’s main goal was to secure FTX’s cash and crypto assets and commented that this effort was ongoing.

Del. Michael San Nicolas (D-GU):

- Del. San Nicolas asked Mr. Ray to indicate whether he could pinpoint the specific cause for FTX’s collapse.

- Mr. Ray attributed FTX’s collapse to the unlimited ability of the company’s management to take customer funds and deploy the funds for their own use. He indicated that the use of these funds included margin trading, which he commented was inherently risky.

- Del. San Nicolas asked Mr. Ray to indicate how much money had FTX lost as a result of its bankruptcy.

- Mr. Ray stated that while he could not provide an exact figure for FTX’s losses, he estimated that the losses were in excess of $7 billion.

- Del. San Nicolas asked Mr. Ray to indicate whether FTX’s misallocation of funds was responsible for FTX’s collapse.

- Mr. Ray noted how FTX had moved customer funds to Alameda Research and that Alameda Research had then incurred trading losses with these funds. He commented that these lost funds would never be valued at the same dollar amount. He also mentioned how FTX had made over $5 billion in investments in various ventures. He stated that his team would work to recover any remaining value from these investments. He noted however that FTX had made many investments without proper valuations, which he called concerning.

- Del. San Nicolas asked Mr. Ray to confirm that Alameda Research had lost $7 billion as a result of investment decisions and margin trading.

- Mr. Ray remarked that there were a multitude of reasons for the loss of customer funds at FTX. He stated that these losses were not solely attributable to trading activities.

- Del. San Nicolas remarked that it was important to understand the causes of FTX’s collapse so that Congress could develop a policy response that would prevent future collapses. He noted that FTX’s problems appeared to be confined to FTX. He asked Mr. Ray to indicate whether other firms also lacked corporate controls. He also asked Mr. Ray to indicate whether similar financial problems could occur at other cryptocurrency exchanges (such as Binance).

- Mr. Ray stated that his team would detail the sources and uses of FTX’s funds and that this process would uncover how FTX’s losses had been incurred. He commented that this exercise might uncover broader lessons or identify instances of improper payments.

- Del. San Nicolas interjected to ask Mr. Ray to indicate whether the circumstances that had caused FTX’s collapse were still present in the cryptocurrency space.

- Mr. Ray noted that FTX had ceased trading on its platforms. He stated that he could not speak to the likelihood of other cryptocurrency firms facing similar challenges because he was not privy to the operations of other cryptocurrency firms. He stated that FTX had operated in a distinct manner that had caused losses and commented that every company is different.

Rep. French Hill (R-AR):

- Rep. Hill first remarked that frauds had occurred throughout the financial services sector’s history and stated that FTX’s collapse did not mean that digital assets should be avoided. He called for the U.S. to develop a thoughtful regulatory oversight system for digital assets. He then remarked that FTX’s fraud appeared to dwarf Bernie Madoff’s fraud and noted how court filings have suggested that FTX has over one million creditors. He stated that this hearing would constitute the “first step” for Congress to understand what happened with FTX and support efforts to develop an appropriate regulatory environment for the cryptocurrency space. He then noted how Prager Metis had served as the audit firm for the FTX.com silo according to FTX’s bankruptcy filing. He mentioned how Prager Metis’s website had claimed that it was the first ever certified public accountant (CPA) firm in the metaverse. He indicated that Prager Metis’s website also states that the firm has 24 offices, 600 staff, and 100 partners. He asked Mr. Ray to confirm that he was unfamiliar with Prager Metis.

- Mr. Ray answered affirmatively.

- Rep. Hill asked Mr. Ray to indicate whether Prager Metis was cooperating with his team’s bankruptcy investigation.

- Mr. Ray stated that all of the firms that were working with FTX appeared to be cooperative thus far. He added that his team had tools to address firms that were uncooperative.

- Rep. Hill asked Mr. Ray to indicate whether Prager Metis would actively participate in his team’s forensic accounting work into FTX with Ernst & Young.

- Mr. Ray answered no. He stated that his team was collecting information from FTX’s prior accountants, auditors, and tax professionals and then would independently review this information.

- Rep. Hill asked Mr. Ray to identify who had been the partner in charge of FTX’s audit at Prager Metis.

- Mr. Ray stated that he could not recall who had been the partner in charge of FTX’s audit at Prager Metis and indicated that he could follow with the Committee on this inquiry.

- Rep. Hill also noted how FTX’s second auditing firm had been Armanino. He asked Mr. Ray to indicate whether Armanino had been inadequate in its auditing of FTX.

- Mr. Ray stated that he did not want to disparage Armanino and indicated that his team would need to first assess the quality of Armanino’s audits of FTX. He also indicated that his team would review the related party disclosures in Armanino’s audits of FTX. He stated that these audits would be key for identifying missed opportunities for actions.

