- This event has passed.

Digital Assets and the Future of Finance: The President’s Working Group on Financial Markets’ Report on Stablecoins (U.S. House Committee on Financial Services)

February 8, 2022 @ 5:00 am – 9:00 am

| Hearing | Digital Assets and the Future of Finance: The President’s Working Group on Financial Markets’ Report on Stablecoins |

| Committee | U.S. House Committee on Financial Services |

| Date | February 8, 2022 |

Hearing Takeaways:

- Stablecoins: The hearing focused on stablecoins, which are digital assets that have their values pegged to a reserve asset (such as the U.S. dollar). Stablecoins are primarily used in the U.S. to facilitate the trading, lending, and borrowing of cryptocurrencies.

- Recent Growth of Stablecoins: Committee Members and Under Secretary Liang noted how the market capitalization of stablecoins had grown “rapidly” over the previous two years from $5 billion at the start of 2020 to approximately $175 billion today. They acknowledged that while stablecoins currently represented a small percentage of the digital asset industry’s total value, they noted that stablecoins were facilitating the majority of trading within the digital assets ecosystem. Rep. Sylvia Garcia (D-TX) emphasized however that the actual number of people that were using and investing in stablecoins remained unknown.

- Ability of Stablecoins to Support the U.S. Dollar’s Status as the World’s Dominant Reserve Currency: Committee Members and Under Secretary Liang contended that stablecoins backed by U.S. dollar reserves could help the U.S. dollar maintain its status as the world’s dominant reserve currency. Under Secretary Liang attributed the U.S. dollar’s status as the world’s reserve currency to the U.S.’s rule of law, strong institutions, economic potential, and robust financial markets. She stated that stablecoin technology could reinforce these strengths of the U.S. dollar.

- Ability of Stablecoins to Support Foreign Populations: Committee Members and Under Secretary Liang noted how stablecoins could be help foreign populations that were facing turmoil in their countries to access and transact money.

- Ability of the Stablecoin Structure to Provide Tokenized Investment Options: Rep. Tom Emmer (R-MN) and Rep. Warren Davidson (R-OH) suggested that the stablecoin structure could be applied to investment instruments in which a stablecoin would be backed by something other than cash or a cash-equivalent asset (e.g., a company’s stock). They stated that this structure could enable attractive and low-cost financial products. Under Secretary Liang raised concerns however that stablecoins not backed by cash or cash-equivalent assets could be very volatile, which would undermine the ability of said stablecoins to support payments.

- Concerns Regarding Fraudulent Stablecoins: Several Committee Members highlighted how the stabecoin Tether had deceived clients and markets through failing to hold promised reserves to back their stablecoins in circulation. They raised concerns that there might be other stablecoins currently in circulation making false claims and called for robust stablecoin oversight and reserve disclosures.

- Impact of Stablecoins and Digital Assets on Minority and Underserved Communities: Committee Members highlighted how minority communities had higher adoption rates of stablecoins and digital assets than the White community. They stated that these higher adoption rates among minority communities had the potential to increase financial inclusion for unbanked and underbanked individuals. They warned however that these higher adoption rates could particularly harm minority communities in the event of stablecoin downturns and frauds.

- Impact of Stablecoins on Monetary Policy: Rep. Stephen Lynch (D-MA) raised concerns that the U.S. Federal Reserve’s efforts to control inflation could be undermined by the widespread introduction of stablecoins. Under Secretary Liang remarked that the rapid increase in scale of a private digital currency could impact the U.S. Federal Reserve’s ability to control monetary policy, which would pose prudential risks. She suggested that the adoption of interoperability requirements for stablecoins could mitigate these risks.

- The President’s Working Group on Financial Markets (PWG) Report on Stablecoins: Under Secretary Liang’s testimony focused on the recently released PWG Report on Stablecoins. This Report outlined various risks that stablecoins might present to market integrity, investor protection, and illicit finance. The Report further highlighted systemic risk concerns due to the threat of stablecoin runs when the stablecoins were not fully backed by their promised assets, the concentration of economic power, and regulatory gaps that undermined the effective oversight of the market.

- Requirement that Stablecoin Issuers Be Insured Depository Institutions: One of the key recommendations of the PWG Report on Stablecoins was that stablecoin issuers ought to be insured depository institutions. Under Secretary Liang stated that this approach would provide sufficient confidence in the assets backing the stablecoin and provide regulatory oversight over stablecoin payment arrangements. Several Committee Members expressed concerns that this approach was too aggressive given how it would subject stablecoin issuers to banking regulations, despite the fact that many issuers did not engage in typical banking activities (e.g., loan making, fractional reserve banking, etc.). They also expressed concerns that this approach could erect barriers to startup stablecoin issuers seeking to enter the digital assets space. Under Secretary Liang remarked however that the PWG recognized these differences between stablecoin issuers and banks and that the insured depository regulatory framework would not provide stablecoin issuers with some flexibility to comply with traditional banking rules depending on the issuer’s structure.

- Prudential Risks of Stablecoins: Under Secretary Liang noted how the PWG Report on Stablecoins had focused on three prudential risks associated with the use of stablecoins for payments. She indicated that the first risk was run risk, which involved a scenario in which the loss of confidence in a given stablecoin would trigger a wave of redemptions. She indicated that the second risk was payment risk, which included operational issues that could interfere with the ability of users to store stablecoins or use them to make payments. She indicated that the third risk involved concerns related to the concentration of economic power. She testified that the Report had found “significant gaps” in authorities that would address the aforementioned prudential risks and stated that some of the largest stablecoin issuers operated with limited regulatory oversight. She commented that this lack of oversight raised questions as to whether stablecoins received adequate backing. She later clarified that the Report did not suggest that stablecoins were currently a threat to financial stability and posed systemic risk. She stated however that the ability of stablecoins to scale up rapidly could lead them to pose systemic risks.

- Ability of Technology Companies to Issue Stablecoins: Full Committee Chairman Maxine Waters (D-CA) expressed concerns over the prospect of technology companies (such as Meta) issuing stablecoins. She highlighted how the PWG Report on Stablecoins had recommended that stablecoin issuers should be required to limit their affiliation with commercial entities. Under Secretary Liang noted that the PWG Report on Stablecoins recommended that stablecoins be issued by insured depository institutions. She remarked that this recommendation would therefore mean that technology companies should not issue stablecoins. She stated however that the Report recommended that Congress consider whether technology companies could play a part in the stablecoin ecosystem as providers of custodial wallets and other services related to the use, storage, and transfer of stablecoins for payments.

- Jurisdictional Uncertainty Surrounding Stablecoin Regulation: Several Committee Republicans expressed concerns over the lack of jurisdictional clarity surrounding stablecoins. They stated that there were conflicting statements from regulators over whether stablecoins should be regulated as securities, commodities, or both. Under Secretary Liang indicated that the PWG Report on Stablecoins did not seek to conclude how stablecoins ought to be classified.

- Republican Concerns with the PWG Report on Stablecoins: Committee Republicans expressed several concerns with the PWG Report on Stablecoins relating to its omissions and recommendations.

- Republican Criticism Regarding the Report’s Lack of State Analysis: Several Committee Republicans criticized the PWG Report on Stablecoins for failing to discuss the existing regulatory frameworks for stablecoin issuers at the state level. They stated that the U.S. ought to examine all existing regulatory frameworks and structures for stablecoins in order to identify best practices and lessons learned. Under Secretary Liang indicated that while the PWG did consider how states were approaching stablecoin regulation in developing their Report on Stablecoins, she testified that the PWG’s desire to create a consistent regulatory framework led it to not focus on state-based regulatory approaches.

- Republican Criticism Regarding the Report’s Failure to Highlight the Benefits of Stablecoins: Full Committee Ranking Member Patrick McHenry (R-NC) criticized the PWG Report on Stablecoins for failing to address the potential benefits of stablecoins, including their ability to move money faster, cheaper, and better.

