- This event has passed.

The Future of Digital Assets: Providing Clarity for Digital Asset Spot Markets (U.S. House Committee on Agriculture)

June 6, 2023 @ 6:00 am – 10:00 am

| Hearing | The Future of Digital Assets: Providing Clarity for Digital Asset Spot Markets |

| Committee | U.S. House Committee on Agriculture |

| Date | June 6, 2023 |

Hearing Takeaways:

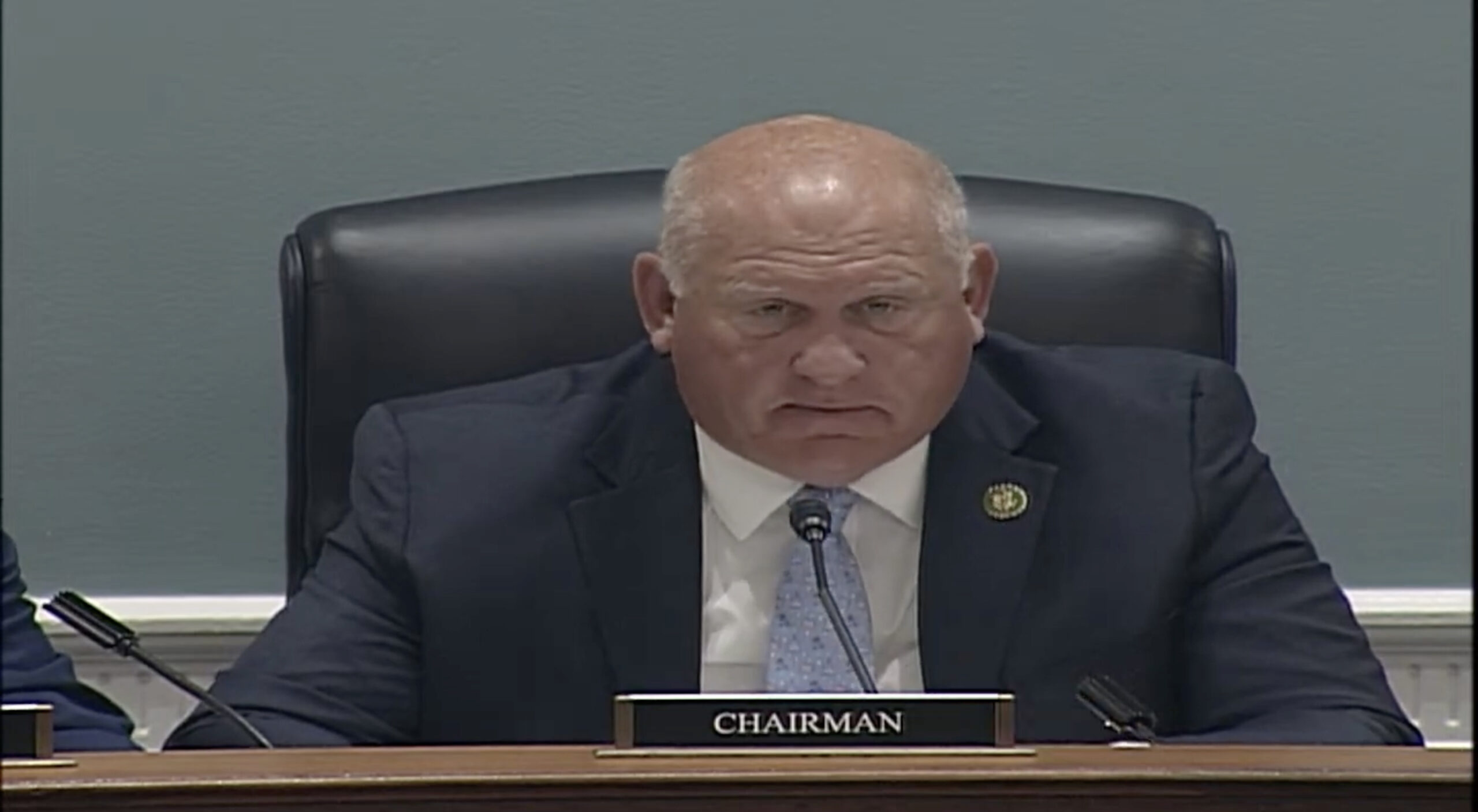

- The Current State of the Digital Assets Market: The hearing focused on the current regulatory environment for digital assets and ongoing trends within the digital assets space. Committee Members and the hearing’s witnesses expressed general agreement that the U.S. currently lacks a robust regulatory framework governing digital assets, which has resulted in stakeholder uncertainty and market volatility. Full Committee Chairman Glenn “GT” Thompson (R-PA), Mr. Giancarlo, and Mr. Grewal also highlighted how blockchain technology and digital assets can provide numerous benefits, including improved banking and financial services, data privacy, supply chain logistics, digital forms of identification (ID), and health care records.

- Lack of Regulation for the Digital Assets Spot Market: Committee Members and the hearing’s witnesses expressed concerns over how there is currently no federal regulatory framework for digital asset spot commodities market. They highlight how the U.S. Commodity Futures Trading Commission (CFTC) only has regulatory jurisdiction over the digital asset commodity derivatives market. They also noted how the CFTC has limited anti-fraud and anti-manipulation enforcement authority over the digital asset spot market and that the CFTC can only respond to this fraud and manipulation after it has already occured. They called this lack of regulatory authority for the digital asset spot commodity market concerning given how Bitcoin and Ether (which comprise 60 percent of the digital asset market) are widely considered to be commodities.

- Lack of Digital Assets Registration Opportunities: Mr. Grewal and Mr. Gallagher both testified that their companies (Coinbase and Robinhood Markets, respectively) had attempted to register with the U.S. Securities and Exchange Commission (SEC) as special purpose broker-dealers (SPDCs), alternative trading systems (ATSs), and national securities exchanges (NSEs). They stated that the SEC had rebuffed these registration attempts and attributed the SEC’s refusals to approve the registrations to existing securities laws and rules that do not adequately account for the unique nature of digital assets.

- Lack of Clarity Surrounding the Classification of Digital Assets: Committee Members, CFTC Chairman Behnam, and Mr. Gallagher discussed how regulators and market participants often experience challenges and controversies when attempting to classify digital assets as commodities, tokens, or other asset types for the purposes of regulatory treatment. They cautioned that that the current test for determining the status of a given asset under the U.S. Supreme Court’s SEC v. W.J. Howey Co. decision (known as the Howey test) is not always straightforward to apply.

- CFTC Enforcement Actions: Several Committee Members expressed in interest in how the CFTC is employing its existing anti-fraud and anti-manipulation authorities to police the digital assets space. CFTC Chairman Behnam testified that the CFTC has brought over 80 cases that have resulted in over $4 billion in penalties and restitution. He expressed concerns however that even more illegal activity is occurring within the digital assets space that the CFTC cannot address under current law.

- SEC Enforcement Actions: Committee Republicans expressed concerns that the SEC has taken a “regulation by enforcement” approach to digital assets, which they called inappropriate for governing markets, adequately protecting customers, and promoting innovation. They noted how the SEC had filed a lawsuit against digital asset exchange Coinbase for listing unregistered securities on the morning of the hearing. Mr. Grewal (who is Coinbase’s chief legal officer) described this lawsuit as “disappointing, but not surprising.”

- Foreign Regulatory Frameworks for Digital Assets: Committee Members, CFTC Chairman Behnam, Mr. Giancarlo, Mr. Grewal, Mr. Gallagher, and Mr. Lukken expressed concerns over how other jurisdictions, including the European Union (EU), Singapore, Hong Kong, and the United Kingdom (UK), have already developed their own regulatory frameworks for digital assets. They stated that these foreign regulatory frameworks for digital assets put the U.S. digital assets industry at a competitive disadvantage and are driving digital assets activity and innovation abroad. Mr. Giancarlo further expressed concerns that the U.S.’s failure to establish its own regulatory framework for digital assets will lead other jurisdictions to better influence the global regulations for digital assets.

