- This event has passed.

Digital Assets and the Future of Finance: Understanding the Challenges and Benefits of Financial Innovation in the United States (U.S. House Committee on Financial Services)

December 8, 2021 @ 5:00 am – 9:00 am

| Hearing | Digital Assets and the Future of Finance: Understanding the Challenges and Benefits of Financial Innovation in the United States |

| Committee | U.S. House Committee on Financial Services |

| Date | December 8, 2021 |

Hearing Takeaways:

- Cryptocurrencies and Digital Assets: The hearing focused on the growth in popularity of digital assets and cryptocurrencies. Committee Members and the hearing’s witnesses expressed interest in how these assets would impact consumers, businesses, and the U.S. more broadly, as well as how policymakers ought to approach these assets. Committee Members and the hearing’s witnesses raised concerns that the U.S.’s failure to provide regulatory clarity for cryptocurrencies and digital assets would cause innovation within this space to move abroad.

- Regulatory Framework: A key area of discussion during the hearing was the U.S.’s regulatory framework for cryptocurrencies and digital assets. Committee Members and the hearing’s witnesses stated that the U.S.’s current regulatory approach to these assets was very fragmented and forced market participants to obtain licenses and oversight from a variety of federal and state government agencies. The hearing’s witnesses called for the establishment of a primary regulator for cryptocurrencies and digital assets that could better account for the unique natures of these assets (rather than apply ill-fitting existing regulatory frameworks to these assets). Ms. Haas also called for the establishment of a self-regulatory organization (SRO) that would work alongside government regulators to oversee cryptocurrencies and digital assets. She stated that an SRO could more nimbly respond than government regulators to technological changes within the space.

- Lack of Clarity Surrounding What Constitutes a Security: The hearing’s witnesses expressed frustration with how it was difficult to determine whether a new digital asset constitutes a security. They indicated that while the U.S. Supreme Court had established tests for determining whether digital assets constituted securities in SEC v. W.J. Howey Co. (known as the Howey test) and Reves v. Ernst & Young (known as the Reves test), they stated that these tests were difficult to apply in practice. Mr. Brooks and Ms. Haas noted how the cryptocurrency industry had established the Crypto Rating Council to perform objective quantitatively based assessments of digital assets to make determinations as to whether the assets constituted securities under the Howey and Reves tests. These tests however are not official government tests, which means that the SEC could always override their determinations.

- Ability to Support International Remittances: Several Committee Members expressed interest in how cryptocurrencies and blockchain technology could be used to enable cheaper and quicker international money remittances. The hearing’s witnesses highlighted how the low number of intermediaries required to support transactions on a blockchain coupled with the continuous operations resulted in cheaper and quicker transactions. Rep. Sylvia Garcia (D-TX) raised concerns however that many parties in these international remittance transactions would still face challenges in terms of converting their physical currency into virtual currency and vice versa.

- Potential Impact on Financial Inclusion: Several Committee Members and the hearing’s witnesses expressed interest regarding the potential of cryptocurrencies and digital assets to improve financial inclusion. They highlighted how the fees associated with the traditional banking system often made it difficult for people to obtain bank accounts. They noted how people only needed to download digital wallets (rather than establish bank accounts) to make cryptocurrency transactions, which would make this a more accessible payments method. They also emphasized how there were currently more minority cryptocurrency investors than White cryptocurrency investors in the U.S. Mr. Brooks stated that cryptocurrencies provided ordinary investors with access to an early-stage investment opportunity and noted how these opportunities had been traditionally reserved for the very wealthy and well-connected. He further contended that blockchain technology could reduce bias in the financial system because its mathematical basis made it agnostic to a user’s race, gender, nationality, and income.

- Concerns Regarding Cryptocurrency’s Volatility: Several Committee Members expressed concerns over the large amounts of volatility currently associated with various cryptocurrencies. Mr. Brooks remarked that much of the current price volatility surrounding cryptocurrencies was attributable to the early stage of the market and the thinly traded nature of the asset. He stated that U.S. equity and debt markets tended to be more stable because there was more price discovery in these markets. He elaborated that the U.S. had regulated equity mutual funds, derivatives products, and futures products and commented that these products provided the market with indicators of what was occurring within the financial system. He remarked that similar tools did not exist within the cryptocurrency space yet, which meant that the cryptocurrency market could be very sensitive to a single actor’s actions.

- Concerns Regarding Cryptocurrency’s Impact on Systemic Risk: Several Committee Democrats raised concerns that the volatility surrounding cryptocurrencies could pose systemic risks to the financial system. The hearing’s witnesses argued however that the transparent nature of blockchains would reduce systemic risks because they enabled exchanges to proactively identify and address market issues before they became significant.

- Concerns Regarding Cryptocurrency Mining’s Environmental Impact: Full Committee Chairman Maxine Waters (D-CA) and Rep. Rashida Tlaib (D-MI) raised concerns over the large amounts of energy needed to run cryptocurrency networks. Ms. Dixon testified that the cryptocurrency industry was working to address these concerns and develop and implement less energy intensive consensus mechanisms.

- Concerns Regarding Hacking and Surveillance: Several Committee Members expressed concerns over the extent to which digital wallets and cryptocurrency exchanges were vulnerable to hackings and surveillance. The hearing’s witnesses asserted that blockchains were more secure than existing computer networks. Mr. Brooks added that the transparent nature of blockchains enabled parties to identify hackings that had occurred more quickly than in traditional financial systems. Rep. Sean Casten (D-IL) also raised concerns that countries may issue central bank digital currencies (CBDCs) that tracked user activities.

- Concerns Regarding Cryptocurrency’s Use in Illicit Activity, Fraud, and Sanctions Evasion: Several Committee Members and hearing witnesses expressed interest in working to ensure that cryptocurrencies were not being used in illicit activities, fraud, and sanctions evasions. The hearing’s witnesses testified that their companies and exchanges maintained robust surveillance operations and adhered to know your customer (KYC) and anti-money laundering (AML) requirements.

- Concerns Regarding Ransomware: Several Committee Members discussed how the problem of ransomware was becoming worse and highlighted how criminals frequently sought payment for ransomware attacks through cryptocurrencies. The hearing’s witnesses highlighted how the transparent nature of blockchains often enabled the recovery of ransomware payments after they were made. Mr. Bankman-Fried commented that standardized open lines of communications between cryptocurrency exchanges and law enforcement bodies would be beneficial in enabling quicker responses to ransomware attacks.

- Inability to Obtain U.S. Approval for Sport Market Cryptocurrency Exchange-Traded Funds: Several Committee Members, Mr. Brooks, and Mr. Bankman-Fried expressed frustration with how cryptocurrency ETFs were not permitted within the U.S., but permitted outside of the U.S. They stated that this prohibition was denying Americans of investment opportunities and was driving innovation abroad.

- Concerns Regarding Quantum Computing: Rep. Ed Perlmutter (D-CO) and Rep. John Rose (R-TN) both expressed concerns over the prospects that quantum computing could eventually pose threats to the security of blockchains. Mr. Bankman-Fried He stated that blockchain security algorithms ought to be resistant to quantum computing threats. He remarked however that quantum computing had the potential to create new cryptographic algorithms that were faster, more secure, and more efficient.

- Concerns Regarding the Infrastructure Investment and Jobs Act’s Expansion of the Definition of Broker for U.S. Internal Revenue Service (IRS) Reporting Requirements: Rep. Al Lawson (D-FL), Rep. Ted Budd (R-NC) Mr. Brooks, Ms. Dixon, and Ms. Haas expressed concerns over the Infrastructure Investment and Jobs Act’s expansion of the definition of broker under U.S. Internal Revenue Service (IRS) reporting requirements to include cryptocurrency miners and other validators, as well as software and hardware digital wallet makers. They asserted that there existed a difference between centralized exchanges and decentralized algorithms and stated that there did not exist a well-situated party to provide tax reporting for decentralized algorithms. Ms. Haas added that this expanded definition raised privacy concerns and could apply to parties that were not necessarily intended to be covered under the law.

- Proposed Requirements for Digital Identity Standards for Crypto Transactions: Rep. Bill Foster (D-IL) expressed interest in having all crypto transactions be associated with legally traceable identities. He commented that such a requirement would be key to preventing crypto assets from being used for ransomware or other criminal payments. He stated that while a person’s identity for crypto transactions could be pseudonymous for market participants and the public, he asserted that the transactions must be capable of being de-anonymized pursuant to the action of a court within a trusted jurisdiction. The hearing’s witnesses expressed general support for this proposal.