- Republican Concerns Regarding the Report’s Call for Regulation Absent Congressional Action: Rep. Alex Mooney (R-WV) raised concerns over how the PWG Report on Stablecoins had called on the U.S. Financial Stability Oversight Council (FSOC) to act on its own to regulate stablecoins in the absence of legislation. Under Secretary Liang remarked that FSOC had a responsibility to monitor for risks to the U.S.’s financial stability and to consider actions for reducing such risks. She indicated that while FSOC had some tools to address the stablecoin space, she contended that FSOC action did not constitute a sufficient substitute for Congressional action. She also asserted that any FSOC action on stablecoins would be premature given the rapidly evolving nature of the cryptocurrency space

- Other Stablecoin Topics: Committee Members used the hearing to discuss other issues regarding stablecoins and digital assets more broadly.

- Development of Central Bank Digital Currencies (CBDCs): Several Committee Members expressed interest in the U.S. Federal Reserve’s current consideration of CBDCs and how a U.S. CBDC would coexist with privately issued stablecoins. Rep. Anthony Gonzalez (R-OH) remarked that a well-regulated private stablecoin provided several potential advantages over a CBDC, including privacy and innovation. Under Secretary Liang expressed agreement with Rep. Gonzalez’s remarks and called it entirely feasible that private stablecoins and a U.S. Federal Reserve-issued stablecoin could coexist.

- Use of Puerto Rico as a Cryptocurrency Tax Shelter: Rep. Nydia Velázquez (D-NY) discussed how Puerto Rico’s tax policies had made the territory an attractive for cryptocurrency speculators and investors. She expressed interest in working to ensure that the territory did not became a tax shelter for cryptocurrency profits.

- Development of a Digital Identification (ID) System: Rep. Bill Foster (D-IL) expressed interest in developing a secure and legally traceable digital identity system for digital asset users. He remarked that a legally traceable digital identity for the beneficial owners behind a given digital asset would be necessary in order to prevent the use of digital assets in illicit activities.

Hearing Witnesses:

- The Hon. Nellie Liang, Under Secretary for Domestic Finance, U.S. Department of the Treasury

Member Opening Statements:

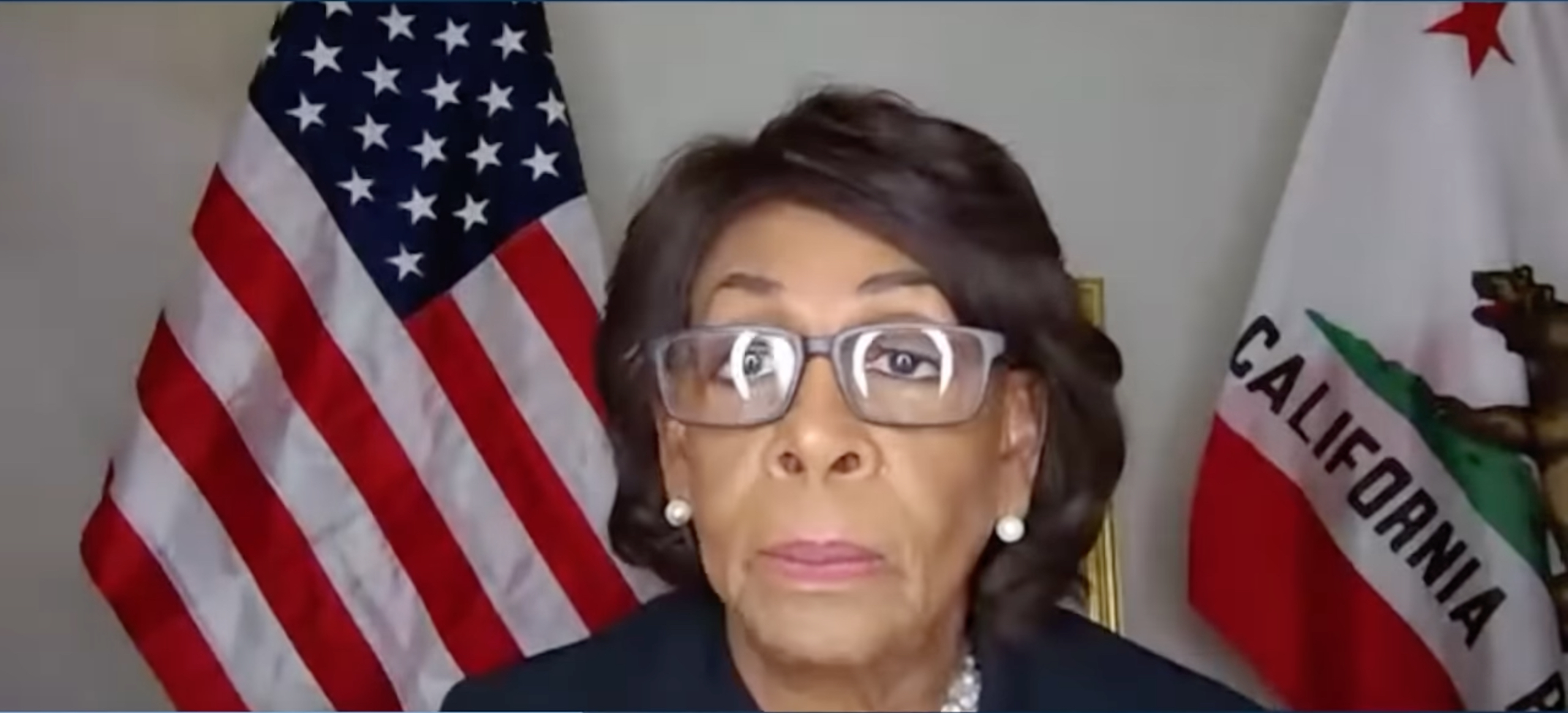

Full Committee Chairman Maxine Waters (D-CA):

- She remarked that the “explosive” growth of digital assets presented both risks and opportunities for the U.S. economy and U.S. communities.

- She stated that digital assets would particularly impact communities of color, which have historically experienced difficulties in terms of accessing the U.S. financial system.

- She commented that these communities must be given opportunities for input as part of the policymaking process.

- She noted that the current hearing would focus on stablecoins, which she explained were a subset of cryptocurrencies that were pegged to a reserve asset (such as the U.S. dollar).

- She indicated that stablecoins were primarily used in the U.S. to facilitate the trading, lending, and borrowing of other cryptocurrencies.

- She discussed how “troubling” investigations had found that many stablecoins were not actually backed fully by reserve assets.

- She also stated that stablecoins could pose threats to the U.S.’s financial stability due to their speculative trading and lack of investor protections.

- She mentioned how the PWG had published its Report on Stablecoins, which reviewed the regulatory landscape of stablecoins.

- She indicated that the PWG Report on Stablecoins had outlined various risks that stablecoins might present with regard to market integrity, investor protection, and illicit finance.

- She also noted how the PWG Report on Stablecoins had highlighted systemic risk concerns resulting from the threat of stablecoin runs when the stablecoins were not fully backed by their promised assets, concentration of economic power, and regulatory gaps that undermined the effective oversight of the market.

- She remarked that the aforementioned stablecoin risks could impact the ordinary users of stablecoin products and the overall U.S. financial system.

- She mentioned that the PWG Report on Stablecoins had recommended that Congress take action to address these risks.

- She stated that policymakers must work to ensure that any innovation within the stablecoin space was responsible, provided robust consumer and investor protections, mitigated environmental impacts, and promoted financial inclusion.

- She also indicated that the Committee would continue to investigate the development of a U.S. CBDC.

- She commented that such a CBDC might provide a safe, stable, and secure method of instantaneous digital payments.

Full Committee Ranking Member Patrick McHenry (R-NC):

- He remarked that the Committee needed to develop legislation to bring clarity to the digital assets ecosystem.

- He noted how there currently did not exist a federal law governing digital assets and called this lack of a federal law concerning given how nearly a quarter of American adults were now invested in cryptocurrencies.

- He mentioned how Committee Republicans had released a set of principles for developing policies governing CBDCs.

- He indicated that one of these principles emphasized how stablecoins could support a U.S. CBDC if they were issued under a “thoughtful” regulatory framework.

- He stated that the PWG Report on Stablecoins had outlined a model that could be pursued to oversee stablecoins in the U.S.

- He remarked however that the PWG Report on Stablecoins had failed to account for the full array of options available to policymakers for overseeing the stablecoin space.

- He noted that Committee Democrats had emphasized the need to derisk the U.S. financial services sector in their policy arguments over the previous decade and anticipated that Committee Democrats would argue that stablecoins could introduce new risks into the U.S. financial services sector.