- Recent Problems in the Digital Assets Market: Committee Democrats discussed how several large digital asset companies have recently collapsed and filed for bankruptcy and how the CFTC and other federal financial regulators have pursued enforcement actions against several of these companies for abusive and manipulative trading practices. CFTC Chairman Behnam attributed many of these problems to the fact that the CFTC has limited authority to oversee the digital assets space. He highlighted however that the CFTC’s regulatory authority over LedgerX (which was an FTX entity) had allowed LedgerX to survive after FTX had declared bankruptcy in 2022 while over 130 other FTX entities had not been able to survive the bankruptcy.

- Potential Digital Assets Legislation: The hearing largely considered a recently proposed discussion draft bill from U.S. House Committee on Agriculture Chairman Glenn “GT” Thompson (R-PA) and U.S. House Committee on Financial Services Chairman Patrick McHenry (R-NC). This discussion draft bill would provide the contours of a statutory framework for digital assets and seeks to provide certainty, fill regulatory gaps, and bolster innovation. Committee Members and the hearing’s witnesses expressed interest in building upon this discussion draft bill to develop comprehensive and bipartisan legislation that can be signed into law. Committee Democrats expressed frustration however that the discussion draft bill had only been released one week before the hearing and stated that they had been provided with limited opportunity to review the proposal and provide input on it. Full Committee Ranking Member David Scott (D-GA) further expressed concerns that the discussion draft bill does not respond to the CFTC’s wants and needs and questioned whether this bill would establish clear regulatory and registration guidelines. Moreover, CFTC Chairman Behnam and Mr. Berkovitz asserted that any new digital assets legislation must not undermine existing law, including the Commodity Exchange Act (CEA), the Securities Act of 1933, and the Securities Exchange Act of 1934.

- CFTC Regulation, Registration, and Oversight of Digital Assets: Committee Members and the hearing’s witnesses expressed interest in having legislation establish a regulatory, registration, and oversight regime for digital assets at the CFTC. They stated that these new authorities would enable the CFTC to proactively police the digital asset commodity spot markets (which are currently not subject to CFTC registration), oversee digital asset intermediaries, establish a disclosure regime, require segregation of customer funds, and prohibit conflicts of interest. Mr. Lukken also suggested that Congress further consider whether to provide separate registration processes at both the broker and exchange levels. Rep. Jim Baird (R-IN), Mr. Giancarlo, Mr. Grewal, and Mr. Gallagher further stated that the legislation should impose deadlines on the CFTC and the SEC to complete their joint definitional rulemakings for digital assets and warned that the absence of a deadline could lead the financial market regulators to prioritize other non-pressing matters. Mr. Berkovitz cautioned however that Congress should be cognizant of the CFTC’s limitations when seeking to expand its jurisdiction to cover assets traditionally regulated by the SEC. He noted how the function of the CFTC-regulated markets is price discovery and risk management while the function of the SEC-regulated markets is capital formation. He also highlighted how the CFTC’s regulatory regime is designed for the wholesale market and that the SEC’s regulatory regime by contrast is more retail-focused.

- Potential Exploitation of Regulatory Regime: Full Committee Vice Chairman Austin Scott (R-GA) expressed interest in determining which cryptocurrencies would qualify for CFTC regulation based on certain thresholds, such as the U.S. dollar value of a cryptocurrency or the number of individual owners involved in a cryptocurrency. He stated that a party may seek to obtain CFTC regulation for a given digital asset through manipulating the asset to meet the thresholds for CFTC regulation. He commented that a regulated cryptocurrency would likely be worth more than an unregulated cryptocurrency.

- Digital Assets Disclosure Requirements: Committee Members, CFTC Chairman Behnam, and Mr. Gallagher expressed interest in developing disclosure requirements for digital assets that account for the unique characteristics of these assets. These characteristics include investment risk, cybersecurity risk, mining, settlement practices, and other related activities. Rep. John Duarte (R-CA) expressed concerns regarding the feasibility of digital asset disclosure requirements given that traditional metrics for securities (including competitive advantages, value propositions, corporate strategies, resources, and talent) are not always applicable to digital assets. Mr. Giancarlo suggested that third party data providers can facilitate investments within the digital asset commodities space.

- Provisional Rulemaking: Full Committee Ranking Member Scott expressed concerns over the discussion draft bill’s provisional registration process and indicated that this process would be in place while the CFTC and the SEC undergo a resource intensive joint-rulemaking process. Chairman Behnam remarked that the discussion draft bill’s provisional registration framework would constrain the CFTC from using its existing authority to oversee the digital assets space. He stated however that this provisional period would also provide policy certainty to digital asset registrants as the CFTC implements these rules.

- Determination of a Digital Asset’s Level of Decentralization: Committee Members, CFTC Chairman Behnam, Mr. Ginacarlo, Mr. Grewal, Mr. Gallagher, and Mr. Berkovitz expressed interest in having federal legislation determine when a digital asset achieves sufficient decentralization (or conversely becomes sufficiently centralized) to warrant a reclassification of the asset type. A digital asset’s level of decentralization can determine whether it is a commodity or a security and may fluctuate over time. They further expressed interest in establishing a process for the CFTC and the SEC to make such decentralization determinations.

- The CFTC’s Principles-Based Regulatory Approach: Committee Members, CFTC Chairman Behnam, Mr. Lukken, and Mr. Berkovitz highlighted how the Commodity Futures Modernization Act of 2000 (CFMA) had provided the CFTC with a new principles-based regulatory regime. This law provides the CFTC with the ability to issue rules and guidance on core principles while providing “built-in flexibility” for entities to take a different approach if they can prove that the core principles are still being met. They asserted that this flexibility has allowed for innovative new products and market approaches and suggested that this approach should be considered when developing new digital assets legislation.

- Role of Self-Regulatory Organizations (SROs): Committee Members, CFTC Chairman Behnam, and Mr. Luken expressed interest in how the CFTC will leverage SROs, including the National Futures Association (NFA), to oversee the digital assets space as part of any future regulatory framework for digital assets. CFTC Chairman Behnam remarked that the CFTC has a “great” relationship with the NFA and asserted that the NFA’s resources and relationships would make them a valuable and trusted partner in overseeing the digital assets market.

- Provision of Funding for the CFTC to Develop Rules for and Oversee the Digital Assets Market: Committee Democrats, CFTC Chairman Behnam, Mr. Berkovitz, and Mr. Lukken remarked that federal digital assets legislation must provide the CFTC with sufficient funding to develop rules for and oversee the digital assets market. They warned that the failure to provide the CFTC with adequate funding would delay the Commission’s implementation of a regulatory regime and could result in reduced enforcement activities. Chairman Behnam estimated that it would cost the CFTC $120 million over three years to establish a new regulatory regime for the digital asset commodity spot market. He also estimated that this rulemaking process would take between six months and two years to complete. He recommended that Congress consider establishing a user fee-based system for the CFTC where CFTC registrants would pay proportional fees to help to financially support the Commission.

- Financial Inclusion Considerations: Rep. Nikki Budzinski (D-IL) and CFTC Chairman Behnam stated that federal digital assets legislation must consider the impact of digital assets on financial inclusion. They noted how digital markets are often promoted as a means of fostering financial inclusion to populations that may be most vulnerable to the inherent risks associated with these assets and predatory financial schemes. CFTC Chairman Behnam remarked that the U.S. must provide disclosures and customer education for digital assets as part of these efforts to ensure that digital assets can support financial inclusion.

- Climate Change Considerations: Rep. Shontel Brown (D-OH) and CFTC Chairman Behnam expressed interest in having federal digital assets legislation consider the impact of cryptocurrencies on climate change. CFTC Chairman Behnam suggested that the U.S. could further study the digital asset industry’s mining capacity and energy usage, as well as the types of energy sources that support cryptocurrency mining efforts. He also stated that investor disclosures regarding digital asset energy usage and mining techniques could help to address this issue.

- Previous Efforts to Expand the CFTC’s Regulatory Authority: Committee Members, CFTC Chairman Behnam, Mr. Berkovitz, and Mr. Lukken highlighted how Congress had previously expanded the authority of the CFTC to oversee the swaps and the retail foreign exchange (forex) markets. They stated that these efforts had been successful and can provide lessons for expanded CFTC regulation of the digital assets market.