- Diversity of Cryptocurrency Companies: Rep. Alma Adams (D-NC) and Rep. Sylvia Garcia (D-TX) expressed interest in obtaining demographics data of both the employees and customers of the companies testifying at the hearing. The hearing’s witnesses expressed their willingness to share this data with the Committee.

- Stablecoins: One notable type of cryptocurrency that was highlighted during the hearing was stablecoins. Stablecoins are cryptocurrencies that have their value pegged to an external reference. Both Mr. Allaire and Mr. Cascarilla’s companies offer stablecoins that are backed by U.S. dollars and short-duration U.S. Treasuries.

- Proposed Regulatory Changes for Stablecoins: The hearing’s witnesses expressed support for establishing requirements for stablecoin issuers to make daily attestations on their stablecoin reserves and have their stablecoin reserves periodically be subjected to third-party audits. They added that regulators should oversee these attestations and audits. They stated that these requirements would make it easier for U.S. consumers to trust stablecoins, which would support their adoption and use.

- Differential Treatment of Stablecoin and Traditional Financial Assets: Mr. Brooks and Mr. Bankman-Fried contended that the U.S.’s current rules favored traditional financial assets over stabecoins. Mr. Brooks questioned how the U.S.’s current rules only permitted banks to issue stablecoins while the U.S. was failing to grant bank charters to the largest issuers of stablecoins. He commented that stabecoin issuers should be considered less risky than banks given that they tended to not engage in lending activities. He also stated that stablecoins that functioned as payment instruments ought to be treated the same as traveler’s checks and prepaid cards.

- Impact on the U.S. Dollar’s Status as the World’s Reserve Currency: Mr. Allaire, Mr. Brooks, and Mr. Cascarilla contended that U.S. dollar-backed stablecoins would be key to maintaining the U.S. dollar’s status as the world’s reserve currency. They stated that these stablecoins would provide people with access to internet-enabled U.S. dollars, which could be transferred at fast speeds and low costs. Mr. Brooks also asserted that the crypto economy would push the U.S. Federal Reserve to address U.S. dollar inflation, which would be beneficial to its global competitiveness.

- President’s Working Group on Financial Markets’ (PWG) Report on Stablecoins: Several Committee Members expressed interest in the recent President’s Working Group on Financial Markets’ (PWG) Report on Stablecoins. Mr. Allaire and Ms. Dixon criticized the report’s recommendation that the issuance of stablecoins be limited to depository institutions. They contended that stablecoin issuers were often less risky than traditional banks because they did not engage in lending activities.

- Concerns Regarding Meta’s Pursuit of a Stablecoin Project: Full Committee Chairman Waters (D-CA) expressed concerns over Paxos’s partnership with Meta (formerly known as Facebook) to pilot a digital wallet called Novi. Mr. Cascarilla remarked that Novi was merely a customer of Paxos and that Novi likely chose Paxos because it had the most regulated stablecoin product available. He stated that the services that Novi received from Paxos were not different than the services that Novi received from any other financial institution that they maintained a relationship with.

Hearing Witnesses:

- Mr. Jeremy Allaire, Co-Founder, Chairman and CEO, Circle

- Mr. Samuel Bankman-Fried, Founder and CEO, FTX

- Mr. Brian P. Brooks, CEO, Bitfury Group

- Mr. Charles Cascarilla, CEO and co-Founder, Paxos Trust Company

- Ms. Denelle Dixon, CEO and Executive Director, Stellar Development Foundation

- Ms. Alesia Jeanne Haas, CEO, Coinbase Inc. and CFO, Coinbase Global Inc.

Member Opening Statements:

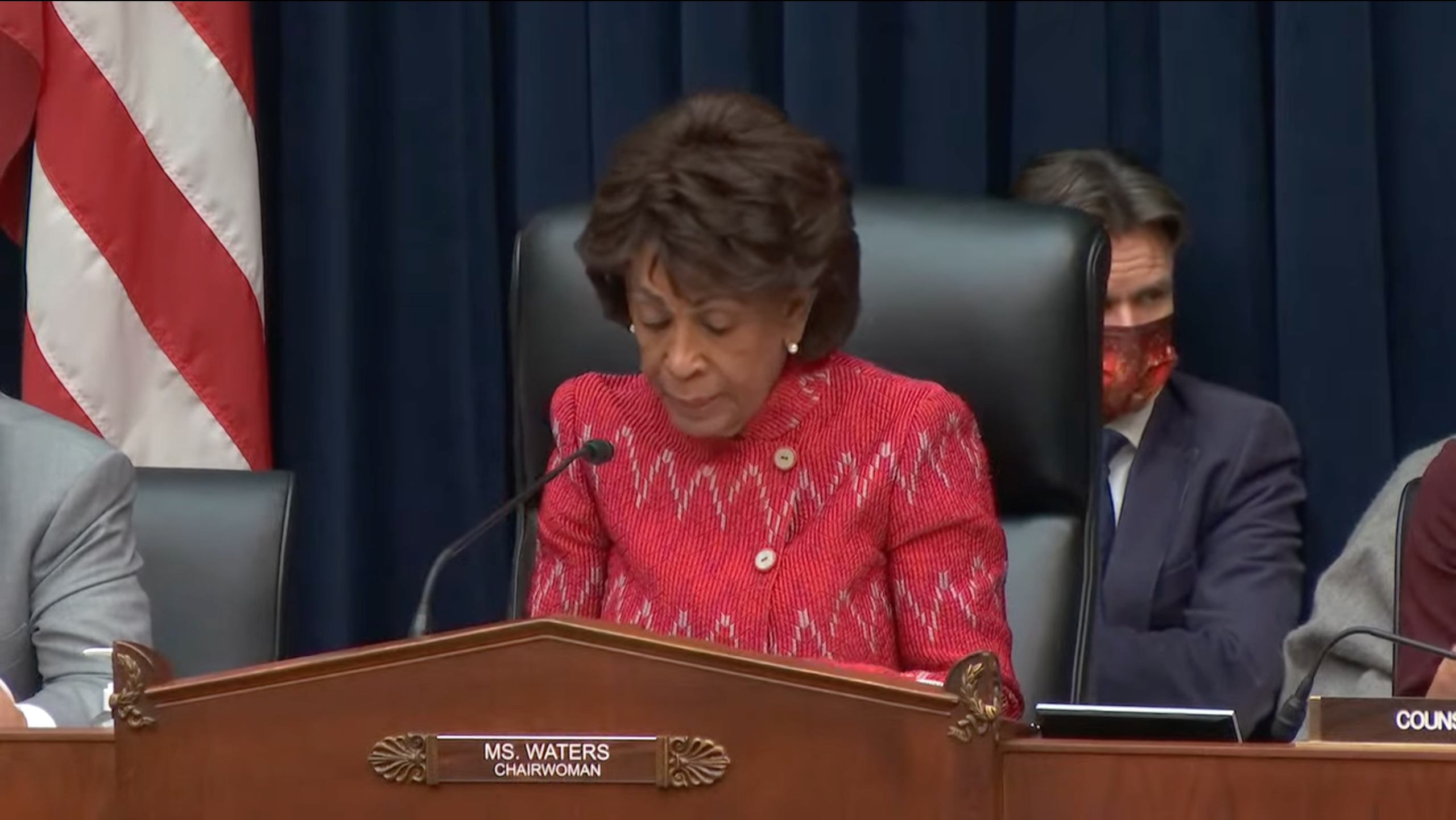

Full Committee Chairman Maxine Waters (D-CA):

- She discussed how Americans were increasingly making financial decisions using digital assets and noted how some pension funds had even begun to invest in cryptocurrencies on behalf of retirees.

- She commented how these investments in cryptocurrencies were being made in spite of their volatile natures.

- She also stated that the COVID-19 pandemic was leading many working families to consider cryptocurrencies as a way of rebuilding their savings and retirement accounts.

- She mentioned how the cryptocurrency industry had become increasingly visible as a result of celebrity endorsements and the advent of ATMs that exchange cash for cryptocurrencies.

- She remarked that there remained questions as to how existing rules applied to cryptocurrencies and whether regulators possessed sufficient authority to protect investors and consumers.