- He highlighted how the PWG Report on Stablecoins had sought to mitigate this potential risk through proposing to regulate stablecoins as banks.

- He criticized this approach for providing stablecoins with a potential U.S. taxpayer backstop and contended that it would introduce more risk into the U.S. financial services sector.

- He then discussed how the PWG Report on Stablecoins had included an analysis of the U.S. stablecoin market, which he criticized for failing to address existing regulatory frameworks for stablecoin issuers at the state level.

- He commented that stablecoin issuers were subjected to a “comprehensive” set of state supervisory regimes, including reserve requirements, examinations, and anti-money laundering (AML) rules.

- He contended that the U.S. ought to examine all existing regulatory frameworks and structures for stablecoins in order to identify best practices and lessons learned.

- He further criticized the PWG Report on Stablecoins for failing to address the potential benefits of stablecoins.

- He commented that digital currencies (including stablecoins) could help to move money faster, cheaper, and better.

- He remarked that requiring that stablecoins only be issued by banks would hamper innovation within the nascent digital assets industry.

- He stated that the U.S. should not force new financial products into ill-fitting and inappropriate existing financial regulatory structures and should instead consider a new approach for these financial products.

- He asserted that any new policies ought to promote private sector innovation and foster competition in order to build resilient products.

- He further contended that the U.S. should not myopically focus on the risks associated with stablecoins and commented that such a myopic focus would undermine the U.S.’s ability to realize the full benefit of stablecoins.

Witness Opening Statements:

The Hon. Nellie Liang (U.S. Department of the Treasury):

- She first explained how the PWG was chaired by the U.S. Secretary of the Treasury and was composed of members from the U.S. Federal Reserve Board of Governors, the U.S. Securities and Exchange Commission (SEC), and the U.S. Commodity Futures Trading Commission (CFTC).

- She noted how the PWG Report on Stablecoins received input from the U.S. Federal Deposit Insurance Corporation (FDIC) and the U.S. Office of the Comptroller of the Currency (OCC).

- She then remarked that stablecoins were part of an emerging set of digital assets, activities, and services that could have “profound” implications for the U.S. financial system and economy.

- She stated that the distinguishing feature of stablecoins was that they are designed to maintain a stable value relative to reference asset.

- She highlighted how the U.S. dollar was a popular reference asset for stablecoins.

- She discussed how the market capitalization of stablecoins had grown “rapidly” from $5 billion at the start of 2020 to approximately $175 billion today.

- She testified that the PWG had focused on stablecoins because the offer of a stable value meant that stablecoins had the potential to be used widely as a means of payment by households, businesses, and financial firms.

- She commented that this potential use could create benefits and risks for both stablecoin users and payments transactions.

- She noted how the PWG Report on Stablecoins had focused on three prudential risks associated with the use of stablecoins for payments.

- She indicated that the first risk was run risk, which involved a scenario in which the loss of confidence in a given stablecoin would trigger a wave of redemptions.

- She indicated that the second risk was payment risk, which included operational issues that could interfere with the ability of users to store stablecoins or use them to make payments.

- She indicated that the third risk involved concerns related to the concentration of economic power.

- She testified that the PWG Report on Stablecoins had found “significant gaps” in authorities that would address the aforementioned prudential risks and stated that some of the largest stablecoin issuers operated with limited regulatory oversight.

- She commented that this lack of oversight raised questions as to whether stablecoins possessed adequate backing.

- She also expressed concerns that supervisors might not be able to oversee the broader operations that support the use of a given stablecoin.

- She elaborated that multiple entities might be involved in operating a given stablecoin.

- She stated that neither state money transmitter nor securities law requirements were designed to address the financial stability of the payment system or the concentration of economic powers for a payment instrument that was based on distributed ledger technology (DLT).

- She mentioned how the PWG Report on Stablecoins had recommended legislation to ensure that stablecoins would be subjected to a consistent and comprehensive framework that was “proportionate” to the risks that they posed.

- She commented that such legislation would complement existing authorities with respect to market integrity, investor and consumer protection, and illicit finance.

- She noted that the PWG Report on Stablecoins had specifically recommended limiting the issuance of stablecoins to insured depository institutions, giving supervisors of stablecoin issuers visibility into broader stablecoin arrangements, and giving supervisors of stablecoins the authority to set risk management standards for critical activities related to the use of stablecoins for payment.

- She added that the PWG Report on Stablecoins had proposed certain measures to reduce concerns over the concentration of market power.

- She testified that the PWG Report on Stablecoins had relied upon the flexibility that banking regulatory agencies would have to adjust for differences between stablecoin issuers and traditional commercial banks and to adjust to new market structures that might emerge over time.

- She remarked that the Biden administration was continuing to work across agencies to develop a comprehensive strategy for all digital assets.

- She expressed the Biden administration’s hope to partner with Congress on these efforts.

Congressional Question Period:

Full Committee Chairman Maxine Waters (D-CA):

- Chairman Waters mentioned how the Diem Foundation (which was founded by Facebook) had recently announced that it had sold its stablecoin project to a bank. She noted that Facebook had made multiple attempts at entering the cryptocurrency market and stated that the Committee’s actions had caused Facebook to slow down their efforts to create a digital currency. She highlighted how the PWG Report on Stablecoins had recommended that stablecoin issuers be required to limit their affiliations with commercial entities. She asked Under Secretary Liang to indicate whether this recommendation meant that technology companies that had access to large amounts of sensitive personal data should not be permitted to create their own stablecoins or other cryptocurrencies. She also asked Under Secretary Liang to indicate whether technology companies engaged within the stablecoin and cryptocurrency space ought to be subjected to heightened scrutiny.

- Under Secretary Liang noted that the PWG Report on Stablecoins had recommended that stablecoins be issued by insured depository institutions. She remarked that this recommendation would therefore mean that technology companies should not issue stablecoins. She stated however that the PWG Report on Stablecoins had recommended that Congress consider whether technology companies could play a part in the stablecoin ecosystem as providers of custodial wallets and other services related to the use, storage, and transfer of stablecoins for payments. She also noted how the PWG Report on Stablecoins had recommended that Congress consider restrictions on what digital wallet providers could do with the customers transaction data that they would have access to. She further mentioned how the PWG Report on Stablecoins had recommended that Congress consider whether there should exist limitations on privacy and security that could address concerns related to the concentration of economic power if commercial companies were to become involved within the stablecoin space.

- Chairman Waters then noted how the overall value of stablecoins had grown significantly over the previous year. She stated however that simply labeling a stablecoin as stable or having that the stablecoin maintain a 1:1 ratio with a reference asset did not necessarily mean that the stablecoin would have a stable value. She mentioned how some stablecoin issuers had recently transitioned from having their stablecoins being backed by various forms of debt securities to only being backed by the U.S. dollar and short duration U.S. Treasuries. She asked Under Secretary Liang to indicate whether these recent moves were sufficient for addressing the systemic risk and run risk concerns that the PWG Report on Stablecoins had highlighted.

- Under Secretary Liang remarked that the PWG Report on Stablecoins had focused on the function that stablecoins could provide as a means of payment by households, businesses, financial firms, and governments. She noted how the PWG Report on Stablecoins had found that stablecoins could pose run risks. She explained that run risks would involve investors losing confidence in the quality of a stablecoin’s backing assets, which could in turn lead investors to pull their money from the market and trigger a selloff. She then remarked that the PWG Report on Stablecoins had broadened the policy discussion of stablecoins beyond stablecoin creation and redemption to include the storage and transfer of stablecoins for payments. She called it important for supervisors to oversee the storage and transfer of stablecoins for payments and to establish risk management standards for the stablecoin payments system. She remarked that having insured depository institutions issue stablecoins would allow for sufficient confidence in the assets backing the stablecoin and provide regulatory oversight over stablecoin payment arrangements.

Full Committee Ranking Member Patrick McHenry (R-NC):

- Ranking Member McHenry asked Under Secretary Liang to indicate whether there existed current federal laws that governed stablecoins and/or digital assets.

- Under Secretary Liang remarked that there existed federal laws that applied to various aspects of stablecoins. She indicated that these federal laws addressed illicit finance and stablecoins as investment assets. She further stated that federal consumer protection laws would apply to stablecoins.