Hearing Witnesses:

Panel I:

- The Hon. Rostin Behnam, Chairman, U.S. Commodity Futures Trading Commission

Panel II

- The Hon. J. Christopher Giancarlo, Former Chairman, Commodity Futures Trading Commission

- Mr. Paul Grewal, Chief Legal Officer, Coinbase

- The Hon. Dan Gallagher, Chief Legal Compliance and Corporate Affairs Officer, Robinhood Markets, Inc.; Former Commissioner, U.S. Securities and Exchange Commission

- The Hon. Dan Berkovitz, Former Commissioner, Commodity Futures Trading Commission; Former General Counsel, U.S. Securities and Exchange Commission

- The Honorable Walt Lukken, President and Chief Executive Officer, Futures Industry Association; Former Acting Chairman, Commodity Futures Trading Commission

Member Opening Statements:

Full Committee Chairman Glenn “GT” Thompson (R-PA):

- He remarked that blockchain technology and digital assets can provide numerous benefits, including improved banking and financial services, data privacy, and supply chain logistics.

- He called it important for digital asset consumers and market participants to enjoy the same long standing customer protections that are found in traditional financial markets.

- He discussed how Congress has debated the federal treatment of digital assets for nearly a decade, which has involved numerous hearings, bill introductions, and panel discussions meant to provide regulatory certainty and clarity for these novel technologies.

- He asserted that further coordination between Committees and Members of Congress is required to address digital assets.

- He thanked U.S. House Committee on Financial Services Chairman Patrick McHenry (R-NC) for his willingness to collaborate with the U.S. House Committee on Agriculture on addressing digital assets.

- He stated that the two Committees are seeking to develop digital assets legislation that would foster U.S. innovation and establish customer protections for digital asset-related activities and intermediaries.

- He mentioned how the two Committees had held numerous member and staff education events regarding digital assets and highlighted how the two Committees had recently held a joint-subcommittee hearing on the topic.

- He remarked that current federal policies provide few “rules of the road” for parties that wish to engage with digital assets.

- He commented that this lack of regulatory clarity has hampered the ability of regulators to pursue enforcement actions and has fostered confusion for both the digital assets industry and the digital assets market.

- He discussed how he had worked with Financial Services Committee Chairman McHenry on developing a discussion draft bill that would provide the contours of a statutory framework for digital assets.

- He indicated that this discussion draft bill had been released the prior week and commented that this draft seeks to provide certainty, fill regulatory gaps, and bolster innovation.

- He emphasized however that this discussion draft will be improved upon through additional debates, stakeholder feedback, and technical assistance.

- He expressed his interest in working with Congressional Democrats on this legislative proposal to develop a bipartisan legislative product.

- He called it incumbent on the Committee to bring certainty to the digital assets space and highlighted how other jurisdictions, including the EU, Singapore, Hong Kong, and the UK, have already developed their own regulatory frameworks for digital assets.

- He lastly mentioned how the SEC had just filed a complaint against digital assets exchange Coinbase and noted how a witness from the company would be testifying at the hearing.

- He commented that while he could not speak to the specific allegations against Coinbase, he asserted that these recent charges demonstrate the importance of addressing digital assets.

- He remarked that the SEC’s current “regulation by enforcement” approach to digital assets is inappropriate for governing markets, adequately protecting customers, and promoting innovation.

- He expressed hope that the Committee can develop a regulatory framework for digital assets that promotes customer protections, provides clear lines of authority to regulators, and enables regulated entities to understand their obligations under the law.

Full Committee Ranking Member David Scott (D-GA):

- He described the CFTC’s regulated markets as ever evolving and commented that the CFTC requires more resources to obtain the necessary talent and technology to oversee the space.

- He stated that the discussion draft bill under consideration at the hearing does not respond to the CFTC’s wants and the needs.

- He asserted that this bill would instead create several complex and untested processes and questioned whether this bill would establish clear regulatory and registration guidelines.

- He expressed concerns over the discussion draft bill’s provisional registration process and indicated that this process would be in place while the CFTC and the SEC undergo a resource intensive joint-rulemaking process.

- He warned that changes in longstanding regulatory processes and practices increase the likelihood for mistakes and oversights to occur.

- He noted how the discussion draft bill does not provide additional staffing or funding resources to the CFTC, which will contribute to the likelihood of such mistakes and oversights.

- He then remarked that the digital assets industry exposes all participants to serious potential financial risks and uncertainties.

- He asserted that the digital asset commodity spot market operates under an ill-suited regulatory regime that varies substantially based on the states in which the trading platforms are operating.

- He stated that digital assets industry has demonstrated its fragility and vulnerability over the previous year and highlighted how this industry had lost billions of dollars in customer funds due to questionable and inefficient business practices.

- He noted how these failures have included collapses of digital asset trading platforms (including Terra and FTX) and cybersecurity deficiencies.

- He further mentioned how hackers had stolen a record $3.8 billion from cryptocurrency businesses in 2022.

- He asserted that these problems within the digital assets space should not be permitted to continue.

Panel I Witness Opening Statements:

The Hon. Rostin Behnam (U.S. Commodity Futures Trading Commission):

- He called for Congress to address the lack of federal regulation over the digital asset commodity market.

- He mentioned how the U.S. Financial Stability Oversight Council (FSOC) had unanimously issued a landmark 2022 report calling on Congress to enact legislation to address regulatory gaps in the spot market for non-security digital assets.

- He commented that recent events within the digital assets space (including bankruptcies and frauds) bring added urgency for pursuing federal regulation of this market.

- He discussed how the Committee had previously worked on a bipartisan basis to make reforms to the then-unregulated swaps market following the 2008 Financial Crisis.

- He commented that these reforms were based on core principles of sound market regulation, including transparency, reporting, and registration.

- He asserted that similar reforms are necessary to prevent future crises within the digital assets space and highlighted how one of the only FTX entities to avoid the broader 2022 FTX bankruptcy had done so because of CFTC regulation.

- He explained that this regulation had mandated that registered entities maintain segregation of customer funds, sufficient financial resources, and proper governance.

- He contended that the broader digital asset commodity market should be subject to similar time-tested regulations focused on the protection of customer assets, surveillance of trading activity, prohibitions on conflicts of interest, and impositions of cybersecurity standards.

- He expressed encouragement with Congress and the Biden administration’s interest in addressing the current federal regulatory gaps involving digital asset commodities and in supporting legislation that would provide the CFTC with additional authority to address these gaps.

- He asserted however that any new legislation must not undermine existing laws and stated that the SEC should use its robust authorities to protect customers and to address information gaps in areas where securities laws apply.

- He stated that Congress should ensure that the CFTC is fully empowered to require registered entities to make necessary disclosures regarding a variety of matters, such as investment risk, cybersecurity risk, mining, settlement practices, and other related activities.

- He added that the CFTC should ensure that customers are receiving the best available prices and that customer assets are segregated and safeguarded in the event of a failure.

- He noted how digital markets are often promoted as a form of financial inclusion to populations that may be most vulnerable to the inherent risks associated with these assets and predatory financial schemes.

- He asserted that digital assets legislation must recognize this dynamic and require additional studies to better understand how these populations interact with this market.

- He remarked that fraud and manipulation have plagued the digital assets market in the absence of federal regulation and stated that the CFTC has been “aggressive and proactive” in policing this market.

- He testified that the CFTC has brought over 85 cases that have resulted in over $4 billion in penalties and restitution.

- He stated however that the CFTC’s legal authority within the spot market for digital asset commodity tokens is necessarily limited to acting only after the fraud has occurred.

- He contended that a key feature of any regulatory scheme for digital assets should be the provision of authority for the CFTC to proactively establish rules to minimize fraud in the first place.

- He commented that this should include the authority to set stringent standards for preventing conflicts of interest, establish rules for maintaining fair, open, and transparent markets, and actively monitoring trading by market participants.

- He then discussed how the CFTC is the only financial market regulator that relies upon appropriated dollars from Congress for its funding.

- He noted how other financial regulators have self-funding mechanisms in place that provide greater assurances that their fiscal year budget requests will be fully funded.

- He called it imperative for any regulatory taking on new authorities to possess the resources necessary to implement the new authorities.

- He asserted that the CFTC cannot assume responsibility for these new authorities if it is forced to rely upon its existing resource levels.