- She commented that the lack of an overarching and centralized regulatory framework for cryptocurrency markets left digital asset investments vulnerable to fraud, manipulation, and abuse.

- She mentioned how some cryptocurrency market exchanges and stablecoin issuers had obtained state money transmitter and sale of checks licenses from multiple states.

- She also indicated that at least three cryptocurrency companies had obtained conditional approval for national trust bank charters from the U.S. Office of the Comptroller of the Currency (OCC).

- She also discussed how the U.S. Federal Reserve was conducting research on CBDCs and how other federal agencies, including the U.S. Federal Deposit Insurance Corporation (FDIC) and the U.S. National Credit Union Administration (NCUA), had announced requests for information (RFIs) from the digital assets industry.

- She further noted how the U.S. Securities and Exchange Commission (SEC) was using its existing authorities in order to carry out enforcement actions against cryptocurrency market participants.

- She then mentioned how the increasing popularity of cryptocurrencies had raised environmental concerns tied to the computing power needed to mine some cryptocurrencies.

- She remarked that the Committee would explore the promise of digital assets in terms of their ability to provide faster payments, instantaneous settlement, and lower transaction fees.

Full Committee Ranking Member Patrick McHenry (R-NC):

- He discussed how cryptocurrencies had achieved mainstream popularity in 2021 and stated that the companies before the Committee were creating the “on ramps” that enabled Americans to participate in the digital asset ecosystem.

- He asserted that while the technology underlying cryptocurrencies was already being regulated, he acknowledged that the regulations might be “clunky” and not up to date.

- He stated that policymakers needed to improve their understanding of the technology so that they could appropriately update the regulations and laws governing it.

- He remarked that the technology underlying cryptocurrencies promised a new direction for financial economies, services, and products and stated that U.S. policymakers must work to ensure that cryptocurrency innovation occurred within the U.S. (and not overseas).

- He expressed concerns that overregulating the technology underlying cryptocurrencies before the technology was fully understood could stifle innovation.

- He asserted that the U.S. should not force the private sector to navigate unclear public statements from policymakers and that regulation by enforcement constituted the wrong approach for overseeing cryptocurrencies.

- He noted that while there existed concerns over the use of cryptocurrencies for nefarious activities, he highlighted how existing currencies (including cash) were already being used for nefarious activities.

Witness Opening Statements:

Mr. Jeremy Allaire (Circle):

- He asserted that the U.S. should be “aggressively” promoting the use of the U.S. dollar as the primary currency of the internet and leverage this use as a source of national economic competitiveness.

- He noted how his company, Circle, was the sole issuer of the USD Coin (USDC) and stated that this stablecoin provided fast, inexpensive, highly secure, global, and interoperable value exchange over the internet.

- He asserted that USDC did not have the downside of extreme volatility that had plagued most cryptocurrencies.

- He remarked that USDC was helping to create a system in which digital U.S. dollars could become the leading currency of the internet.

- He discussed how the use of stablecoins in everyday payments was expanding “rapidly” and testified that his company was signing on institutional customers who were using these services for small business payments, international remittances, and efficient payments for remote workers.

- He then acknowledged that while not all stablecoins were created equal, he asserted that not all stablecoins were entirely unregulated.

- He remarked that Circle had prioritized building, designing, and guarding the prudential standards for USDC inside of and conforming with prevailing U.S. regulatory standards that apply to leading financial technology (FinTech) and payments firms.

- He stated that this approach had helped USDC to reach over $40 billion in circulation and powered more than $1 trillion in on-chain transactions.

- He testified that the reserves backing USDC were held in the care, custody, and control of the U.S.-regulated banking system.

- He indicated that these reserves were “strictly held” in cash and short-duration U.S. Treasuries and that Circle had consistently reported on the status of these reserves and their sufficiency to meet demands for USDC outstanding with third party attestations from a global accounting firm.

- He then discussed how Circle planned to deploy cash deposits to minority depository institutions (MDIs) and community banks across the country for the allocation of USDC reserves.

- He commented that these efforts sought to foster a more inclusive banking and payments system.

- He mentioned how the PWG Report on Stablecoins had made recommendations for establishing national regulatory supervision of firms like Circle and expressed support for the effort.

- He noted how Circle had announced plans to pursue a national banking charter from the OCC prior to these recommendations and stated that Circle remained actively engaged with both federal and state banking regulators.

- He discussed how the technology underlying blockchains and digital assets were constantly evolving and asserted that policymakers must seek to ensure the U.S.’s global leadership within these areas.

Mr. Samuel Bankman-Fried (FTX):

- He discussed how his company, FTX, was a global cryptocurrency exchange that processed about $15 billion per day of trading value on its platform.

- He remarked that the cryptocurrency industry had the potential to improve a lot of people’s lives through reducing fees paid to intermediaries.

- He commented that these fees particularly impacted vulnerable populations that tended to have reduced access to the financial ecosystem.

- He asserted that cryptocurrencies could address the aforementioned issues through making it easier, cheaper, faster, and more equitable to transfer funds.

- He then discussed how FTX had a different structure than most traditional exchanges in that it provided open and free market data to all of its users.

- He indicated that this data access was available to users accessing the exchange through an application programming interface (API), website, or mobile application.

- He also testified that FTX had adopted robust risk controls for its platform and indicated that FTX conducted sophisticated KYC diligence on all of its users.

- He noted how FTX monitored all blockchain transfers into and out of its exchange.

- He mentioned that FTX maintained a 24/7 risk engine and stated that its 24/7 nature made it unique.

- He noted that traditional risk engines tended to accumulate risks during nights, weekends, and holidays and explained that FTX’s risk engine did not allow for risks to accumulate.

- He remarked that FTX was already regulated and licensed by both states and the federal government.

- He elaborated that states regulated FTX through the money services business and money transmitting regime and that the U.S. Commodity Futures Trading Commission (CFTC) regulated FTX at the national level.

- He expressed support for efforts to regulate the cryptocurrency industry and reiterated that the industry was already subject to regulation in certain areas.

Mr. Brian Brooks (Bitfury Group):

- He remarked that digital assets were important to supporting the U.S. financial sector’s competitiveness, empowering average consumers, and enabling the next iteration of the internet.

- He noted that his company, Bitfury Group, provided a suite of infrastructure products and services that support various aspects of the cryptocurrency ecosystem.

- He explained that the cryptocurrency ecosystem was often referred to as Web 3.0 because crypto assets represent either the rewards paid to participants for maintaining a particular decentralized network or an application that operated on such a network.

- He remarked that a national policy agenda for cryptocurrency should assess whether it was sensible to keep cryptocurrency activities outside or inside of the regulated financial system.

- He questioned how the U.S.’s current rules only permitted banks to issue stablecoins while the U.S. was failing to grant bank charters to the largest issuers of stablecoins.

- He also questioned how the U.S. was bringing enforcement actions against certain crypto assets as unregistered securities while preventing these crypto assets from being registered and traded on national securities exchanges.

- He stated that the U.S. needed a clear policy for a decentralized Web 3.0 that would be powered by crypto assets and asserted that the U.S. should not solely regulate crypto assets as financial services.

- He contended that the U.S.’s regulatory approach should focus on doing no harm to the emerging Web 3.0 network.

- He made several suggestions for the policy questions that policymakers ought to consider when approaching Web 3.0.

- He suggested that policymakers consider whether a user-controlled decentralized internet would be preferable to an internet controlled by a small number of large companies.

- He suggested that policymakers consider whether the financial services sector was any less subject to network effects than information or commerce had been in earlier iterations of the internet.

- He suggested that policymakers consider whether big banks or open-source software were more trustworthy in terms of their ability to maintain ledgers of account and to allocate credit and capital.

- He lastly suggested that policymakers acknowledge that there existed a difference between crypto projects that failed due to a lack of demand and crypto projects that were scams.

- He then remarked that crypto policy should take into account both new risks introduced into the financial system and the risks within the present system that could be solved through decentralization.

- He recounted his experience issuing civil monetary penalties (CMPs) against banks during his tenure at the OCC and asserted that the U.S.’s current financial system possessed ample risks and costs, as well as safety and soundness problems.

- He stated that the U.S. should consider ways that algorithms and open-source software could help to improve the existing financial system.