- Ranking Member McHenry interjected to comment that none of the aforementioned federal laws were specifically focused on stablecoins or digital assets.

- Under Secretary Liang expressed agreement with Ranking Member McHerny’s comment.

- Ranking Member McHenry remarked that the Committee ought to examine current state regulatory frameworks for stablecoins and digital assets. He asked Under Secretary Liang to indicate whether the PWG had consulted with state regulators on their existing frameworks for stablecoins and digital assets.

- Under Secretary Liang answered affirmatively and stated that many state regulators had increased their expertise in this area. She remarked that the PWG Report on Stablecoins believed that a more consistent and less fragmented regulatory framework was needed for stablecoins and digital assets.

- Ranking Member McHenry interjected to note that the PWG Report on Stablecoins did not mention existing state regulatory frameworks for stablecoins and digital assets. He asked Under Secretary Liang to explain this omission.

- Under Secretary Liang remarked that the PWG had proposed a consistent regulatory framework for stablecoins and digital assets. She stated that proposals to have insured depository institutions issue stablecoins could involve both federally-chartered and state-chartered banks.

- Ranking Member McHenry asked Under Secretary Liang to address why the PWG Report on Stablecoins did not discuss lessons learned from states that had established their own regulatory regimes for stablecoins and digital assets.

- Under Secretary Liang stated that there was no “explicit” reason for why the lessons learned from states were not included within the PWG Report on Stablecoins and testified that these lessons were considered in developing the report. She noted how the state regulatory system for stablecoins and digital assets was fragmented across issuers and custodial wallet providers. She commented that this fragmentation was the principal reason that lessons learned from states were not included in the PWG Report on Stablecoins.

- Ranking Member McHenry then noted how the PWG Report on Stablecoins had concluded that stablecoins posed various risks. He indicated that the Report’s proposed solution to these risks was to require that federally-insured depository institutions issue stablecoins. He stated that this proposed solution would provide stablecoins with a federal taxpayer backstop based on the unwinding authority granted in the Dodd–Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) for insured depository institutions. He commented that this proposed solution would increase the likelihood of a federal bailout for stablecoins.

- Under Secretary Liang remarked that the current stablecoin environment put financial regulators in an uncomfortable position. She noted how the popularity of stablecoins was growing rapidly and stated that regulation was about determining where risks should reside and how to protect users and investors from risks. She remarked that if stablecoins are backed by high quality assets, then the risks posed by stablecoins would be very low. She commented that this low risk would enable stablecoins to play a foundational role in payment systems. She stated however that unsupported stablecoins could create risks for the broader financial system.

- Ranking Member McHenry reiterated that the U.S. ought to identify best practices and lessons learned from state efforts to oversee stablecoins and digital assets.

Rep. Nydia Velázquez (D-NY):

- Rep. Velázquez recounted how the New York State Attorney General had conducted a 2021 investigation that revealed that the stablecoin Tether had deceived clients and markets through failing to hold promised reserves to back their stablecoins in circulation. She mentioned how the PWG Report on Stablecoins highlighted the lack of standards for stablecoin reserve assets and recommended the enactment of legislation that would require stablecoin issuers to become insured depository institutions. She asked Under Secretary Liang to elaborate on this recommendation and to address why it would lead to the creation of standards regarding the composition of the reserve assets and the information that issuers make to the public.

- Under Secretary Liang mentioned how the PWG Report on Stablecoins had highlighted the risk of stablecoin runs resulting from the quality and composition of the assets backing a given stablecoin not providing stable value (especially during periods of stress). She stated that current market regulators possessed authorities to promote market integrity and protect investors. She remarked that the proposal to require stablecoin issuers to be insured depository institutions would bring the quality and composition of the assets backing a given stablecoin under a supervisory framework where there would be a regulator that could attest to the quality and composition of said assets backing the stablecoin. She also stated that this proposal would ensure that there was a regulator that could oversee a given stablecoin’s entire arrangement for use in payments. She asserted that this approach would provide clarity to stablecoin issuers through providing them with a consistent regulatory framework and not forcing them to comply with various state laws and regulations. She also stated that this clarity would support “beneficial innovation.”

- Rep. Velázquez then discussed how Puerto Rico had become a popular location for cryptocurrency speculators from U.S. mainland investors. She attributed this popularity to Puerto Rico’s Individual Investors Act, which enables wealthy mainland U.S. citizens that establish themselves as Puerto Rican residents to pay zero taxes on capital gains, dividends, and interest. She asked Under Secretary Liang to indicate whether additional legislative authority from Congress would be helpful to go after cryptocurrency investors that were attempting to use Puerto Rico as a tax shelter and evade U.S. Internal Revenue Service (IRS) reporting requirements.

- Under Secretary Liang testified that she was not familiar with Puerto Rico’s Individual Investors Act. She remarked that the U.S. Treasury Department sought to ensure that U.S. taxpayers paid the taxes that they owed to the federal government. She stated that U.S. Treasury Department and IRS officials were likely examining the efforts of cryptocurrency investors to use Puerto Rico as a tax shelter. She expressed the U.S. Department of Treasury’s willingness to follow up with Rep. Velázquez on this particular issue.

Full Committee Vice Ranking Member Ann Wagner (R-MO):

- Vice Ranking Member Wagner mentioned how the Financial Stability Board (FSB) had made high level recommendations for the supervision and oversight of global stablecoin arrangements. She mentioned that the FSB’s recommendations included the establishment of a comprehensive governance framework, the establishment of effective risk management frameworks, the provision of transparent information for understanding the functioning of the stablecoin arrangement, and the provision of legal clarity for users on the nature and enforceability of any redemption rights and process. She commented that these recommendations sought to address the potential for fraud and the mismanagement of reserves. She mentioned how several cryptocurrency company CEOs had appeared before the Committee in December 2021 to discuss their operations. She remarked that the testimonies of these cryptocurrency company CEOs suggested that existing state-level regulatory structures put the operations of their companies in compliance with the FSB’s recommendations, as well as address the risks highlighted in the PWG Report on Stablecoins. She asked Under Secretary Liang to indicate whether she agreed with this view.

- Under Secretary Liang stated that the recommendations from the PWG Report on Stablecoins were attempting to meet the FSB’s principles on the supervision and oversight of stablecoin arrangements. She remarked that the U.S.’s current state-level regulatory structures failed to meet all of the FSB’s principles at this point.

- Vice Ranking Member Wagner interjected to reiterate that the cryptocurrency CEOs that had previously appeared before the Committee had asserted that state regulatory structures met the FSB’s principles and addressed the risks highlighted in the PWG Report on Stablecoins.

- Under Secretary Liang testified that the PWG had consulted with some states in developing its Report on Stablecoins. She noted that these states believed that they had oversight of stablecoin issuers through stablecoin licenses and other oversight mechanisms for digital wallet providers and additional entities that stored, transferred, and permitted stablecoins to be used as payments. She indicated that these oversight mechanisms involved a different set of regulations compared to money transmitter licenses. She remarked that states were not providing plenary oversight of overall stablecoin arrangements. She commented that such oversight would be necessary if stablecoins were to achieve widespread use as a payments mechanism.

- Vice Ranking Member Wagner remarked that the U.S. ought to work to identify the best state regulatory frameworks for stablecoins and digital assets. She asserted that applying a uniform regulatory framework to stablecoin innovation would discourage innovation and cause stablecoin activity and jobs to move abroad. She stated that any federal regulatory framework for stablecoins must provide clarity and ensure that the regulation fits the activity. She then asked Under Secretary Liang to address how stablecoins could reduce barriers to financial inclusion and lower transaction costs.

- Under Secretary Liang remarked that the potential for digital assets and stablecoins to improve financial inclusion were high. She stated that digital assets and stablecoins could reduce the cost of payments and facilitate payments for unbanked and underbanked individuals that might not feel comfortable going to banks. She mentioned how there were currently pilot programs underway to test the use of stablecoins for cross-border remittances.