- He reiterated his encouragement with the Committee’s efforts to address regulatory gaps within the digital assets space.

- He expressed his willingness to engage with Congress on developing legislation to address these issues.

Congressional Question Period:

Full Committee Chairman Glenn “GT” Thompson (R-PA):

- Chairman Thompson asked Chairman Behnam to discuss the importance of having Congress proactively work to close the regulatory gaps within the digital asset commodity spot market.

- Chairman Behnam highlighted the growth of commodity spot markets that are accessible to retail market participants. He noted how commodity markets have historically been wholesale oriented and used for risk management purposes. He stated however that technology developments and increased market access have enabled retail market participants to have greater exposure to commodity assets. He noted that the CFTC regulates derivatives and does not regulate commodity spot markets. He indicated that the SEC regulates securities markets, including both security spot markets and security derivative markets. He stated that the one area that the federal government does not oversee is commodity spot markets. He highlighted how Bitcoin and Ether comprise 60 percent of the digital asset market. He mentioned how a federal court has determined Bitcoin to constitute a commodity and argued that Ether should also be considered a commodity. He stated that this situation results in 60 percent of the digital assets market going unregulated. He called on Congress to fill this regulatory vacuum so that the CFTC can protect customers in this market.

- Chairman Thompson then asked Chairman Behnam to briefly elaborate on FSOC’s recommendations in their 2022 report for addressing the regulatory gaps in the non-security digital asset spot markets.

- Chairman Behnam noted how FSOC had found that there exists a regulatory gap for digital tokens that are not securities. He also noted how FSOC had emphasized that regulators make use of all enforcement tools to the extent they can. He stated that the CFTC is using its existing authorities to oversee the digital assets space. He described these authorities as “quite limited.”

- Chairman Thompson asked Chairman Behnam to indicate whether his discussion draft bill would address the concerns raised by FSOC’s recent report.

- Chairman Behnam stated that Chairman Thompson’s discussion draft bill would address the concerns raised by FSOC’s recent report through providing the CFTC with regulatory authority over commodity tokens.

- Chairman Thompson then noted that while the CFTC is significantly smaller than the SEC, he stated that the CFTC has demonstrated itself to be a nimbler regulator. He asked Chairman Behnam to indicate whether the CFTC can expand and adapt to a change in its remit.

- Chairman Behnam mentioned how the CFTC had expanded its jurisdiction to oversee the swaps market following the 2008 Financial Crisis. He stated that the CFTC had been one of the most efficient and effective regulators in implementing this new regulatory scheme over the swaps market, which he described as large and complicated. He expressed confidence in the CFTC’s ability to oversee the digital asset commodities market so long as the CFTC receives appropriate funding. He stated that the CFTC has expertise and experience with digital assets.

Full Committee Ranking Member David Scott (D-GA):

- Ranking Member Scott asked Chairman Behnam to project what will happen if Congress fails to provide additional funding and resources to the SEC and the CFTC to implement Full Committee Chairman Glenn “GT” Thompson’s (R-PA) discussion draft bill’s joint-rulemaking process.

- Chairman Behnam remarked that the CFTC would not be able to appropriately and impactfully implement the discussion draft bill without additional resources. He stated that the CFTC would need staff to work on implementing very complex rules. He also stated that the CFTC would need additional resources (both hardware and software) for information technology (IT) purposes and cybersecurity purposes to implement the rules. He further noted how the discussion draft bill would create a new joint-advisory committee, which would have per diem requirements for committee members. He commented that all of the aforementioned requirements would impose financial burdens and responsibilities on the CFTC. He stated that the CFTC already must oversee growing futures, swaps, and options markets. He asserted that the CFTC would therefore require new and additional funding to take on new digital asset market oversight responsibilities.

- Ranking Member Scott asked Chairman Behnam to estimate the amount of time that the discussion draft bill’s joint-rulemaking process will take to complete without the provision of additional resources to the CFTC.

- Chairman Behnam estimated that it would take between one and two years for the CFTC to implement new rules for digital assets if it were to receive additional resources. He estimated that it would take between three and four years for the CFTC to implement new rules for digital assets if it did not receive additional resources. He attributed this longer implementation period to the CFTC’s existing obligations and staff constraints.

- Ranking Member Scott asked Chairman Behnam to indicate whether there are any benefits to the discussion draft bill’s provisional framework that would provide the CFTC with authorities or information that it cannot currently assess.

- Chairman Behnam remarked that the discussion draft bill’s provisional registration framework would constrain the CFTC from using its existing authority to oversee the digital assets space. He noted that this existing authority is very limited and focused on combating fraud and manipulation in the digital assets market. He commented that this framework could be improved. He discussed how the CFTC had finalized new rules for overseeing the swaps market within two years following the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank). He indicated that these rules included definitions for swaps, frameworks for swap dealers, and frameworks for swap execution facilities (SEFs). He stated that the finalization of these rules had enabled the CFTC to provisionally register swap dealers and SEFs for several years. He explained that the rationale for this approach was to provide for a registration pathway as the CFTC worked to implement the rules. He remarked that the Committee should consider reforms to the proposed provisional registration framework as the Committee further develops digital assets legislation. He commented that these reforms would ensure that the CFTC would not be constrained in its actions. He noted how the digital assets market is currently unregulated and expressed confidence in the CFTC’s ability to swiftly develop appropriate rules for this market if provided with appropriate funding. He stated that a provisional period following the adoption of CFTC digital asset rules would provide policy certainty to digital asset registrants as the CFTC implements these rules. He indicated that these registrants would include registered exchanges, brokers, and affiliated entities.

- Ranking Member Scott called it important for Congress to provide the CFTC with sufficient funding so that the CFTC can properly oversee the digital assets market.

Full Committee Vice Chairman Austin Scott (R-GA):

- Vice Chairman Scott remarked that cryptocurrencies are not securities and that the CFTC (rather than the SEC) should regulate cryptocurrencies. He noted how there are currently over 20,000 cryptocurrencies in the market. He asked Chairman Behnam to indicate whether the CFTC has conducted any analysis on the workforce it would need to oversee all of these cryptocurrencies.

- Chairman Behnam estimated that the CFTC would require $120 million over three years to take on new digital asset market oversight responsibilities. He stated that this funding would enable the CFTC to increase its staff to develop a registration system for digital asset exchanges, brokers, custodians, and other parties.

- Vice Chairman Scott interjected to ask Chairman Behnam to indicate the CFTC’s current budget.

- Chairman Behnam stated that the CFTC’s current budget is $365 million per year.

- Vice Chairman Scott commented that Chairman Behnam’s requested funding increase for the CFTC to take on new digital asset market oversight responsibilities would amount to about a 10 percent increase.

- Chairman Behnam noted that the CFTC’s current budget request for fiscal year (FY) 2024 is $411 million. He then discussed how the CFTC has largely focused on Bitcoin and Ether because there exist listed futures contracts for these digital asset tokens. He mentioned however that the CFTC has brought enforcement cases involving other digital asset tokens (such as Litecoin). He stated that there currently exists debate surrounding which digital asset tokens constitute securities and which digital asset tokens constitute commodities. He commented that Full Committee Chairman Glenn “GT” Thompson’s (R-PA) discussion draft bill seeks to address this debate. He stated that there currently exist digital asset tokens that resemble securities based on current legal precedent. He noted however that there also exist many digital asset tokens that resemble and function like commodities.

- Vice Chairman Scott expressed interest in determining which cryptocurrencies would qualify for CFTC regulation. He asked Chairman Behnam to indicate whether there should exist thresholds for this regulation, such as the U.S. dollar value of a cryptocurrency or the number of individual owners involved in a cryptocurrency. He also asked Chairman Behnam to address how the CFTC could guard against the manipulation of these thresholds. He commented that a party that bought into an unregulated cryptocurrency and took actions to obtain CFTC regulation for the cryptocurrency could make a profit. He commented that a regulated cryptocurrency would likely be worth more than an unregulated cryptocurrency.