- He commented that these algorithms and software could take a measure of human error, greed, negligence, fraud, and bias out of the financial system.

- He then expressed concerns that U.S. regulatory decisions were driving cryptocurrency activities offshores in ways that harmed U.S. investors, innovators, and workers.

- He specifically highlighted how cryptocurrency ETFs were not permitted within the U.S., but permitted outside of the U.S.

- He also noted how cryptocurrency exchanges and stablecoin issuers were unable to obtain e-money licenses within the U.S.

- He lastly stated that there was no path for crypto-insured depositories chartered within the state of Wyoming to access U.S. Federal Reserve payment services (which other insured depositories had access to).

Mr. Charles Cascarilla (Paxos Trust Company):

- He discussed how his company, Paxos, was a regulated financial institution and blockchain infrastructure platform that helped financial institutions provide their clients with reliable and regulated access to digital assets.

- He testified that Paxos’s customers included Bank of America, PayPal, MasterCard, Interactive Brokers, and Credit Suisse.

- He also mentioned how Paxos offered the Pax Dollar (USDP), which he described as a uniquely structured and regulated stablecoin.

- He explained that each USDP was fully backed by one U.S. dollar and asserted that this backing meant that the USDP was not volatile.

- He stated that the USDP could be transferred nearly instantly, overnight, and on weekends and was programmable, secure, and traceable.

- He remarked that digital assets and blockchain technologies could create a more efficient, secure, and innovative financial system, as well as a more inclusive and equitable global economy.

- He stated that while bank accounts were critical for participating in the traditional financial system, he noted that 18 percent of all Americans were either unbanked or underbanked according to the U.S. Federal Reserve.

- He added that this figure was even higher for African Americans and adults without high school degrees.

- He discussed how the current financial system was expensive and slow and noted how there were trillions of dollars in capital held up in unsettled transactions at any given time.

- He also emphasized how digital assets were very accessible and could be sent or received using a smartphone.

- He indicated that no bank account was required to transfer digital assets.

- He further highlighted how the transfer of digital assets was instantaneous, convenient, and inexpensive.

- He then contended that blockchain technology could reduce bias in the financial system because its mathematical basis made it agnostic to a user’s race, gender, nationality, and income.

- He also discussed how a blockchain’s permanent and public recording of transactions reduced errors, fraud, and systemic risk.

- He commented that the ability of blockchains to settle transactions instantaneously reduced potential counterparty risks and eliminated the need for costly central clearinghouses.

- He testified that Paxos had recently completed a successful pilot program to offer same day security settlement.

- He then called regulation “essential” for increasing public trust in digital assets and ensuring their adoption.

- He mentioned how Paxos had sought out oversight by a primary prudential regulator, even though it did not require such oversight.

- He testified that Paxos adhered to the same AML and KYC requirements as banks and was subject to regular examinations of their operations, procedures, and capital levels.

- He also noted how Paxos’s financial products were regulated.

- He remarked that the uncertainty surrounding digital asset regulation was hampering the industry’s development and asserted that the solution to this problem was not to “shoehorn” digital assets into pre-existing regulatory structures.

- He contended that a primary prudential state or federal regulator should oversee digital asset companies and their products.

- He also stated that independent auditors should regularly attest that the assets backing a stablecoin were regularly being held in reserve.

- He commented that these reserves ought to be held in bankruptcy remote accounts.

- He warned that the U.S. government’s stifling of the adoption of digital assets would drive issuers, talent, and capital to more welcoming foreign jurisdictions.

- He remarked that the absence of regulated U.S. dollar-backed stablecoins or a CBDC would make it less viable for other countries and companies to continue using the U.S. dollar as the global reserve security.

Ms. Denelle Dixon (Stellar Development Foundation):

- She discussed how the Stellar Development Foundation’s network, Stellar, was open, permissionless, and decentralized and stated that the network was optimized for payments.

- She testified that there was no single entity (including her foundation) that controlled the code base of the network or its growth.

- She stated that Stellar was designed for asset issuance, which made it possible to create, send, and trade digital assets backed by nearly any form of value.

- She also noted how Stellar was designed with compliance tools built-in in order to help digital asset issuers meet their own compliance obligations.

- She mentioned how numerous businesses and users had built use cases around Steller-based stablecoins over the past several years.

- She commented that these use cases were not confined to lending, trading, and borrowing.

- She discussed how MoneyGram International was using the Stellar network to develop a solution that would enable the seamless conversion between cash and digital assets.

- She indicated that this solution was currently in the pilot phase within the U.S. and was expected to be widely available by 2022.

- She also highlighted how Leaf Global Fintech had built a solution using the Stellar network for refugees and cross-border goods traders who were vulnerable to theft.

- She asserted that this functionality was only possible as a result of Stellar’s ability to issue stablecoins and exchange value with low transaction fees and high speeds.

- She further mentioned how Tala was currently working to use Stellar’s assets and stablecoins to help their customers with accessing credit through allowing them to borrow, spend, save, invest, send, and receive money.

- She testified that a recent report from the Group of Twenty (G20) and the International Finance Corporation (IFC) had identified five Stellar ecosystem companies for having innovative solutions in digital finance that supported micro, small, and medium enterprises (MSMEs).

- She remarked that stablecoins were a core technological component for the aforementioned use cases and called stablecoins essential for supporting financial inclusion.

- She then criticized the PWG Report on Stablecoins for seeking to limit the issuance of stablecoins to insured depository institutions.

- She stated that this proposal was not narrowly tailored to the actual risk of stablecoin arrangements because most stablecoins were fully reserved.

- She advocated for a regulatory approach that would focus on stablecoin reserves.

- She called for requiring stablecoin arrangements to be fully reserved by appropriate assets.

- She called for requiring reserves to be held at insured depository institutions.

- She called for creating clear standards for regular audit and public disclosure of stablecoin reserves and key contractual terms regarding redemption.

- She called for making explicit that payment stablecoins did not constitute securities.

- She stated that the aforementioned regulatory approach should permit oversight through state banking supervision or a narrowly tailored OCC charter.

- She lastly discussed how regulators around the world were hampering innovation within the digital assets space through premature regulation and legislation and urged U.S. policymakers to avoid these mistakes.

Ms. Alesia Jeanne Haas (Coinbase Inc. and Coinbase Global Inc.):

- She stated that her company, Coinbase, securely stored 12 percent of the world’s cryptocurrency on its platform and mentioned how Coinbase enabled its customers to learn about, sell, send, receive, and buy more than 100 different types of digital assets on its platform.

- She also noted how Coinbase enabled customers to spend, borrow, earn, stake, and transact on select digital assets.

- She testified that nearly 50 percent of Coinbase’s transacting customers were doing something other than buying and selling cryptocurrencies and commented that this dynamic suggested that cryptocurrencies had progressed from its initial investment phase to a utility phase.

- She remarked that Coinbase had sought to become the most secure, trusted, and legally compliant bridge to the crypto economy.

- She mentioned how Coinbase was federally registered as a money services business with the U.S. Financial Crimes Enforcement Network (FinCEN), licensed as a money transmitter in 42 states, held a BitLicense and trust charter from the New York Department of Financial Services, and was authorized to engage in consumer lending in 15 states.

- She testified that Coinbase maintained a “robust” AML and Bank Secrecy Act (BSA) program and indicated that Coinbase was one of only two digital asset members of the U.S. Department of the Treasury’s BSA Advisory Group.

- She discussed how Coinbase was subject to federal regulatory oversight from the U.S. Department of the Treasury, the CFTC, the SEC, the U.S. Federal Trade Commission (FTC), and the U.S. Consumer Financial Protection Bureau (CFPB).

- She then remarked that the U.S. was experiencing “dramatic advancements” in the adoption of crypto participation and highlighted how there were more than 200 million crypto holders globally.

- She indicated that around 16 percent of Americans had either invested in, traded, or used cryptocurrencies.

- She noted that the total crypto market capitalization at the end of the third quarter of 2021 was over $2 trillion.

- She then remarked that novel technologies, including non-fungible tokens (NFTs) and decentralized application platforms, would support the transition to Web 3.0.

- She contended that “sound” regulation was central to fueling crypto innovation and adoption and mentioned how Coinbase had developed a Digital Asset Policy Proposal, which proposes a four-pillar solution.