Rep. Brad Sherman (D-CA):

- Rep. Sherman first applauded the Committee’s successful efforts to prevent Facebook from pursuing a digital currency. He then expressed skepticism regarding the merits of a state-based regulatory system for financial products and services. He stated that a state-based regulatory system would lead to a “race to the bottom” among states in terms of regulatory standards. He then called it unfair to compare the alleged potential benefits of stablecoins and cryptocurrencies with the current U.S. financial and payments system. He noted how a very small number of businesses currently accepted stablecoins and cryptocurrencies as a means of payment. He also stated that stablecoins posed risks to investors and that stablecoins that were backed by cryptocurrencies posed even greater risks to investors. He then remarked that the U.S. must consider the risks that stablecoins posed to the payments system. He applauded the PWG Report on Stablecoins for focusing on how cryptocurrencies and stablecoins undermined AML and know your customer (KYC) rules. He then stated that the cryptocurrency industry was a powerful political force at the federal level, which made it difficult for the PWG to advance its legislative agenda on cryptocurrencies and stablecoins. He asked Under Secretary Liang to recommend specific laws and statutory language for Congress to adopt.

- Under Secretary Liang expressed the PWG’s willingness to work with Congress on legislative proposals. She specifically expressed the PWG’s support for proposals requiring that stablecoin issuers be insured depository institutions.

- Rep. Sherman requested that the PWG convert its legislative proposals into statutory language. He then stated that cryptocurrencies enjoyed significant investments from parties and entities that tended to disenfranchise minority communities. He asked Under Secretary Liang to indicate whether a collapse in the cryptocurrency or stablecoin market would negatively impact low- and moderate-income communities (and particularly communities of color).

- Under Secretary Liang answered affirmatively. She discussed how there were currently many instances of fraud within the digital assets space and stated that the PWG’s member agencies were taking actions to protect investors and consumers from such fraud.

Rep. Blaine Luetkemeyer (R-MO):

- Rep. Luetkemeyer mentioned how the average daily turnover value of the U.S. dollar had constituted 88 percent of foreign exchange market transactions globally in 2019. He stated that the U.S. dollar’s dominance in the global marketplace was a key reason why the U.S. dollar remained the reserve currency of the world. He remarked that the existence of hundreds of different privately established cryptocurrencies presented a threat to the U.S. dollar’s status in global transactions. He stated however that stablecoins backed by the U.S. dollar presented a unique opportunity to ensure that the U.S. dollar remained the world’s reserve currency as the financial services industry adopted blockchain technologies and cryptocurrencies. He noted that the PWG Report on Stablecoins did not mention global competitiveness as a key aspect of stablecoin development. He called this omission a “striking oversight.” He asked Under Secretary Liang to indicate whether she was concerned about the large number of cryptocurrencies currently being established. He also asked Under Secretary Liang to address whether stablecoins provided an opportunity to enhance the U.S. dollar’s global reserve currency status.

- Under Secretary Liang asserted that the U.S. dollar’s position in the global financial system was very important for the U.S.’s economic well-being. She stated that the recommendations of the PWG Report on Stablecoins to require the issuers of U.S. dollar-backed stablecoins to be put into an established regulatory framework would constitute the best way to promote the U.S. dollar. She remarked that there were currently U.S. dollar-backed stablecoins being issued with limited regulatory oversight or outside the purview of regulators.

- Rep. Luetkemeyer asked Under Secretary Liang to indicate whether there was a way to incentivize stablecoins to use U.S. dollars as reference assets.

- Under Secretary Liang remarked that stablecoins currently had an incentive to use U.S. dollars as reference assets because the U.S. dollar was the world’s reserve currency. She stated that the U.S. should provide incentives to ensure that the U.S. dollar remained the world’s reserve currency. She attributed the U.S. dollar’s status as the world’s reserve currency to the U.S.’s rule of law, strong institutions, economic potential, and robust financial markets. She stated that stablecoin technology could reinforce these strengths of the U.S. dollar.

- Rep. Luetkemeyer expressed agreement with Under Secretary Liang’s assertion that the U.S. needed a stable economy and currency in order for a U.S. dollar-backed stablecoin to be successful. He then asked Under Secretary Liang to indicate whether there had ever occurred a run on a stablecoin or cryptocurrency.

- Under Secretary Liang stated that there had occurred runs on some smaller stablecoins.

Rep. David Scott (D-GA):

- Rep. Scott discussed how a significant portion of the U.S. population lacked access to banking services, payments technology, and financial literacy. He asked Under Secretary Liang to explain how stablecoins connected financially underserved populations with the broader financial system. He also asked Under Secretary Liang to discuss the current guardrails in place to protect stablecoin users.

- Under Secretary Liang remarked that stablecoins could promote financial inclusion through making payments faster and cheaper if users were more willing to use technology for payments than a traditional bank. She also stated that the pilot programs for using stablecoins for cross-border remittances served as an example for how stablecoins could support cheaper payments. She then noted that the recommendations of the PWG Report on Stablecoins tried to address the risks associated with stablecoins. She stated that stablecoins could provide a strong operational payment structure, which would protect consumers.

- Rep. Scott asked Under Secretary Liang to address whether the PWG Report on Stablecoins had recommended that the increased adoption of stablecoins ought to be coupled with corresponding increases in stablecoin user protections.

- Under Secretary Liang remarked that the recommendations of the PWG Report on Stablecoins were premised on the idea that stablecoins would continue to grow “rapidly” and that guardrails would need to be adopted in order to protect stablecoin users and investors.

- Rep. Scott interjected to ask Under Secretary Liang to discuss the recommendations of the PWG Report on Stablecoins.

- Under Secretary Liang indicated that the PWG Report on Stablecoins recommended that the U.S. require stablecoin issuers to be insured depository institutions and subject stablecoin custodians, digital wallet providers, and those that manage stablecoin reserve assets to supervisory oversight.

- Rep. Scott asked Under Secretary Liang to indicate whether there was a body that could enforce the recommendations of the PWG Report on Stablecoins.

- Under Secretary Liang stated that the Report’s proposed supervisory and regulatory framework for stablecoins would provide enforcement of the Report’s recommendations.

Rep. Bill Huizenga (R-MI):

- Rep. Huizenga mentioned how Committee Republicans had released a set of principles for assessing a potential U.S. CBDC. He remarked that a U.S. Federal Reserve-issued CBDC should not impede the development and utilization of stablecoins. He called it important for the private sector to play a leadership role in the stablecoin space. He then noted how the SEC was a member of the PWG. He mentioned how SEC Chairman Gary Gensler had stated that stablecoins may have attributes of investment contracts and banking products and that U.S. banking authorities lacked sufficient resources to oversee stablecoins. He commented that Chairman Gensler’s statement suggested that he believed that Congress needed to put stablecoins under the SEC’s regulatory authority. He noted however that SEC Chairman Gensler had also stated that some stablecoins were commodities. He commented that Chairman Gensler’s latter statement were in conflict with Chairman Gensler’s former statement. He asked Under Secretary Liang to address why the PWG Report on Stablecoins did not include any analysis of how U.S. securities laws apply to stablecoins. He also asked Under Secretary Liang to indicate whether the PWG had considered whether stablecoins constituted securities, commodities, or both.

- Under Secretary Liang remarked that the PWG was convened to consider whether stablecoins could be used to improve the U.S. payments system and to identify gaps in the regulation of stablecoins. She stated that the PWG Report on Stablecoins built on existing applicable laws and regulations, including the SEC’s regulations that applied to stablecoins as investment assets and securities. She indicated that the PWG Report on Stablecoins did not include analysis on whether stablecoins constituted securities. She stated that she would need to defer to the SEC regarding their enforcement strategy for stablecoins. She noted that the SEC’s authorities were for market integrity and investor protection related to the redemption and creation of stablecoins. She indicated that the SEC did not oversee the use of stablecoins as a payments instrument.

- Rep. Huizenga then noted how Under Secretary Liang’s testimony had mentioned proposals to regulate stablecoins as either securities or money market mutual funds. He asked Under Secretary Liang to identify the parallels between money market mutual funds and stablecoins. He also asked Under Secretary Liang to provide recommendations for approaching this topic.

- Under Secretary Liang discussed how many money market mutual funds invested in U.S. government securities and noted that investors purchased these funds with the expectation of earning the yield on the underlying asset. She highlighted how a stablecoin could be purchased and used for payments (rather than just investments). She stated that this dynamic made stablecoins unique, which resulted in a “regulatory gap” that necessitated the consideration of a new regulatory framework.