- Chairman Behnam noted how most of the 20,000 current cryptocurrencies are not being traded. He stated that most cryptocurrency trading involves a very small number of cryptocurrency tokens. He remarked that a regulatory regime for digital assets would likely be similar to the existing regulatory regimes for futures, options, swaps, and equities. He explained that these regulatory regimes involve registered exchanges that must list assets for trading. He noted how assets that remain off an exchange would violate the CEA, the Securities Act of 1933, or the Securities Exchange Act of 1934. He predicted that many current digital asset tokens will disappear over time due to regulation and obsolescence.

- Vice Chairman Scott reiterated his concerns that a party could manipulate factors so that a digital asset token would become eligible for CFTC regulation (which would make the token more valuable). He expressed faith in Chairman Behnam’s leadership at the CFTC and ability to support Congress in developing digital assets legislation.

Rep. Jim Costa (D-CA):

- Rep. Costa noted how Chairman Behnam had previously told the U.S. Senate Committee on Agriculture, Nutrition, and Forestry that there would remain gaps in the federal regulatory framework for digital assets absent the provision of new authorities to the CFTC. He asked Chairman Behnam to discuss the lessons that should be learned from FTX’s collapse and to provide recommendations for how the U.S. can prevent future collapses of digital asset firms.

- Chairman Behnam mentioned how the CFTC had regulated LedgerX (which was an FTX entity) and noted how FTX’s collapse had resulted in over 130 entities around the world filing for bankruptcy.

- Rep. Costa interjected to ask Chairman Behnam to indicate whether the CFTC could have anticipated FTX’s collapse.

- Chairman Behnam stated that the CFTC had only overseen FTX through LedgerX. He described LedgerX as a highly regulated, well-resourced, and well-governed entity. He stated that the CFTC could not have anticipated FTX’s collapse because the CFTC lacks authority over digital asset commodity tokens. He also noted how much of FTX’s activities occurred outside of the U.S., which had limited the CFTC’s jurisdiction over the company. He expressed interest in working with Congress to provide this authority to the CFTC so that the CFTC can prevent future collapses of digital asset firms.

- Rep. Costa asked Chairman Behnam to indicate whether the U.S. could learn any lessons from foreign regulatory frameworks for digital assets.

- Chairman Behnam noted how derivatives markets are global in nature because they involve large institutions needing to manage global risks. He commented that digital assets are similarly global in nature. He stated that there are many global efforts to coordinate rules for digital assets. He highlighted how the EU, the UK, Singapore, and Hong Kong have all pursued their own regulatory frameworks for digital assets. He called it important for international jurisdictions to coordinate their rules for these assets.

- Rep. Costa interjected to ask Chairman Behnam to indicate whether there exist models that should inform the U.S.’s rules for digital assets.

- Chairman Behnam remarked that every jurisdiction is unique. He noted how the U.S. has the largest and most liquid markets in the world and has a very diverse set of market participants. He stated however that the digital asset regulatory frameworks developed by the EU, UK, and Singapore can inform the U.S.’s efforts to develop its own regulatory framework for digital assets.

- Rep. Costa asked Chairman Behnam to discuss the fears he has regarding the continuation of the status quo for overseeing digital assets.

- Chairman Behnam remarked that the CFTC and the SEC have strong enforcement records regarding digital assets. He highlighted how the CFTC has brought 82 enforcement cases involving digital assets over an eight-year period. He commented that this enforcement activity is significant given how the CFTC lacks regulatory authority over the digital assets space. He indicated that these enforcement cases were based on inbound tips (and not proactive pursuit). He also stated that these enforcement cases are based on narrow authority provided to the CFTC. He expressed concerns that even more illegal activity is occurring within the digital assets space that the CFTC cannot address under current law. He also raised concerns that growth in the digital assets market can pose financial stability risks and other challenges for financial markets.

- Rep. Costa indicated that his question period time had expired and expressed interest in working to pass bipartisan legislation to address digital asset issues.

Rep. Rick Crawford (R-AR):

- Rep. Crawford highlighted how former FTX CEO Sam Bankman-Fried was not a CFTC registrant. He noted how the CFTC had overseen LedgerX (which was an FTX entity) and asked Chairman Behnam to elaborate on the CFTC’s relationship with LedgerX.

- Chairman Behnam noted how LedgerX was a clearinghouse and trading platform that offered fully collateralized futures, options, and swaps. He mentioned how FTX had purchased LedgerX in the fall of 2021 and indicated that LedgerX had been registered with the CFTC for several years prior to this purchase. He discussed how FTX had submitted an application to the CFTC following this purchase to change LedgerX’s business model from being fully collateralized to margined. He commented that the unique nature of this proposed business model was that it would be non-intermediated.

- Rep. Crawford interjected to comment that this proposed move toward margined instruments could have posed problems. He then asked Chairman Behnam to discuss the potential licensure requirements for digital asset market participants and to address the role that the NFA would play in this process.

- Chairman Behnam remarked that the CFTC has a “great” relationship with the NFA and commented that a SRO would be necessary to facilitate a regulatory scheme for digital assets. He stated that both Congress and regulators will need to decide whether to permit futures commission merchants (FCMs) or brokers to offer digital assets. He also stated that both Congress and regulators will need to decide whether to permit registered futures exchanges to offer spot digital asset commodities under a CFTC license. He noted how Full Committee Chairman Glenn “GT” Thompson’s (R-PA) discussion draft bill would propose the establishment of a digital asset commodity contract market. He commented that policymakers must work to address the aforementioned questions.

- Rep. Crawford interjected to note that his hometown has several vape shops that sell cryptocurrencies and called this situation problematic. He asserted that this situation underscores the need for the U.S. to establish licensure requirements for digital asset market participants. He then asked Chairman Behnam to address how the CFTC will determine which cryptocurrencies it will regulate.

- Chairman Behnam first stated that no cryptocurrency tokens should be operating within an unregulated space. He remarked however that the U.S. would need to develop a way for determining which cryptocurrency tokens constitute commodities and which cryptocurrency tokens constitute securities. He then stated that the CFTC will need to work with state regulators and the NFA to identify and pursue bad actors that are selling cryptocurrencies. He remarked that the U.S. already pursues Ponzi schemes and “pump and dump” schemes in the futures space and the stock market and commented that digital assets simply provide another means of perpetrating these schemes. He asserted that the CFTC requires additional policing authority to proactively pursue bad actors within the digital assets space.

- Rep. Crawford lastly asked Chairman Behnam to indicate whether the CFTC is engaging with banking stakeholders on its work within the digital assets space.

- Chairman Behnam testified that he is engaging in conversations with large bank leaders, brokers, and asset managers on digital asset issues. He stated that there is a general reluctance among these stakeholders to enter the digital assets space so long as it remains unregulated. He stated that while several of these stakeholders view certain digital asset tokens as viable financial instruments and have clients that are interested in purchasing these tokens, he commented that these stakeholders remain concerned over the unregulated nature of the digital assets market. He asserted that these stakeholders desire U.S. regulation because it is clear, predictable, and enforced.

Rep. Shontel Brown (D-OH):

- Rep. Brown first mentioned that the Committee has held three hearings on digital assets in the 118th Congress. She noted however that the Committee will only be holding its first hearing on food insecurity in the 118th Congress tomorrow. She called on the Committee to hold more hearings on specialty crops, minority farmers, and U.S. Department of Agriculture (USDA) operations. She then criticized Full Committee Chairman Glenn “GT” Thompson’s (R-PA) discussion draft bill for not being drafted with input from Congressional Democrats. She commented that Committee Members had little time to review the discussion draft bill prior to the hearing. She mentioned how the U.S. House Committee on Appropriations’s Subcommittee on Rural Development, Food and Drug Administration and Related Agencies Committee had recently marked up legislation that would “dramatically” cut funding for the CFTC. She asked Chairman Behnam to address how this legislation’s proposed funding cuts for the CFTC would impact the Commission’s ability to implement digital assets legislation (such as the discussion draft bill).