- She indicated that the first pillar involved having the government recognize digital assets under a new comprehensive framework that acknowledged the unique technological innovations underpinning these assets.

- She indicated that the second pillar would assign the responsibility for this new framework to a single federal regulator.

- She stated that this regulator would be charged with establishing a registration process for intermediaries.

- She indicated that the third pillar would establish three goals to ensure that holders of digital assets were empowered and protected.

- She noted that the first goal would be enhanced transparency, which would be accomplished through robust and appropriate disclosure requirements.

- She noted that the second goal would be protection from fraud and market manipulation.

- She noted that the third goal would be market efficiency and resiliency.

- She indicated that the fourth pillar would be ensuring that regulatory solutions promoted interoperability and fair competition.

Congressional Question Period:

Full Committee Chairman Maxine Waters (D-CA):

- Chairman Waters expressed concerns over Paxos’s partnership with Meta (formerly known as Facebook). She noted how Meta had previously sought to enter the cryptocurrency market and mentioned how Meta was partnering with Paxos to pilot a digital wallet called Novi. She discussed how this pilot project would allow for a limited number of people in the U.S. and Guatemala to send and receive USDP. She mentioned how the recent PWG Report on Stablecoins had recommended legislation that would require stablecoin users to comply with activity restrictions that limit affiliation with commercial entities. She asked Mr. Cascarilla to indicate whether there were any barriers that would prevent Meta from allowing its billions of active monthly users to make payments and save funds with the USDP stablecoin or other stablecoins through the Novi digital wallet. She also asked Mr. Cascarilla to explain why this widespread use of the Novi digital wallet would not undermine the U.S. dollar’s status as the world’s reserve currency.

- Mr. Cascarilla remarked that Novi was merely a customer of Paxos and that Novi likely chose Paxos because it had the most regulated stablecoin product available. He also noted how Novi was a regulated money services business that was permitted to operate in almost all of the states within the U.S. He testified that Paxos had conducted “extensive” due diligence on Novi’s controls and their regulatory oversight. He expressed Paxos’s confidence that Novi was adhering to these controls and regulatory oversight. He stated that the services that Novi received from Paxos were not different than the services that Novi received from any other financial institution that they maintained a relationship with.

- Chairman Waters asked Mr. Cascarilla to indicate whether there was anything preventing Meta from allowing its billions of users to make payments and save funds using the USDP stablecoin or other stablecoins through the Novi wallet. She also asked Mr. Cascarilla to indicate how long the pilot project would last.

- Mr. Cascarilla testified that the pilot project was limited and controlled and had received regulatory review. He stated that Novi would be best positioned to discuss their plans to expand the pilot project.

Full Committee Ranking Member Patrick McHenry (R-NC):

- Ranking Member McHenry discussed how the internet had evolved over time from a read-only format to a more interactive format and commented that the internet had become more centralized during this evolution. He asked Mr. Brooks to define the characteristics that had defined Web 1.0 and Web 2.0.

- Mr. Brooks remarked that Web 1.0 was largely based on the ability for users to look into a “curated walled garden.” He noted that Web 1.0 content was not interactive. He then remarked that the innovation of Web 2.0 was that it provided users with the ability to both read and write content. He stated that this evolution had resulted in centralization because a very small number of companies (including Meta and Google) were monetizing this internet activity. He remarked that Web 3.0 would differ from previous versions of the internet because it would permit users to own the actual network. He elaborated that users could be rewarded for providing ledger maintenance services and computing power to networks, which was currently being provided by large companies.

- Ranking Member McHenry asked Mr. Brooks to explain how digital assets would fit into the concept of Web 3.0.

- Mr. Brooks noted how there existed application layer tokens and protocol layer tokens. He discussed how a cryptocurrency token represented an ownership stake in a crypto network while applications could be built on top of a crypto network. He stated that people would invest in a crypto network’s tokens based on the perceived viability and value of the network. He remarked that the investors in a crypto network would decide how the network would operate. He commented that this dynamic differed from the traditional internet, which was largely governed by a small number of companies with outsized influence.

- Ranking Member McHenry stated that Congress ought to be sensitive to the impact of their actions on the development of Web 3.0.

- Mr. Brooks remarked that an owner-controlled network (which Web 3.0 would enable) would address many of the problems currently associated with large technology companies.

- Ranking Member McHenry stated that Web 3.0 would enable the development of a whole new suite of technology. He commented that this development would occur regardless of whether the U.S. embraced it. He concluded that it was very important for U.S. policymakers to understand Web 3.0.

Rep. Carolyn Maloney (D-NY):

- Rep. Maloney recounted how the New York Attorney General had released a 2018 report on cryptocurrency trading platforms that detailed the potential for conflicts of interest, the lack of serious efforts to stop abuses associated with trading activities, and the limited protections for customer funds. She mentioned how the report had asserted that customers were “highly exposed” in the event of a hack or unauthorized withdrawal. She noted how there did not exist a form of deposit insurance available for virtual currency losses. She highlighted how Coinbase had been the subject of a hack earlier in 2021 that impacted 6,000 of their customers. She asked Ms. Haas to address what would happen to a Coinbase customer in the event of a hack of the Coinbase network or a Coinbase wallet or in the event of unauthorized withdrawal from a Coinbase account. She further asked Ms. Haas to discuss the current protections that Coinbase provided to its customers.

- Ms. Haas testified that Coinbase secured 12 percent of the world’s cryptocurrency and stated that the company maintained “extensive” controls to protect the assets of their customers. She noted how Coinbase bifurcated its assets into two different storage systems: hot wallets and cold storage. She indicated that less than two percent of Coinbase’s assets were held in hot wallets, which could be subject to a cyberattack. She then asserted that the hack that Rep. Maloney had referenced was not a hack of the Coinbase systems. She testified that Coinbase did reimburse its customers that lost funds stemming from that event. She stated that Coinbase did protect its customers for any hack of the Coinbase hot wallet, maintained a third-party insurance policy, and used its own balance sheet to protect their customers in the event of losses on their platform. She then discussed how press reports typically highlighted Coinbase account takeovers, which involved a customer losing their account credentials due to a hack of their personal device. She remarked that these types of account takeovers were difficult to address. She expressed Coinbase’s interest in working to address this challenge.

- Rep. Maloney asked Ms. Haas to clarify whether other cryptocurrency exchanges and wallets provided the same types of protections to their customers as Coinbase provided to its customers.

- Ms. Haas indicated that her previous response only addressed the protections that Coinbase provided to its customers.

- Rep. Maloney asked Ms. Haas to indicate whether cryptocurrency exchange and wallet customers could benefit from a set of standardized minimum protections in the event that the customers lose their funds through no fault of their own.

- Ms. Haas commented that there was an opportunity for a set of standardized minimum protections for cryptocurrency exchange and wallet customers.

- Rep. Maloney then discussed how the problem of ransomware was becoming worse and highlighted how criminals frequently sought payment for ransomware attacks through cryptocurrencies. She remarked that AML requirements were key to combatting fraud, sanctions evasion, and the financing of terrorism. She noted that while Circle and Coinbase had highlighted the AML compliance policies of their respective companies, she stated that many cryptocurrency companies had either rejected or avoided AML compliance standards. She asked Mr. Allaire and Ms. Haas to discuss why their companies had adopted AML compliance policies. She also asked Mr. Allaire and Ms. Haas to provide recommendations for Congress for bolstering AML efforts to ensure broad AML requirement compliance within the cryptocurrency space.

- Note: Rep. Maloney’s question period time expired here.

Full Committee Vice Ranking Member Ann Wagner (R-MO):

- Vice Ranking Member Wagner mentioned how SEC Chairman Gary Gensler had repeatedly asserted that the test for determining whether a crypto asset constituted a security was clear. She noted however that SEC Commissioners Hester Peirce and Elad Roisman had contended that there existed a lack of clarity for market participants regarding how securities laws applied to digital assets and their trading. She expressed agreement with Commissioners Peirce and Roisman and highlighted how the SEC received numerous requests for no action letters. She asked Ms. Haas to indicate whether additional SEC guidance for investors and market participants regarding whether a digital asset constituted a security was needed.

- Ms. Haas remarked that the current laws were clear as to what constituted a security. She stated however that existing laws, regulations, and legal precedents were clear that blockchain tokens were not securities. She asserted that blockchain-based digital assets were either a new form of digital property or a new way to record ownership. She called for regulatory clarity regarding these assets and commented that agreed upon definitions would benefit all parties within the digital asset ecosystem.