- Note: Rep. Huizenga’s question period time expired here.

Rep. Al Green (D-TX):

- Rep. Green discussed the extreme fluctuations of Dogecoin (which he noted was not a stablecoin). He asked Under Secretary Liang to identify the foundations underlying Dogecoin.

- Under Secretary Liang remarked that the digital asset marketplace was rapidly evolving and commented that this marketplace was built on top of a novel technology with the potential to “radically” change how different financial services would be provided. She noted how there were numerous digital asset products and services available that consumers could evaluate and make use of. She stated that consumers should have investor protections for these products and services. She asserted that it was difficult for policymakers to anticipate how the digital asset landscape would evolve over the coming years.

- Rep. Green interjected to ask Under Secretary Liang to indicate what exactly investors were investing in with regard to Dogecoin.

- Under Secretary Liang speculated that cryptocurrency investors could be investing in the application of novel DLTs. She noted that there was a popular view among the cryptocurrency industry that more cryptocurrency investments would lead to the development of new DLT applications. She stated that the long-term durability of existing cryptocurrency products remained an “open question” and that it was difficult for policymakers to prejudge the winners and losers within the cryptocurrency space.

- Rep. Green raised concerns that Dogecoin and similar cryptocurrencies were not based on anything, which could put the investors of these cryptocurrencies in peril. He stated that policymakers need to consider outlawing certain cryptocurrencies given the risks that they may pose to investors.

Rep. Frank Lucas (R-OK):

- Rep. Lucas asked Under Secretary Liang to discuss the diffrent types of reserve assets that were held by stablecoins.

- Under Secretary Liang mentioned how there were many stablecoins being offered that were tied to the value of the U.S. dollar. She noted that reserve assets backing stablecoins included U.S. Treasuries, bank deposits, short-term liabilities (such as commercial paper), and commercial debt. She stated that stablecoins involved backing from self-reported assets that were subject to audits by private firms. She indicated however that regulators did not confirm whether these self-reported assets were actually being used to back the stablecoins. She concluded that there was a mix of reserve assets being used to back stablecoins and predicted that not all stablecoins would be able to be exchanged for U.S. dollars during periods of economic stress.

- Rep. Lucas asked Under Secretary Liang to indicate whether there was a “typical assortment” of reference assets that backed stablecoins.

- Under Secretary Liang remarked that the desired asset pool for backing stablecoins would be high quality assets that could enable the stablecoin to be redeemed for U.S. dollars, even under stress conditions. He stated that the current mix of assets backing stablecoins varied across stablecoin issuers. She noted how there might be between 50 and 60 stablecoin issuers currently in existence. She stated that the largest stablecoin issuers relied upon corporate short-term liabilities, which she commented were unproven in their ability to support U.S. dollar redemptions during periods of economic stress.

- Rep. Lucas stated that the assortment of reference assets backing a given stablecoin would impact the ability of the stablecoin’s user to redeem the stablecoin for U.S. dollars. He commented that the choice of such reference assets was therefore important.

- Under Secretary Liang expressed agreement with Rep. Lucas’s comments.

- Rep. Lucas then noted how the CFTC had demonstrated through enforcement actions that it possessed some authority over stablecoins. He asked Under Secretary Liang to indicate whether the PWG believed that the Commodity Exchange Act (CEA) granted the CFTC the full authority to audit stablecoins to ensure that the stablecoin’s underlying assets were fully accounted for.

- Under Secretary Liang stated that she would need to defer to the CFTC on that question. She remarked that the PWG did not attempt to determine whether securities or commodities laws should apply to stablecoins. She noted that there were currently enforcement cases going through the judicial process that were addressing which sets of laws applied to stablecoins. She remarked that the PWG had sought to identify gaps in existing regulations related to stablecoins as payment instruments.

- Rep. Lucas then asked Under Secretary Liang to identify the current barriers that stablecoins might face in their efforts to achieve wide adoption. He also asked Under Secretary Liang to answer whether the wide adoption of stablecoins would be a positive development for consumers.

- Under Secretary Liang remarked that the widespread use of stablecoins provided potential benefits, such as faster and cheaper payments. She testified that the PWG had found that the lack of regulatory clarity surrounding stablecoins served as a barrier to stablecoin adoption based on stakeholder interviews. She also emphasized how stablecoins were very nascent technologies and commented that these technologies could scale up quickly.

Rep. Emanuel Cleaver (D-MO):

- Rep. Cleaver expressed concerns that bad actors could issue digital currencies that were Ponzi schemes. He asked Under Secretary Liang to discuss the current protections in place that would prevent Americans from being taken in by digital currency Ponzi schemes.

- Under Secretary Liang remarked that consumers and investors needed to be protected from digital currency Ponzi schemes. She stated that the U.S. Consumer Financial Protection Bureau (CFPB) and banking agencies were taking actions to try to protect consumers and investors from digital currency Ponzi Schemes and commented that these actions were likely to continue. She elaborated that these protections were meant to address fraud, misleading advertising, and manipulation. She further mentioned how there was ongoing monitoring of digital assets to determine whether leverage was being used in the trading of these assets, which could lead the prices of these assets to sharply decline. She remarked that financial regulators were very focused on protecting digital currency investors and consumers. She noted how the PWG Report on Stablecoins had focused on stablecoins, which purported to have more stable values than other types of digital currencies.

- Rep. Cleaver highlighted how private companies were actively entering the digital currency space and stated that some of these entrants were likely unregistered entities. He expressed concerns that this environment could foster fraud.

- Under Secretary Liang indicated that she shared Rep. Cleaver’s concerns regarding the prospects for fraud within the digital currency space. She remarked that the combination of new technologies, a growing market, and an unclear and inconsistent regulatory framework raised concerns. She stated that the PWG Report on Stablecoins had sought to provide ideas for how stablecoins should be regulated. She also mentioned how the Biden administration was engaged in an ongoing effort to review digital assets, including user protection and financial stability concerns.

Rep. Bill Posey (R-FL):

- Rep. Posey discussed how banks received prudential supervision and deposit insurance in order to ensure that the U.S. payment system could redeem its deposit liabilities at par. He stated that this treatment was essential for bank deposits to function as money that could be redeemed during periods of economic stress. He noted how several questions had arisen within the stablecoin realm regarding the quality of the assets backing stablecoins. He asked Under Secretary Liang to address whether the stablecoin Tether was backed by the U.S. dollar or cash equivalents.

- Under Secretary Liang noted that Tether’s public documents indicated that their reserve assets included assets that were not credit risk-free.

- Rep. Posey asked Under Secretary Liang to indicate whether Tether had investments in Chinese commercial paper or other types of illiquid assets that might threaten its redeemability.

- Under Secretary Liang stated that Tether held the commercial paper of private firms, which did not constitute a credit risk-free asset.

- Rep. Posey asked Under Secretary Liang to indicate whether there had been Tether issued that was not fully collateralized.

- Under Secretary Liang stated that she believed that there had been Tether issued that was not fully collateralized under all conditions. She noted how Tether was not regulated.

- Rep. Posey asked Under Secretary Liang to indicate whether she possessed concerns regarding Tether’s opacity and impact on consumers.

- Under Secretary Liang indicated that she did have concerns regarding the opacity of the reserve assets of stablecoin issuers. She stated that this opacity of stablecoin reserve assets made stablecoins vulnerable to runs, which could create problems for other short-term financing markets.

- Rep. Posey expressed hope that the Committee could enact stablecoin policies that protected consumers and investors while also enabling the U.S. economy to realize financial innovations. He noted how the PWG Report on Stablecoins had concluded that stablecoins ought to be regulated as banks and deposits, which would necessitate that stablecoins obtain deposit insurance. He asked Under Secretary Liang to discuss the alternative regulatory regimes for stabecoins that would provide adequate disclosures to consumers.

- Under Secretary Liang remarked that the proposal from the PWG Report on Stablecoins that stablecoin issuers be insured depository institutions relied upon flexible nature of that supervisory and regulatory framework. She stated that a stablecoin issuer that only issued stablecoins for payments and that did not engage in lending should be subject to a different supervisory regime than banks. She commented that there existed a “degree of flexibility” in the PWG’s proposal. She then noted that the PWG Report on Stablecoins did not make a statement on deposit insurance. She commented that deposit insurance might not be necessary depending on the quality of the stablecoin’s reserve assets and the capital and liquidity standards of the stablecoin’s issuer.