- Rep. Hill asked Mr. Ray to indicate whether he anticipated the U.S. being a creditor in FTX’s bankruptcy proceedings.

- Mr. Ray stated that it was premature to tell whether the U.S. would be a creditor in FTX’s bankruptcy proceedings. He remarked that his team would notify the IRS of any irregularities in FTX’s tax information.

- Rep. Hill noted how Mr. Ray had called FTX’s internal controls the weakest that he had observed during his professional career. He asked Mr. Ray to confirm that there did not exist a real difference between FTX.US and FTX.com.

- Mr. Ray noted how FTX.com had a limited number of customers. He stated that his team was concerned that FTX.US and FTX.com might have commingled customer funds.

- Note: Rep. Hill’s question period time expired here.

Rep. Jim Himes (D-CT):

- Rep. Himes stated that cryptocurrencies and digital assets were growing in popularity and called it incumbent on policymakers to educate themselves about these assets. He remarked that FTX’s fraudulent activities were not novel and involved traditional criminal methods, such as wire fraud, misleading investors, and the comingling of customer funds. He stated however that FTX’s fraud was novel in that it involved tokens (rather than money) that resided in wallets (rather than banks). He asked Mr. Ray to address whether these tokens and wallets would make his job resolving the FTX bankruptcy more difficult. He also asked Mr. Ray to provide policy suggestions for addressing the unique needs of cryptocurrency firm-related bankruptcies.

- Mr. Ray stated that cryptocurrencies were different from the items found in traditional bankruptcies, which made cryptocurrency firm-related bankruptcies more difficult to resolve. He noted how cryptocurrencies stored in hot wallets were vulnerable to hacking and commented that hacking was common within the cryptocurrency space. He also mentioned how FTX’s cryptocurrency keys were not stored in a centralized location and the whereabouts of many of FTX’s cryptocurrency wallets remained unknown. He further testified that FTX had kept some passwords in a plain text format. He asserted that the aforementioned issues had made FTX “uniquely positioned” to fail. He criticized FTX for its lack of discipline in controlling its wallets, cryptocurrency storage practices, password storage practices, and its enabling of users to set up multiple accounts. He stated that FTX’s mistakes provide lessons on the need for cryptocurrency firms to possess more controls, more discipline, more centralized accounting functions, and more oversight and management.

- Rep. Himes then mentioned how many of the “supposedly” most sophisticated investors (including Sequoia Capital, Lightspeed Venture Partners, and Greylock Partners) had put money into FTX. He called this concerning given how much of this money had come from pension funds and university endowments. He noted how Mr. Ray had asserted that FTX had exhibited the worst corporate governance he had ever seen. He asked Mr. Ray to indicate whether he had seen any evidence that the aforementioned venture capital firms had performed appreciable due diligence on FTX.

- Mr. Ray stated that he was not aware of how venture capital firms had performed their due diligence on FTX. He called the involvement of these venture capital firms in FTX “surprising.”

Rep. Tom Emmer (R-MN):

- Rep. Emmer noted how FTX had over 100 affiliated corporate entities and indicated that some of these entities had boards of directors. He asked Mr. Ray to indicate whether there had been a group-level board of directors that had overseen the entirety of FTX.

- Mr. Ray answered no.

- Rep. Emmer asked Mr. Ray to indicate whether FTX should have had a group-level board of directors given the organization’s level of complexity.

- Mr. Ray answered affirmatively.

- Rep. Emmer asked Mr. Ray to indicate whether the concentration of power at FTX amongst a small group of inexperienced individuals with no oversight was concerning.

- Mr. Ray answered affirmatively.

- Rep. Emmer asked Mr. Ray to indicate whether FTX.com had possessed basic corporate functions, such as an accounting or human resources department.

- Mr. Ray answered no.

- Rep. Emmer asked Mr. Ray to indicate whether FTX.com had possessed a legal department.

- Mr. Ray answered affirmatively.

- Rep. Emmer asked Mr. Ray to indicate whether FTX.com had possessed a compliance department.

- Mr. Ray stated that FTX.com had people with titles that suggested that they were providing compliance services.

- Rep. Emmer asked Mr. Ray to indicate whether a financial firm that was the size of FTX needs accounting, human resources, legal, compliance, and risk departments to protect against problems.

- Mr. Ray answered affirmatively.

- Rep. Emmer then mentioned how FTX and IEX had announced a strategic partnership in April 2022. He noted however that the Financial Times had recently reported that Alameda Research’s venture capital portfolio had listed FTX Trading’s $270 million investment into IEX as an acquisition. He asked Mr. Ray to indicate whether FTX Trading had acquired IEX. He also asked Mr. Ray to clarify the nature of FTX Trading’s investment into IEX.

- Mr. Ray stated that he would need to follow up with the Committee regarding Rep. Emmer’s inquiry. He expressed uncertainty as to whether FTX Trading’s investment in IEX had been completed.