- Vice Ranking Member Wagner expressed agreement with Ms. Haas’s comments. She then remarked that digital assets could play a role in promoting financial inclusion. She asked Mr. Dixon and Mr. Allaire to discuss how digital assets and blockchain technology facilitate financial inclusion and benefit unbanked people both domestically and globally.

- Ms. Dixon remarked that blockchain technology enabled money and value to flow seamlessly and quickly, which was especially useful in cross-border money transfers. She stated that blockchain technology would eliminate financial intermediaries (which delayed money transfers), reduce marketplace friction, and provide easy market access to users without bank accounts.

- Mr. Allaire remarked that financial inclusion was a critical design goal for many digital asset companies. He testified that his company’s stablecoin enabled users to transfer U.S. dollars in a fraction of a second with a transaction cost that could be as low as one-twentieth of 1 cent and with the throughput of the Visa network. He stated that blockchain technology supported an open internet in which anyone (both domestically and globally) can access the financial system.

- Vice Ranking Member Wagner asked Mr. Brooks to address how the Committee could avoid hampering innovation within the digital asset space and increase financial inclusion.

- Mr. Brooks called for parity in the treatment of traditional financial assets and internet-based financial assets. He stated that stablecoins that functioned as payment instruments ought to be treated the same as traveler’s checks and prepaid cards.

Rep. Nydia Velázquez (D-NY):

- Rep. Velázquez asked Mr. Allaire and Mr. Cascarilla to confirm that the stablecoins of their respective companies were almost entirely backed by cash reserves and U.S. Treasuries.

- Mr. Allaire testified that 100 percent of the reserves that backed USDC were held in cash and short-duration U.S. Treasuries.

- Mr. Cascarilla testified that 100 percent of the reserves that backed the USDP were held in cash and short-duration U.S. Treasuries.

- Rep. Velázquez asked Mr. Allaire and Mr. Cascarilla to explain why their respective companies had previously offered stablecoins that were not backed by fiat currencies and to address why their respective companies had moved away from these offerings.

- Mr. Allaire explained how USDC was governed by the money transmission statutes throughout the U.S. and stated that the USDC had always complied with the various statutory requirements. He indicated that Circle had engaged in monthly reporting since it launched USDC in 2018.

- Mr. Cascarilla remarked that Paxos had always only backed the USDP with either short-duration U.S. Treasuries, cash, or cash equivalents. He noted how the USDP was overseen by the New York Department of Financial Services, which sets the supervisory agreement with which his company can offer its products. He stated that his company was thus required to back its stablecoins with the aforementioned assets.

- Rep. Velázquez asked Mr. Allaire and Mr. Cascarilla to provide assurances that the products of their respective companies would continue to be fully backed by the U.S. dollar.

- Mr. Allaire expressed Circle’s commitment to a 1:1 backing of its stablecoins. He also expressed Circle’s willingness to work with U.S. policymakers on determining appropriate reserve standards for stablecoins.

- Mr. Cascarilla remarked that Paxos’s stablecoins would always be fully backed by U.S. dollars that were cash and cash equivalents.

- Rep. Velázquez recounted how a 2021 investigation from the New York Attorney General’s Office had found that the stablecoin Tether had deceived clients and markets for periods of time through failing to hold reserves to back their stablecoins in circulation. She asked Mr. Allaire and Mr. Cascarilla to indicate whether they would be supportive of requiring stablecoins to report their reserves to federal regulators and submit to regular examinations.

- Mr. Allaire expressed support for federal supervision of stablecoins and reporting requirements for stablecoins. He stated that such supervision and reporting requirements were key to making stablecoins part of the mainstream financial infrastructure.

- Mr. Cascarilla testified that Paxos was already a regulated trust company and indicated that Paxos already possessed a primary regulator that oversaw their issuance. He remarked that federal supervision of stablecoins was sensible, especially for firms that lacked a state regulator that oversaw their activities.

- Rep. Velázquez then discussed how digital asset trading platforms played an important role in the current functioning of stablecoins. She asked Ms. Haas and Mr. Bankman-Fried to describe the methods that their respective trading platforms used to determine the price for exchanging digital currencies for fiat currency.

- Ms. Haas stated that Coinbase was an agency only platform and testified that Coinbase did not engage in proprietary trading on its platform. She noted that all prices established on the Coinbase platform were attributable to market makers. She explained that Coinbase customers could offer bids and asks on the platform’s offered currencies and stated that the market price was therefore determined by market participants.

- Rep. Velázquez asked Ms. Haas to indicate the stage of the transaction process that Coinbase provided an insurance of or a lock in of an execution price.

- Ms. Haas noted that Coinbase maintained both a consumer product and a pro product that was more targeted towards institutions and advanced traders. She stated that consumers were free to choose either product. She testified that the price displayed for consumers was the price that Coinbase guaranteed for customers.

Rep. Frank Lucas (R-OK):

- Rep. Lucas discussed how the future of blockchain technology might include new areas of tokenization, such as property, titles, and people’s time. He asked Ms. Haas to discuss the trends that she was currently observing in blockchain technology and to address how new asset classes could arise through blockchain technology.

- Ms. Haas remarked that any item of value could be tokenized. She noted how Web 3.0 involved three layers: the protocol layer, the infrastructure layer, and the application layer. She explained that Bitcoin, Ethereum, Stellar, and Solana constituted protocol layers and that applications could be built on top of these protocol layers. She noted how the trading of NFTs was already popular within gaming applications. She remarked that it remained too early to predict the types of applications that would be built upon nascent protocol layers.

- Rep. Lucas then asked Mr. Brooks to identify the fundamental differences between banks and stablecoin issuers that are important for Congress and regulators to understand when considering regulatory proposals.

- Mr. Brooks stated that one key difference between banks and stablecoin issuers was that banks have historically been involved in multiple different kinds of financial intermediation and risk-taking functions. He noted how banks typically engaged in deposit taking, lending, and payments. He stated that the core feature of stablecoins was that they were a new payments technology. He discussed how banks had historically innovated in payments through check clearing, traveler’s checks, and prepaid cards. He remarked that stablecoins were simply a more modern and efficient means of supporting payments. He then stated that stablecoin issuers did not have all of the same risks as banks had. He elaborated that stablecoin issuers did not typically engage in lending activities. He remarked that this dynamic had led the OCC to consider providing bank charters to stablecoin issuers because these issuers were engaged in a core banking function.

- Ms. Dixon remarked that there were several innovative blockchain technology applications being developed, including tokenized real estate assets and fractionalized interest in U.S. stocks. She then discussed how blockchain technology could expand access to banking services for unbanked individuals.

- Rep. Lucas then asked Mr. Bankman-Fried to respond the criticism that stablecoins were ripe for illicit financial activity and to compare the risks posed by stablecoins to the risks posed by other financial payment rails.

- Mr. Bankman-Fried testified that FTX maintained advanced surveillance techniques to prevent financial crimes for all digital assets (including stablecoins). He stated that FTX adhered to KYC requirements and conducted blockchain surveillance on all users, deposits, and withdrawals on their platform. He further remarked that all “legitimate” stablecoin issuers conducted sophisticated KYC policies on all issuances and redemptions of those stablecoins. He stated that physical cash transactions did not typically involve KYC or AML surveillance. He concluded that the digital asset industry had set a strong standard for addressing illicit financial activity.

Rep. Al Green (D-TX):

- Rep. Green noted how the digital asset market had grown significantly over the previous year and commented that the market was rife with “extreme” volatility. He expressed concerns that the digital asset market had very easy credit via margin investing, a lack of transparency, and a lack of adequate financial disclosure. He asked the witnesses to indicate when policymakers ought to be concerned over the prospect of a bubble within the cryptocurrency market.

- Mr. Brooks remarked that much of the current price volatility surrounding cryptocurrencies was attributable to the early stage of the market and the thinly traded nature of the asset. He stated that U.S. equity and debt markets tended to be more stable because there was more price discovery in these markets. He elaborated that the U.S. had regulated equity mutual funds, derivatives products, and futures products and commented that these products provided the market with indicators of what was occurring within the financial system. He remarked that similar tools did not exist within the cryptocurrency space yet, which meant that the cryptocurrency market could be very sensitive to a single actor’s actions. He further noted how the vast majority of Bitcoin holders have never sold a Bitcoin and stated that giant fluctuations within the cryptocurrency market were generally due to the activities of a small number of parties. He contended that the U.S. cryptocurrency market needed more liquidity and more price discovery in order to reduce market volatility.