- Rep. Posey asked Under Secretary Liang to discuss what the Biden administration’s policy was for addressing stablecoins within the financial system.

- Under Secretary Liang remarked that the PWG Report on Stablecoins recognized that there currently existed gaps in the regulatory system for stablecoins. She noted how there were securities, consumer protection, and illicit finance laws meant to address stablecoins and other digital assets. She remarked however that there did not exist a federal regulatory framework that built upon state-level regulations that would apply to the use of stablecoins for payment purposes.

Rep. Ed Perlmutter (D-CO):

- Rep. Perlmutter discussed how the number of people that bought into a given stablecoin would largely dictate how policymakers would approach that stablecoin. He asked Under Secretary Liang to identify the most secure stablecoins that had been developed from an investment standpoint.

- Under Secretary Liang noted how stablecoins could serve as both investments and payment mechanisms and stated that the PWG Report on Stablecoins was focused on the near future prospects for stablecoins as a payment mechanism. She then remarked that there could exist stablecoins that were backed by high quality assets and not used as payments. She commented that the recommendations from the PWG Report on Stablecoins would not be applicable to these types of stablecoins. She reiterated that the PWG’s recommendations were focused on stablecoins that could be used as payments, as well as the convertibility and operational risks of these stablecoins.

- Rep. Perlmutter then discussed the U.S.’s experience with money market mutual funds and noted how the widespread use of these funds for payments had led the U.S. to bail the funds out when they experienced challenges. He suggested that the U.S. should take proactive protective measures regarding stablecoins so that it would not need to bail them out in the event of a financial crisis.

- Under Secretary Liang commented that the PWG Report on Stablecoins suggested that the U.S. take proactive protective measures regarding stablecoins.

Rep. Andy Barr (R-KY):

- Rep. Barr called it important for the U.S. to maintain the U.S. dollar’s status as the world’s reserve currency. He stated that the adoption of stablecoins would likely not compromise the U.S. dollar’s status as the world’s reserve currency given that major stablecoins were denominated in U.S. dollars. He asked Under Secretary Liang to indicate whether she agreed with his statement. He also asked Under Secretary Liang to indicate whether the increased adoption of U.S. dollar-backed stablecoins would diminish threats to the U.S. dollar from cryptocurrencies and other CBDCs.

- Under Secretary Liang expressed agreement with Rep. Barr’s statement that it was important to preserve the U.S. dollar’s value. She stated that stablecoins that were tied to the U.S. dollar and that could actually deliver a stable value would benefit the U.S. dollar.

- Rep. Barr mentioned how the U.S. Federal Reserve was exploring the feasibility of a digital U.S. dollar and had recently released its report on CBDCs. He expressed concerns that the development of a U.S. Federal Reserve CBDC could stymie private sector innovation (including in the stablecoin space). He asked Under Secretary Liang to indicate whether stablecoins issued within a clear regulatory framework would be able to coexist with a U.S. Federal Reserve-issued CBDC.

- Under Secretary Liang remarked that the regulation of U.S. dollar-backed stablecoins would not preclude the introduction of a CBDC. She commented that while it was difficult to project the future stablecoin landscape, she stated that it was entirely feasible that private stablecoins and a U.S. Federal Reserve-issued stablecoin could coexist.

- Rep. Barr reiterated his belief that U.S. dollar-backed stablecoins would ensure that the U.S. dollar remained the world’s reserve currency. He also stated that U.S. dollar-backed stablecoins would diminish the need for a U.S. Federal Reserve-issued CBDC. He then mentioned how the PWG Report on Stablecoins had recommended that Congress pass legislation to require that stablecoins only be issued by insured depository institutions. He commented that this recommendation would bring stablecoins within the banking regulatory regime. He expressed concerns that this recommendation could lead cryptocurrency talent, innovation, and stablecoin issuers to move abroad. He also stated that it was inconsistent for the U.S. to assert that only banks should be permitted to issue stablecoins while failing to grant bank charters to the largest stablecoin issuers. He asked Under Secretary Liang to address his aforementioned concerns regarding the PWG’s recommendation that stablecoin issuance be brought into the bank regulatory regime.

- Under Secretary Liang remarked that the PWG’s recommendation that stablecoin issuers be insured depository institutions was designed to make these issuers stable. She called stability the key attribute of a good stablecoin and asserted that stability and U.S. leadership in the stablecoin space were not conflicting objectives.

- Rep. Barr remarked that oversight of the integrity of stablecoin audits would ensure the integrity of stablecoins and reduce run risk. He stated that such oversight would make it unnecessary to have stablecoin issuance done through insured depository institutions.

- Under Secretary Liang noted how the PWG Report on Stablecoins had found that stablecoins could pose run risks and risks to the payment system absent adequate oversight. She asserted that disclosure or money market mutual fund-type regulations were ill-suited for addressing the aforementioned risks.

Rep. Jim Himes (D-CT):

- Rep. Himes discussed how stablecoins would likely provide benefits and drawbacks to the U.S. and stated that policymakers must work to regulate stablecoins in a manner that would allow for innovation while protecting consumers. He then asserted that there was a “radical” difference between a stablecoin that was fully backed, redeemable at par, and fully transparent and a stablecoin without sufficient backing. He asked Under Secretary Liang to indicate whether she agreed with this assertion.

- Under Secretary Liang expressed agreement with Rep. Himes’s assertion.

- Rep. Himes remarked that a stablecoin that was fully backed, redeemable at par, and fully transparent could be regulated differently than a riskier stablecoin. He asked Under Secretary Liang to indicate whether requiring stablecoin issuers to be insured depository institutions and chartered banks might be unnecessary if the stablecoins being issued were fully backed, redeemable at par, and fully transparent.

- Under Secretary Liang remarked that there existed “important distinctions” between stablecoins and unbacked digital assets. She also stated that the full set of bank regulations did not need to be applied to a stablecoin issuer that exclusively engages in stablecoin issuance. She commented that there was flexibility within the insured depository institution regulatory framework to not focus on the credit risks associated with lending given how many stablecoin issuers did not make loans or engage in fractional reserve banking. She noted however that stablecoin issuers did facilitate payments and highlighted that there existed operational and convertibility risks associated with payments. She stated that oversight was needed regarding stablecoin issuers in order to ensure that the U.S. payment system could continue to properly function.

- Rep. Himes then remarked that it did not appear that there currently existed enough leverage within the stablecoin space to create systemic risk concerns. He asked Under Secretary Liang to identify aspects of the stablecoin market that policymakers ought to monitor in order to guard against systemic risk within the stablecoin space.

- Under Secretary Liang remarked that assets whose values were increasingly determined by leveraged positions could pose systemic risk concerns. She stated that financial regulators, including FSOC, had been monitoring developments in digital assets in search of leverage. She also remarked that having stablecoins become more interconnected with the traditional financial system could pose systemic risk concerns. She noted how digital assets currently had “tenuous” links to the traditional financial system. She highlighted how banking regulators had raised capital requirements on crypto asset holdings and stated that these regulators were keenly aware of the systemic risks posed by the growing digital assets industry.

Rep. Roger Williams (R-TX):

- Rep. Williams remarked that cryptocurrencies could help to address many of the traditional financial services marketplace’s shortcomings. He highlighted how cryptocurrencies could benefit the underbanked and facilitate international payments. He stated that stablecoins played a key role in the functioning of cryptocurrencies through enabling people to remove the volatility often associated with cryptocurrencies. He noted how the PWG Report on Stablecoins had suggested that the U.S. treat all stablecoin issuers as banks. He commented that this proposal would advantage incumbent financial institutions (that had traditionally been skeptical of cryptocurrencies) and disadvantage the innovative entrepreneurs within the cryptocurrency space. He asked Under Secretary Liang to discuss how the PWG had considered the impacts of their recommendations on cryptocurrency innovation.