- Chairman Behnam noted how the CFTC’s current annual budget is $365 million and how the CFTC had requested $411 million for FY 2024. He indicated however that the recent appropriations legislation would only provide $345 million for the CFTC. He stated that a reduction in the CFTC’s annual funding would be “devastating” to the Commission given its current responsibilities, growing interest from new stakeholders, new risks around cybersecurity, and growing markets with increasingly diverse constituents. He added that the CFTC is facing elevated costs (which is a problem throughout the federal government). He stated that this proposed reduction in annual funding would likely force the CFTC to furlough some of its staff, limit its ability to issue regulations, and undermine its enforcement programs. He asserted the CFTC’s enforcement programs are the “gold standard” among global regulators. He highlighted how the CFTC has generally returned $8 to the U.S. Department of the Treasury for every $1 that it has received in Congressional appropriations over the previous ten years. He asserted that the CFTC should therefore be viewed as a good investment of federal tax dollars. He warned that a reduction in the CFTC’s funding would reduce the money collected by the U.S. Department of the Treasury.

- Rep. Brown then noted how the discussion draft bill would not address the impact that cryptocurrencies have on climate change. She asked Chairman Behnam to discuss the climate change issues that should be addressed as part of digital assets legislation.

- Chairman Behnam noted how the climate change concerns related to digital assets involve cryptocurrency mining’s energy usage. He highlighted how some digital asset industry stakeholders have sought to address cryptocurrency mining methods to reduce energy usage. He applauded these efforts. He suggested that the U.S. could further study the digital asset industry’s mining capacity and energy usage, as well as the types of energy sources that support cryptocurrency mining efforts. He also stated that investor disclosures regarding the energy usage and techniques of cryptocurrency miners could help to address this issue. He expressed hope that these disclosures could encourage the use of less energy intensive cryptocurrency mining practices.

Rep. Mike Bost (R-IL):

- Rep. Bost discussed how FCMs play an important role in enabling farmers to participate in futures markets and hedge their risks. He also noted how FCMs provide farmers with access to exchanges and clearinghouses. He called it important for parties to understand the risks associated with futures trading. He asked Chairman Behnam to discuss the obligations that FCMs have to disclose these risks to their clients.

- Chairman Behnam noted how the CFTC and the NFA maintain requirements for FCMs to provide disclosures to their customers. He stated however that many of the disclosures within the derivative and commodity markets relate to the risk of loss and the actual contract specifications themselves. He remarked that the U.S. must create fair, transparent, and orderly markets for commodity assets to trade on and that disclosure requirements can support these efforts. He stated however that securities have much more robust disclosure requirements than commodities. He elaborated that securities must provide more detailed disclosures regarding the nature of their assets and their issuers. He concluded that while FCMs have “serious and significant” disclosure responsibilities, he stated that these responsibilities are tailored to the unique attributes of commodity assets.

- Rep. Bost asked Chairman Behnam to indicate whether the U.S. should require brokers, dealers, and exchanges within the digital asset commodities space to adhere to similar disclosure requirements.

- Chairman Behnam answered affirmatively. He stated that the CFTC would need to identify specific areas that would warrant disclosure and commented that the Committee could provide direction to the CFTC on where to impose these disclosure requirements. He indicated that potential disclosure areas for digital asset commodity tokens would likely include risk of loss, information regarding the tokens themselves, and information regarding the regulated entity that is facilitating the trading of a given token.

- Rep. Bost asked Chairman Behnam to confirm that Full Committee Chairman Glenn “GT” Thompson’s (R-PA) discussion draft bill would empower the CFTC and the NFA to require similar disclosures on digital asset commodities registered with the CFTC.

- Chairman Behnam confirmed that the discussion draft bill would include such disclosure requirements.

- Rep. Bost then discussed how Dodd-Frank had “significantly” expanded the jurisdiction of the CFTC to cover the swaps markets. He noted how this increase in jurisdiction had required the CFTC to undertake increased rulemaking. He asked Chairman Behnam to indicate whether it would be a complex and difficult process for the CFTC to engage in rulemaking for digital asset commodities if the CFTC were to be provided with authority to oversee the digital asset commodity spot market. He also asked Chairman Behnam to estimate the costs and the length of this potential rulemaking process.

- Chairman Behnam estimated that it would cost the CFTC $120 million over three years to establish a new regulatory regime for the digital asset commodity spot market. He noted how this effort would require establishing multiple rulemaking teams, new hardware and software systems, and increased cybersecurity protections. He also estimated that this rulemaking process would take between six months and two years to complete. He stated that the CFTC has experience in setting up new regulatory regimes and highlighted how the CFTC had established a new regulatory regime for swaps following the enactment of Dodd-Frank. He stated that the CFTC had been one of the most efficient, quick, and effective regulators across the world in implementing its over-the-counter (OTC) derivatives regulatory regime. He contended that the CFTC would be well-suited to adopt a new regulatory regime for the digital asset commodity spot market if it were to be provided with a mandate and appropriate funding.

- Rep. Bost concluded that the Committee must work to develop legislation to regulate digital assets.

Rep. Yadira Caraveo (D-CO):

- Rep. Caraveo discussed how several large digital asset companies have recently collapsed and filed for bankruptcy. She highlighted how the CFTC and other federal financial regulators have pursued enforcement actions against several of these companies for abusive and manipulative trading practices. She remarked that the regulatory framework proposed under Full Committee Chairman Glenn “GT” Thompson’s (R-PA) discussion draft bill would be very complex and would require an extensive joint-rulemaking process between the SEC and the CFTC. She also noted how this discussion draft bill would establish a new provisional registration framework while the rulemaking process is underway. She asserted that additional funding for the CFTC would be needed to support this rulemaking process and noted how the discussion draft bill lacks this funding. She also discussed how the CFTC has engaged in conversations regarding digital assets going back to 2014. She stated that the CFTC has subsequently developed significant expertise on digital asset policy topics. She also highlighted how the CFTC has engaged in interagency discussions and reports concerning the appropriate regulatory framework for these assets. She added that the CFTC has been active on digital asset enforcement issues. She asked Chairman Behnam to identify any issues that are missing from the discussion draft bill.

- Chairman Behnam expressed concerns regarding the discussion draft bill’s provisional registration scheme and stated that Congress could develop a provisional registration scheme that does not “handcuff” the CFTC. He remarked that his main concern regarding the discussion draft bill is its lack of additional funding for the CFTC. He asserted that additional funding will be necessary if the CFTC is to expand its jurisdiction to include oversight of the digital asset commodity spot market. He also stated that the discussion draft bill could be improved through including more disclosure requirements. He suggested that these disclosure requirements could include energy usage information and financial inclusion information. He expressed concerns that there are many fraudsters who are using digital assets to take advantage of financially illiterate people in lower income communities. He then remarked that the discussion draft bill does include many of the core responsibilities and requirements that one would want of a market regulator. He indicated that these responsibilities and requirements relate to registration, surveillance, trading practice monitoring, conflicts of interest, governance, and financial resources. He commented that while he has not had significant time to review the discussion draft bill, he remarked that the bill contains many key elements. He stated that U.S. policymakers will need to further assess the bill and ensure that it comports with existing laws.

- Rep. Caraveo then noted how the discussion draft bill will change the definitions for commodities and securities. She explained that this bill would define whether a digital asset constitutes a commodity or a security based on how a digital asset is traded rather than on the digital asset’s characteristics. She asked Chairman Behnam to opine on this proposed change.

- Chairman Behnam remarked that Congress must ensure that digital assets legislation does not compromise any existing laws (including the CEA, the Securities Act of 1933, and the Securities Exchange Act of 1934). He commended the bill for its focus on decentralization as a key characteristic of what would constitute a commodity or a security. He also stated that policymakers should consider where investors are obtaining their digital assets from. He commented that assets sold through issuers would be securities while assets sold through CFTC-regulated exchanges would more likely be commodities. He noted however that a token sold through a CFTC-regulated exchange could still be a security. He remarked that the discussion draft bill’s definitional provisions could be improved and expressed the CFTC’s willingness to work with the Committee on such improvements.

Rep. Dusty Johnson (R-SD):

- Rep. Johnson remarked the current lack of regulatory clarity for digital assets is causing digital assets market activity and innovation to move abroad. He noted however that some argue that the SEC is perfectly equipped to regulate the digital assets space and that new digital assets legislation is not necessary. He asked Chairman Behnam to respond to this argument.