- Ms. Dixon remarked that the digital assets industry needed to focus more on consumer-oriented products that could support consumer literacy regarding the technology.

- Mr. Bankman-Fried remarked that one innovative property of cryptocurrency markets was 24/7 risk monitoring engines. He noted how traditional assets had overnight risk, weekend risk, and holiday risk and commented that these risks were not present within the cryptocurrency markets. He stated that 24/7 risk monitoring engines enabled risk monitoring and the de-risking of positions in real time to help mitigate volatility. He testified that his company had been operating for several years with billions of dollars of open interest and had never experienced customer losses or claw backs (even during periods of volatility). He indicated that his company stored collateral from users to backstop positions, which he commented was not always done in the traditional financial system. He then discussed how the 2008 Financial Crisis was precipitated by several bilateral, bespoke, and non-reported transactions occurring between financial counterparties, which were subsequently repackaged and re-leveraged repeatedly. He stated that these repeated opaque transactions resulted in no one knowing exactly how much risk was present in the financial system until a crisis had occurred. He remarked that modern cryptocurrency exchanges by contrast provided complete transparency regarding the full open interest and the positions being held and applied robust and consistent risk frameworks. He expressed his company’s excitement to work with the CFTC to bring these benefits to U.S. customers.

Rep. Pete Sessions (R-TX):

- Rep. Sessions first expressed support for the digital assets industry. He then asked the witnesses to discuss how their respective companies and organizations worked to address fraud.

- Ms. Haas testified that Coinbase adhered to KYC requirements as part of its customer onboarding process. She also discussed how Coinbase conducted a “robust” assessment of each of the assets that it offered on its platform in order to determine whether the assets were securities or scams, as well as whether digital assets were actually secure. She indicated that Coinbase did not list securities on its platform. She then mentioned how Coinbase maintained traditional exchange rules to protect against spoofing, wash trading, and other forms of market manipulation. She testified that Coinbase used third-party tools and employees with previous work experience at regulatory agencies and traditional financial companies to engage in 24/7 compliance monitoring. She then discussed how Coinbase monitored blockchains to identify illicit activity and file suspicious activity reports (SARs) when necessary. She concluded that the transparent nature of blockchains enabled Coinbase to actively pursue fraud.

- Rep. Sessions remarked that the U.S. government needed to support the digital assets industry in its effort to combat fraud.

Rep. Gregory Meeks (D-NY):

- Rep. Meeks discussed how communities of color often relied upon MDIs and community development financial institutions (CDFIs) for their banking needs. He mentioned how he had long supported efforts to enable MDIs and CDFIs to leverage new technologies so that they could better serve their communities. He noted how Circle had created an initiative to deploy and share USDC reserves into MDIs and CDFIs. He asked Mr. Allaire to provide the Committee with a status update regarding the initiative’s implementation and discuss the systems that Circle was deploying to ensure the initiative’s long-term success.

- Mr. Allaire mentioned how Circle had recently launched its Circle Impact initiative, which included several actions meant to promote financial inclusion. He noted how this initiative would take the deposits backing the USDC and place them with MDIs and CDFIs. He highlighted how Circle was not in the lending business, which provided the company with an opportunity to work with banking institutions that could benefit from strengthened balance sheets. He indicated that the Circle Impact initiative had just launched and stated that Circle expected the first phase of this initiative to be in place by the end of the first quarter of 2022. He also remarked that Circle was looking to coordinate with federal banking regulators that had their own initiatives to support MDIs and CDFIs. He lastly remarked that digital currency technology’s frictionless nature and ability to support money transfers could bring “significant” benefits to underserved communities.

- Rep. Meeks then asked Ms. Haas to discuss the current safeguards that were addressing bad actors that sought to use cryptocurrencies to engage in illicit activity and to hide cash. He also asked Ms. Haas to provide her assessment of the U.S.’s global coordination to combat illicit cryptocurrency activity and to provide recommendations for U.S. policymakers to improve such global coordination.

- Ms. Haas mentioned how Coinbase maintained KYC requirements and had a robust AML program. She stated that other U.S.-regulated cryptocurrency exchanges maintained similar controls. She remarked that regulation should be focused on addressing the marketplaces that did not maintain the aforementioned protocols.

Rep. Blaine Luetkemeyer (R-MO):

- Rep. Luetkemeyer noted how the average daily turnover value of the U.S. dollar constituted 88 percent of foreign exchange market transactions globally in 2019. He stated that the U.S. dollar’s dominance in the global marketplace was a key reason for the U.S. dollar remaining the world’s reserve currency. He asked Mr. Brooks to discuss how the U.S. could ensure that the U.S. dollar remained the world’s reserve currency as digital assets became more common within the global marketplace.

- Mr. Brooks remarked that the secular reduction in U.S. dollar holdings as a percentage of global central bank holdings was “alarming” and commented that this trend had been occurring for over a decade. He stated that this trend indicated that the U.S. dollar could no longer take its primacy for granted and asserted that the U.S. dollar would need to compete globally on utility and features. He remarked that internet-enabled U.S. dollars would enable the U.S. dollar to compete on features. He then stated that U.S. dollar inflation could negatively impact the U.S. dollar’s attractiveness relative to other currencies. He asserted that the crypto economy would push the U.S. Federal Reserve to address U.S. dollar inflation, which would be beneficial.

- Rep. Luetkemeyer asked Mr. Allaire to elaborate on his testimony’s call to promote the U.S. dollar as the world’s primary reserve currency.

- Mr. Allaire discussed how blockchains were currently proliferating globally and predicted that the ability to access and interact with these blockchain networks would reach billions of users over the next two to three years. He contended that stablecoins could play a key role in enabling the U.S. dollar to be the main currency of the internet. He further asserted that the U.S. should view making the U.S. dollar the reserve currency of the internet as a national security priority. He stated that the U.S. could achieve this status for the U.S. dollar through partnering closely with private companies and using open internet technologies.

- Rep. Luetkemeyer asked Mr. Allaire to confirm that Circle’s USDC was fully backed by U.S. Treasuries.

- Mr. Allaire confirmed that Circle’s USDC was fully backed by U.S. Treasuries. He contended that the assets backing U.S. dollar-based digital currencies were far safer than the U.S. dollars in bank accounts because U.S. dollars in bank accounts were fractionally reserved.

- Rep. Luetkemeyer then asked Mr. Brooks to indicate his level of concern regarding the prospect that a party with outsized power could control the platform on which digital U.S. dollars were traded.

- Mr. Brooks remarked that the point of cryptocurrencies was to have true decentralization and contended that successful projects would have such decentralization. He attributed Bitcoin’s success to its decentralized nature.

Rep. Ed Perlmutter (D-CO):

- Rep. Perlmutter discussed how cryptocurrency market exchanges were regulated through a “patchwork” of different state and federal agencies. He noted how some cryptocurrency market exchanges registered as money services businesses with FinCEN at the federal level and also received money transmitter licenses. He asked Mr. Bankman-Fried to answer how FTX was registered from a regulatory perspective.

- Mr. Bankman-Fried testified that FTX had obtained money services business and money transmitter licenses in the U.S. He also testified that FTX was licensed by the CFTC. He indicated that FTX had a derivatives clearing organization (DCO) license, a designated contract market (DCM) license, and other licenses through the CFTC. He expressed FTX’s willingness to continue working with the CFTC and to work with other regulators on potential products within the U.S.

- Rep. Perlmutter highlighted how FTX appeared to be heavily involved in the derivatives market. He asked Mr. Bankman-Fried to indicate whether FTX was registered with the SEC.

- Mr. Bankman-Fried noted how the main U.S. regulator of derivatives was the CFTC and indicated that FTX US Derivatives was registered with the CFTC. He testified that FTX had commenced discussions with the SEC. He noted that while FTX currently did not list securities on its platform, he expressed FTX’s interest in listing digital asset securities on its platform in the future under the guidance of the SEC. He also expressed support for a unified joint regime involving the CFTC and the SEC to create harmonious market regulations between spot markets, derivatives contracts, and other things.