- Under Secretary Liang testified that the PWG was very focused on balancing the benefits for financial innovation with reducing risks to cryptocurrency users, as well promoting the broader financial stability of stablecoins. She contended that stablecoins should be expected to fulfill their promises of stability, which would require stablecoins to face additional regulation. She noted that while the PWG had proposed that stablecoins be issued by insured depository institutions, she remarked the PWG’s proposal relied upon the fact that the regulation and supervision of these institutions could be quite flexible. She stated that stablecoin issuers that had a simple business model of holding high quality reserve assets and issuing liabilities (such as stablecoins) would be subject to a “much less stringent” regulatory and supervisory regime as compared to a traditional commercial bank. She concluded that the PWG’s recommendation for stablecoins to be issued by insured depository institutions would reduce risks and provide regulatory clarity and consistency, which would in turn foster innovation.

- Rep. Williams then asked Under Secretary Liang to discuss how the PWG had consulted the private sector in developing its Report on Stablecoins. He also asked Under Secretary Liang to answer whether the private sector perspectives had been adequately accounted for in the PWG Report on Stablecoins.

- Under Secretary Liang testified that the PWG had reached out to many stakeholders in developing its Report on Stablecoins and indicated that these stakeholders included academics, regulators, and private sector entities. She remarked that many private sector stakeholders were comfortable with requiring stablecoin issuers to be insured depository institutions and noted that some of these private sector stakeholders were already pursuing bank charters. She stated that the PWG had worked to strike the right balance between innovation and safety in developing its Report on Stablecoins.

Rep. Gregory Meeks (D-NY):

- Rep. Meeks stated that a core recommendation of the PWG Report on Stablecoins was to require stablecoin issuers to be insured depository institutions. He asked Under Secretary Liang to indicate the extent to which this recommendation was assessed using the frameworks within President Biden’s Executive Orders (EOs) on Promoting Competition in the American Economy and on Advancing Racial Equity and Support for Underserved Communities Through the Federal Government. He commented that limiting stablecoin issuance to insured depository institutions (which have a higher barrier to entry) could limit competition and have a racial equity impact.

- Under Secretary Liang testified that the PWG did consider how its recommendations would impact competition in the development of its Report on Stablecoins. She called the U.S.’s current regulatory framework for stablecoins inconsistent and fragmented. She asserted that a more comprehensive regulatory framework for stablecoins would benefit competition. She also stated that the PWG wanted to provide regulatory clarity in order to foster stablecoin innovation. She further testified that the PWG wanted to ensure that the uneven implementation of standards across regulators did not create unfair advantages for certain stablecoin issuers. She then remarked that stablecoins could help the U.S. meet its equity goals and serve unbanked and underbanked individuals through lowering costs. She also stated that stablecoins could improve access to financial and payment services to individuals that did not feel comfortable with going to banks.

- Rep. Meeks then discussed how stablecoins could be used to help communities abroad that were facing turmoil in their countries. He stated that non-governmental organizations (NGOs) could help refugees to securely access money in new countries through stablecoins. He asked Under Secretary Liang to address how the U.S. Department of Treasury could assist these NGOs to partner with stablecoin issuers in order to distribute humanitarian aid to refugee populations in a safe and efficient manner. He also asked Under Secretary Liang to identify actions that Congress could take to assist the U.S. Department of Treasury in this area.

- Under Secretary Liang remarked that the ability of stablecoins to support foreign aid was an example of the technology’s potential benefits. She stated that the recommendations of the PWG Report on Stablecoins sought to ensure that stablecoins were actually stable. She commented that these recommendations sought to ensure that stablecoins functioned properly and did not pose unnecessary risks.

- Rep. Meeks commended the cryptocurrency industry for its efforts to support foreign citizens and stated that many stablecoin issuers were adopting AML and KYC procedures. He noted however that peer-to-peer cryptocurrency transactions did not have formal brokers. He mentioned how the U.S. Financial Crimes Enforcement Network (FinCEN) had limited jurisdiction and commented that this resulted in many cryptocurrency transactions not adhering to robust KYC procedures. He asked Under Secretary Liang to address the role that the Financial Action Task Force (FATF) and FinCEN play in combating bad actors within the cryptocurrency space while also facilitating the delivery of humanitarian aid via cryptocurrency and normal cross-border cryptocurrency transactions.

- Under Secretary Liang stated that the U.S. Department of Treasury was leading FATF in trying to improve the implementation of cryptocurrency standards in countries that were lagging in their implementation efforts.

Rep. French Hill (R-AR):

- Rep. Hill commented that there appeared to exist significant agreement at the hearing between Committee Democrats and Republicans on the potential benefits of stablecoins. He elaborated that there existed a bipartisan belief that stablecoins could improve the efficiency, speed, and cost of payments, expand financial access, facilitate the use and adoption of digital assets, support the U.S. dollar’s continued status as the world’s reserve currency, and make the U.S. a preferred country for financial technology (FinTech) innovation. He contended that stablecoin legislative efforts ought to focus on a stablecoins’s permissible reserve assets (which involved credit quality and collateral requirements), liquidity and redemption requirements, and risk management and other governance issues (including audit, transparency, and privacy controls). He also asserted that U.S. regulatory approaches towards stablecoins ought not to account for the use cases of the given stablecoins. He stated that legislation should simply define what would constitute appropriate stablecoins from a consumer or business perspective. He asked Under Secretary Liang to indicate whether she agreed with his proposed approach to overseeing stablecoins.

- Under Secretary Liang remarked that regulations ought to follow the function of a given product or service.

- Rep. Hill interjected to expressed agreement with Under Secretary Liang. He asserted that regulations ought to be activity-based rather than entity-based and commented that activity-based regulations were particularly important in innovative fields. He then expressed uncertainty as to whether there should be requirements that stablecoins be issued by depository institutions. He asked Under Secretary Liang to indicate whether she would support the creation of either a federal money transmission license or a national payment provider license.

- Under Secretary Liang remarked that the U.S. should explore the feasibility of a federal money transmission license and a national payment provider license. She stated that the fact that the U.S. currently lacked the aforementioned license structures had led the PWG to not consider these structures when developing its Report on Stablecoins.

- Rep. Hill asked Under Secretary Liang to indicate whether she supported having states define some quality standards for stablecoins.

- Under Secretary Liang remarked that current regulators needed to take actions to oversee stablecoins given how stablecoins were already available and growing in popularity. She noted how some state money transmitter licenses did not apply to digital assets and suggested that states could probably revisit their money transmitter rules.

- Rep. Hill then remarked that stablecoins and digital assets should not necessarily be required to obtain deposit insurance and reiterated his support for an activity-based regulatory approach for these assets. He also expressed doubts as to whether stablecoins posed systemic risks, especially given how much smaller the stablecoin market was relative to the credit card and money market mutual fund markets. He stated that the Committee should develop a “narrowly-crafted” definitions bill for overseeing stablecoins.

Rep. Bill Foster (D-IL):

- Rep. Foster expressed interest in developing a secure and legally traceable digital identity system for digital asset users. He remarked that a legally traceable digital identity for the beneficial owners behind a given digital asset would be necessary to prevent digital assets from being used in illicit activities. He stated that courts in trusted jurisdictions should be able to access these legally traceable identities and support the extraditions of suspected bad actors when necessary. He mentioned how the cryptocurrency CEOs that had previously testified before the Committee in December 2021 had expressed support for developing a secure and legally traceable digital identity system for digital asset users. He asserted that existing KYC requirements were insufficient for combating illicit activity because users were able to open shell financial accounts to evade KYC monitoring. He asked Under Secretary Liang to provide recommendations for developing a legally traceable digital identity system for digital asset users (both nationally and internationally). He also asked Under Secretary Liang to indicate whether the U.S. Department of Treasury required more specific guidance from Congress as to how to proceed in this endeavor.

- Under Secretary Liang remarked that the principles of security and privacy could be in conflict at times within the digital assets context. She stated that legislation could address how to balance these two principles and indicated that the PWG Report on Stablecoins did not make any recommendations on developing a secure and legally traceable digital identity system for digital asset users. She commented that the PWG remained cognizant of the issue of digital identity for digital asset users and added that this issue was very applicable to the CBDC context. She then discussed how the PWG Report on Stablecoins did address the potential for stablecoins to scale rapidly. She stated that this rapid scaling provided the stablecoin issuers with significant amounts of information and control over customer financial transaction data. She noted how the PWG had suggested that Congress consider ways to manage the security of this data. She commented that Congress would need to address this issue if digital currencies were to become more widely used.