- Chairman Behnam remarked that digital assets regulation is not a “zero-sum game” and commented that providing the CFTC with increased authority to oversee the digital assets market will not result in another regulator losing authority. He stated that there exists a “regulatory vacuum” regarding digital asset commodities. He noted that while the SEC has authority over digital asset commodities, he emphasized that Bitcoin (which is the most popular digital asset) is a commodity. He noted that Bitcoin’s status as a commodity is based on a federal court decision. He indicated that Bitcoin is thus unregulated under current U.S. law. He also mentioned how some digital asset exchanges host tokens that have received legal clarity regarding whether the tokens constitute commodities or securities. He raised concerns that this dynamic could lead digital asset exchanges to only list a small number of tokens for which they have legal clarity. He called on the U.S. to fill the regulatory gaps within the digital assets market.

- Rep. Johnson then noted how Full Committee Chairman Glenn “GT” Thompson’s (R-PA) discussion draft bill would determine the extent to which a given asset is sufficiently decentralized. He asked Chairman Behnam to indicate whether the bill’s provisions related to the Howey test are sensible.

- Chairman Behnam commended the discussion draft bill’s general framework for determining whether a given digital asset constitutes a security or a commodity. He stated however that this framework could be further improved upon and that the CFTC will need to further review the bill to provide more precise recommendations. He remarked that the U.S. must view decentralization as the core factor for determining whether a given asset constitutes a security or a commodity. He also commended the bill for its focus on determining where an investor is obtaining an asset from. He commented that an asset that comes from an issuer is more likely to be a security while an asset that comes from a third-party exchange or venue is more likely to be a commodity. He emphasized that neither of the aforementioned venues necessarily dictate the status of a given asset.

- Rep. Johnson expressed support for the discussion draft bill’s test for determining the extent to which an asset is decentralized. He then noted how Chairman Behnam had expressed interest in ensuring that the bill’s intermediary registration provisions would comport with the CFTC’s existing statutory authorities. He stated that the discussion draft bill did not want to simply apply existing broker and dealer requirements to digital asset intermediaries. He noted how the bill would create new definitions for digital commodity brokers and digital commodity dealers. He asked Chairman Behnam to opine on the bill’s approach of establishing new requirements for digital asset intermediaries. He commented that these new proposed requirements would be very similar to existing requirements.

- Chairman Behnam expressed faith in the U.S.’s existing regulatory framework for futures, options, and swaps. He called this existing framework time-tested and well-functioning. He also stated that this framework is being constantly updated to reflect market evolutions. He remarked that the discussion draft bill would base its regulatory framework on principles of transparency, orderliness, and fairness. He expressed support for the bill’s focus on these principles.

- Rep. Johnson asked Chairman Behnam to indicate whether he supports the discussion draft bill’s approach of establishing new requirements for digital asset intermediaries (rather than on relying upon existing intermediary requirements).

- Chairman Behnam expressed support for establishing unique classifications for digital asset intermediaries in the near-term. He stated that the U.S. will likely learn ways to align its regulatory approaches for digital assets and traditional assets over time.

Rep. Andrea Salinas (D-OR):

- Rep. Salinas discussed how frauds, scams, and manipulations in cryptocurrency markets have been growing and commented that these problems are especially present within her state of Oregon. She mentioned how the U.S. Federal Bureau of Investigations (FBI) had reported that Oregonians had lost $13.6 million in cryptocurrency scams during the first ten months of 2022. She also mentioned how a federal grand jury in Oregon had indicted four Russian nationals for their roles in a global cryptocurrency Ponzi and pyramid scheme in February 2023. She asked Chairman Behnam to discuss what the CFTC and other federal agencies are doing to protect Americans from fraud and manipulation within the digital assets space. She also asked Chairman Behnam to address how the CFTC and other federal agencies should work together to address these frauds and manipulations.

- Chairman Behnam noted how there are two types of financial assets: securities and commodities. He indicated that digital asset tokens can be either securities or commodities. He stated that the CFTC currently has “extremely limited” authority to police spot markets in the event of fraud or manipulation. He noted that the CFTC must be reactive in policing the spot market and testified that the CFTC’s 82 enforcement cases involving digital assets have all involved frauds and manipulations being reported to the Commission. He called this approach suboptimal and asserted that there should exist proactive regulation, registration, and surveillance of markets, individuals, and institutions that are offering digital assets. He stated that while the CFTC is using its existing authorities to police the digital assets space, he reiterated his concerns that current limits on the CFTC’s authorities prevent the Commission from policing the entire digital assets market. He commented that digital asset markets already exists and called it incumbent on the CFTC to police this space.

Rep. Jim Baird (R-IN):

- Rep. Baird remarked that the segregation of customer funds has served as the “bedrock” for protecting customers within the derivatives market. He asked Chairman Behnam to explain how customer funds are segregated. He also asked Chairman Behnam to discuss appropriate fund segregation practices for protecting customers.

- Chairman Behnam remarked that the CFTC views customer funds as “sacrosanct” and stated that the CEA and its associated rules make the segregation of customer funds the CFTC’s highest priority. He indicated that these policies seek to ensure that customer funds are completely separate and siloed from an intermediary or a broker that is facilitating the trading of futures, options, and swaps. He stated that the CFTC’s objective is to ensure that customer funds are completely protected from claims against an intermediary, broker, or FCM in the event of a failure or bankruptcy. He remarked that Full Committee Chairman Glenn “GT” Thompson’s (R-PA) discussion draft bill would apply the CFTC’s existing customer fund segregation regime to the digital assets market. He commended the bill’s use of this approach. He discussed how the segregation of customer funds constitutes one of the greatest concerns for the digital assets market. He highlighted how FTX had failed to segregate the funds of its customers and how digital asset exchange Binance has allegedly failed to segregate the funds of its customers according to recent SEC and CFTC enforcement cases. He reiterated his assertion that Congress must work to ensure that customer funds are not being commingled and commended the bill’s work to address the issue. He expressed his willingness to work with the Committee on this issue.

- Rep. Baird then asked Chairman Behnam to discuss the CFTC’s relationship with the NFA and to address how this relationship impacts efforts to segregate customer funds.

- Chairman Behnam called the NFA a longstanding and “close” partner of the CFTC. He described the NFA as the CFTC’s “boots on the ground” because of the NFA’s close relationships with CFTC registrants and stakeholders. He stated that the NFA provides “invaluable” disclosures, protections, and education and literacy campaigns for all market participants. He called SROs (like the NFA) an “absolute necessity” given the size and scale of the markets that the CFTC oversees. He expressed encouragement with the fact that the discussion draft bill considers a relationship with an SRO and applies time-tested principles to the digital assets market.

- Rep. Baird asked Chairman Behnam to indicate whether the CFTC’s working relationship with the NFA is positive and will provide additional customer protections.

- Chairman Behnam answered affirmatively.

Rep. Nikki Budzinski (D-IL):

- Rep. Budzinski remarked that the digital assets industry has framed digital assets as tools to support greater financial inclusion. She noted how people of color are more likely to own digital assets. She indicated however that Full Committee Chairman Glenn “GT” Thompson’s (R-PA) discussion draft bill does not address the impact of digital assets on financial inclusion. She asked Chairman Behnam to discuss the utility of digital assets to support financial inclusion. She also asked Chairman Behnam to indicate whether the CFTC and the SEC should consider the effects of digital assets on financial inclusion in their registration and approval processes.

- Chairman Behnam remarked that the CFTC is working through its Office of Customer Education and Outreach (OCEO) to provide the public with information regarding digital assets. He acknowledged however that these outreach efforts likely do not reach enough people. He expressed agreement with Rep. Budzinski’s concerns regarding the “friction” between the publicized financial inclusion opportunities of digital assets and digital asset use cases and impacts on unbanked and low-income communities. He noted how many lower income communities experience banking challenges and commented that digital assets could enable these communities to transfer funds more seamlessly and instantly across the world. He noted that many people in these communities have relatives located abroad and that digital asset technologies can improve remittances. He stated however that these remittance capabilities have risks associated with them. He noted that there often does not exist sufficient information regarding digital assets, that digital assets can be volatile, and that there can exist fraud within the institutions facilitating digital asset transfers. He remarked that the U.S. must provide disclosures and customer education for these assets. He also stated that the CFTC should examine digital asset use cases and whether these assets are actually supporting financial inclusion efforts. He noted that the CFTC cannot conclude whether digital assets are currently promoting financial inclusion or fraud.