- Rep. Perlmutter then discussed how blockchain technology was considered to be very secure. He asked Mr. Bankman-Fried to address how quantum computing could pose threats or provide benefits to blockchain technology.

- Mr. Bankman-Fried noted that some cryptographic algorithms could be theoretically vulnerable to quantum computers. He commented however that such vulnerability would be entirely dependent on the specific quantum computing technology that becomes available. He stated that blockchain security algorithms ought to be resistant to quantum computing threats. He remarked however that quantum computing had the potential to create new cryptographic algorithms that were faster, more secure, and more efficient.

Rep. Andy Barr (R-KY):

- Rep. Barr asked Mr. Brooks to indicate whether Congress needed to introduce follow-up legislation to provide more definitional clarity with respect to digital assets. He also asked Mr. Brooks to provide any suggestions he might have regarding any such definitional clarity.

- Mr. Brooks remarked that the current test for assessing whether a given digital asset constituted security was clear in the sense that it was known. He stated however that the fact that the test was a four-factor balancing test made it difficult for market participants to confidently apply it. He expressed frustration with how the SEC was unable to provide guidance as to whether a proposed new crypto project would constitute a security. He remarked that either legislation or regulation was needed to specify what exactly constituted a security.

- Rep. Barr noted how SEC Chairman Gary Gensler had previously asserted that the test for determining whether a crypto asset constituted a security was clear. He asked Mr. Brooks to explain the current process for determining whether a digital asset constituted a security.

- Mr. Brooks remarked that the best test for determining whether a digital asset constituted a security was the test developed by the Crypto Rating Council. He compared the Crypto Rating Council’s test to the Motion Picture Association’s rating system for movies and stated that the test provided broad indicators of a digital asset’s risk level. He explained that the Crypto Rating Council test involved an objective quantitatively based process that asked several dozen questions about a digital asset across each of the dimensions of the Howey test. He stated that the Crypto Rating Council test provided a number score, which was indicative of a digital asset’s risk.

- Rep. Barr then expressed concerns that the federal government and federal regulators could stifle innovation within the digital assets space. He asked Mr. Brooks to provide an example of a potential overreach that could stifle innovation within the digital assets space.

- Mr. Brooks criticized federal regulators for not providing licenses to stablecoin issuers when traveler’s checks were already permitted within the U.S. banking system.

- Rep. Barr then asked Mr. Allaire to describe the differences between stablecoins and CBDCs. He asked Mr. Allaire to identify advantages that stablecoins could provide that a CBDC could not provide.

- Mr. Allaire discussed how stablecoins were currently operational, growing, and built on an open internet technology model. He stated that CBDCs by contrast were currently not operational and would likely be tightly administered and run by governments. He remarked that the private sector had driven most global payment system innovations and commented that stablecoins were a continuation of this trend.

- Rep. Barr interjected to ask Mr. Allaire to indicate whether stablecoins (including USDC) could address concerns related to Chinese currency advancements, the ability of the U.S. to enforce sanctions, and the U.S. dollar’s status as the world’s reserve currency.

- Mr. Allaire answered affirmatively. He remarked that the U.S. dollar was currently winning within the global stablecoin marketplace and stated that the global growth of stablecoins had the potential to benefit the U.S. dollar, U.S. businesses, and U.S. households. He contended that it was a strategic national security and economic priority for the U.S. to develop global stablecoin infrastructure.

Rep. Juan Vargas (D-CA):

- Rep. Vargas asserted that the primary factor currently driving cryptocurrency investments was a belief among investors that cryptocurrencies would appreciate very rapidly. He stated that most cryptocurrency investors were unaware of the features underlying cryptocurrencies. He commented that this same dynamic had been present in the runup to the 2008 Financial Crisis and emphasized that the market crisis ultimately harmed investors. He expressed concerns that the massive size of the digital asset and cryptocurrency market could pose systemic risks to the financial system. He specifically raised concerns that cryptocurrencies could challenge the U.S. dollar’s status as the world’s reserve currency. He asked the witnesses to opine on this concern.

- Mr. Allaire remarked that many investors in traditional equity markets often made investments in technology companies that they did not fully understand. He commented that the digital assets space had a very similar dynamic. He asserted that digital asset industry participants should ensure that they were providing investors with proper disclosures and supporting financial literacy around their products. He then remarked that the overwhelming majority of digital assets were commodities with utility that were used to power some type of technology, network, or protocol. He commented that this characteristic made these digital assets different from fiat currencies. He predicted that the aforementioned digital assets were unlikely to ever rival the U.S. dollar. He remarked that stablecoins and U.S. dollar digital currencies could lead to the U.S. dollar being used even more globally.

- Rep. Vargas interjected to note that there already existed a digital U.S. dollar. He stated that a key aspect of the digital U.S. dollar was that it was a fiat currency that was subject to the U.S. Federal Reserve’s control. He raised concerns over how illicit actors were making use of cryptocurrencies that could not be controlled. He expressed interest in making the digital U.S. dollar the most widely used digital currency. He then yielded back the remainder of his time.

Rep. Roger Williams (R-TX):

- Rep. Williams asked Mr. Brooks to discuss the negative consequences that would arise if the U.S. government were to take a heavy-handed approach to regulating digital assets.

- Mr. Brooks remarked that there were two approaches that policymakers could take to reduce the potential downsides of digital assets technology. He indicated that the first approach would be to prevent people from accessing the technology. He indicated that the second approach would be to make the technology safer. He discussed how the U.S. had previously made equity investments safer through creating mutual funds and sector funds. He criticized how the U.S. currently did not permit mutual funds for cryptocurrencies and noted how such cryptocurrency mutual funds currently existed in Canada, Germany, Singapore, and the United Arab Emirates (UAE). He remarked that the U.S. ought to make digital assets technology safer through mutual funds and other similar instruments.

- Rep. Williams then mentioned how the cryptocurrency industry was often described as being entirely unregulated. He called this description false and noted how the SEC, the CFTC, and states were regulating the cryptocurrency industry. He asked Mr. Bankman-Fried to discuss the different layers of regulation that FTX must abide by as an exchange and in order to uphold the deposits of customers in their digital wallets.

- Mr. Bankman-Fried first noted that FTX operated in 190 regulatory jurisdictions outside of the U.S. He then discussed how states granted money transmitter licenses and indicated that FTX was regulated under these state licenses. He also mentioned how the CFTC regulated margin and derivatives-related transactions and indicated that this system involved CFTC licenses. He further noted how the SEC would regulate any digital assets that were considered to be securities. He lastly mentioned how there had been discussions surrounding additional regulatory regimes for stablecoins and other digital assets.

Rep. Sean Casten (D-IL):

- Rep. Casten asked Mr. Allaire to indicate whether he supported the recommendations of the PWG Report on Stablecoins.

- Mr. Allaire indicated that he did not support all of the recommendations of the PWG Report on Stablecoins. He mentioned how the Report recommended that an insured depository institution ought to be in place around a large-scale U.S. dollar stablecoin issuer. He noted that an FDIC-insured bank required FDIC insurance because the bank was taking risks with deposits.

- Rep. Casten interjected to ask Mr. Allaire to indicate whether he supported efforts to ensure that U.S. dollar-backed stablecoins had the same risk and liquidity features of U.S. dollars.

- Mr. Allaire answered affirmatively and expressed support for requirements that U.S. dollar-backed stablecoins have full reserves, disclosures, transparency, and liquidity. He elaborated that the U.S. ought to clarify whether fully reserved U.S. dollar-backed stablecoins should be FDIC-insured or subject to statutory reserve requirements.

- Rep. Casten commented that a stablecoin holder might falsely perceive that they were holding a currency when they were in fact holding something subject to numerous exogenous risks (which would make it more of a commodity). He asked Mr. Allaire to answer whether the U.S. ought to regulate stablecoins as commodities until proper stablecoin regulatory protections were in place.

- Mr. Allaire answered no. He remarked that Circle’s USDC operated under the same stored value, electronic money, and electronic money transmission statutes that govern Square, Stripe, and PayPal. He stated that Circle’s USDC therefore had consumer protections and was subject to reserve requirements. He noted that these protections and requirements included 1:1 redeemability, AML requirements, surety bonds, and the segregation of client funds. He stated that policymakers ought to consider a new framework as stablecoins began to operate at global scales.