- Rep. Budzinski expressed agreement with Chairman Behnam’s calls for more studies regarding the impacts of digital assets on financial inclusion. She asked Chairman Behnam to provide further details regarding the low-income populations that use digital assets. She also asked Chairman Behnam to discuss how digital assets legislation should address financial inclusion challenges to ensure that low-income populations are protected.

- Chairman Behnam noted that low-income communities and racially diverse communities that are living in traditionally underbanked areas are increasingly using digital assets. He stated that digital assets reduce barriers to accessing financial markets and banking services because digital assets only require the user to possess a phone (as opposed to physical banks, credit scores, physical address information, and financial history information). He remarked that digital assets can both provide opportunities and pose risks to consumers. He asserted that policymakers must consider how digital assets impact vulnerable communities, which are more prone to using digital asset technologies.

Rep. Doug LaMalfa (R-CA):

- Rep. LaMalfa discussed how Full Committee Chairman Glenn “GT” Thompson’s (R-PA) discussion draft bill would impose new requirements on the digital asset commodities that would be registered with the CFTC. He indicated that these new requirements would relate to customer risk disclosures and conflicts of interest. He noted how the NFA already maintains similar requirements. He asked Chairman Behnam to discuss how the CFTC currently works with the NFA on these requirements and to project how these requirements would be applied to digital asset commodities.

- Chairman Behnam remarked that the discussion bill would seek to apply current requirements for traditional markets to the digital assets space. He noted how the CFTC currently works closely with the NFA to implement disclosures regarding assets and risks of loss, conflict of interest, anti-money laundering (AML) requirements, and know your customer (KYC) requirements for both retail and institutional market participants. He asserted that these requirements are key for protecting investors and have been developed based on experience and previous frauds. He commented that these requirements are time-tested and promote information flows to investors that enable informed decision making. He expressed interest in applying these requirements to the digital assets market.

- Rep. LaMalfa interjected to ask Chairman Behnam to comment on the feasibility of applying requirements designed for traditional financial markets to the digital assets market (which he described as very different).

- Chairman Behnam remarked that many of the existing requirements for traditional financial markets are adaptable to the digital assets market. He stated however that the U.S. will still need to make appropriate modifications to these requirements to reflect the unique nature of digital assets.

- Rep. LaMalfa asked Chairman Behnam to comment on the CFTC’s ability to work with the NFA to modify their requirements for the digital assets space.

- Chairman Behnam remarked that the CFTC has a great working relationship with the NFA and expressed confidence in the CFTC’s ability to work with the NFA to modify their requirements for the digital assets space.

- Rep. LaMalfa then asked Chairman Behnam to discuss how the CFTC works to support fair, open, and transparent derivatives markets.

- Chairman Behnam discussed how the CFTC maintains a registration regime to obtain information from exchanges, FCMs, introducing brokers, associated persons, commodity pool operators, and trading officers about key personnel, governance, compliance, and conflicts of interest. He also mentioned how the CFTC conducts regular surveillance of derivatives markets and will work closely with exchanges and SROs to monitor these markets. He stated that the CFTC maintains a robust Whistleblower Program, which encourages people to alert the CFTC about bad actors within the derivatives markets. He further noted how the CFTC uses its civil enforcement authority through its Division of Enforcement to discourage illegal activity. He remarked that the CFTC’s oversight regime for derivatives markets focuses on registration, surveillance, and enforcement. He stated that this approach has proven successful and can be replicated within the digital assets market.

- Rep. LaMalfa then asked Chairman Behnam to address how digital asset commodity spot market regulatory authority would have enabled the CFTC to ensure consumer protections. He commented that requirements for digital asset firms to segregate their customer assets would have been important for protecting FTX customers.

- Chairman Behnam noted how LedgerX was an FTX-affiliated entity that was subject to CFTC regulation. He highlighted how FTX’s current CEO John Ray III has indicated that LedgerX has responsible management and valuable franchise. He noted how LedgerX had recently been auctioned for $50 million. He stated that LedgerX’s operational and financial viability following FTX’s collapse demonstrates the success of the CFTC’s regulatory regime. He asserted that expanded CFTC jurisdiction within the digital assets space will help to prevent future crises.

Rep. Jonathan Jackson (D-IL):

- Rep. Jackson asked Chairman Behnam to indicate how digital asset account deposits are assured.

- Chairman Behnam noted that the CFTC requires FCMs to have relationships with either banking entities or custodians. He indicated that the CFTC receives daily reports regarding customer funds and balances to ensure that customer funds are in the correct locations and available to be withdrawn or used for trading activities.

- Rep. Jackson then asked Chairman Behnam to discuss the current level of transparency for bidders and bids.

- Chairman Behnam noted how the CFTC maintains an order book and rules regarding transparent markets, settlements, and the validity of bids. He stated that the CFTC prohibits many disruptive trading practices, including spoofing and wash sales. He lamented however that these disruptive trading practices are “systemic” in the unregulated digital assets trading market. He also discussed how the CFTC maintains rules at both the Agency level and the exchange level to ensure that bids and offers are valid and that bids and offers will be executed if they are on the order book.

- Rep. Jackson asked Chairman Behnam to explain how digital asset exchanges process their bids. He expressed concerns that the sudden failure of a digital asset exchange could cause all bids on the platform to disappear. He also expressed concerns that bad actors can abuse the bidding process to engage in wash trading.

- Chairman Behnam thanked Rep. Jackson for highlighting the problems associated with unregulated markets. He noted how unregulated markets lack rules for bids and segregated customer funds and commented that the absence of these rules can result in unscrupulous activities. He mentioned how the CFTC has brought several enforcement cases related to wash sales, spoofing, the co-mingling of customer funds, and conflicts of interest. He stated that the digital asset commodity market remains largely unregulated. He called on the U.S. to apply the many of the rules and requirements used for traditional markets to the digital asset market.

- Rep. Jackson asked Chairman Behnam to indicate who ultimately possesses custody of a digital asset in the unregulated digital asset space.

- Chairman Behnam stated that the answer to Rep. Jackson’s question would depend on the entity and who is facilitating the trading. He noted how some of the larger entities that facilitate digital asset trading have custodians and comply with state regulations around custody. He added that these entities will comply with the U.S. Department of the Treasury’s AML and KYC requirements. He stated that while the entire digital assets industry is not void of regulation, he asserted that these current regulations are not sufficient. He remarked that there remain too many bad actors and institutions willing to skirt rules within the digital assets space. He commented that this dynamic can lead digital asset firms to implode, declare bankruptcy, and lose customer funds.

Rep. Frank Lucas (R-OK):

- Rep. Lucas remarked that consumer protection should be a central aspect of any potential digital asset market structure framework. He asked Chairman Behnam to discuss the importance of ensuring that any legislative framework for digital assets will be consistent with federal securities laws and the CEA.

- Chairman Behnam remarked that the U.S.’s existing governance frameworks for securities and commodities markets are time-tested and have proven efficient and effective in supporting capital formation and risk management. He stated that these governance frameworks have helped make U.S. financial markets the world’s strongest and most desirable financial markets. He commented that these governance frameworks provide clarity, certainty, and a robust legal system (which provides assurances that bad actors will be held accountable). He reiterated his assertion that the U.S.’s existing governance frameworks for securities and commodities markets are well-functioning and stated that these frameworks should inform the development of a governance framework for digital assets. He noted how the U.S. had previously used these existing governance frameworks for futures and options to inform its development of a regulatory framework for the swaps market.

- Rep. Lucas then discussed how Full Committee Chairman Glenn “GT” Thompson’s (R-PA) discussion draft bill is the result of a collaborative effort with U.S. House Committee on Financial Services Full Committee Chairman Patrick McHenry (R-NC). He commented that this bill seeks to provide a regulatory framework for digital assets. He stated that the CFTC and the SEC will need to work together to oversee the digital assets market. He commented however that there exist “notable” cases of disagreement between the CFTC and SEC regarding which digital assets constitute commodities and which digital assets constitute securities. He asked Chairman Behnam to discuss the current collaboration between the CFTC and the SEC regarding the treatment of digital assets and their intermediaries. He also asked Chairman Behnam to address how the bill would support this collaboration.